Using the Corporate Relationship Management Cycle to Assess, Rightsize, and Grow Corporate Collaborations on Campus

This research report will help institutions determine how to measure the success of industry partnership strategy and efforts by using the corporate relationship management cycle.

Executive summary

Industry partnerships closely connect colleges and universities with their communities and bring in much-needed revenue through research engagements, donated gifts, and customized training programs. To develop effective and prosperous partnerships, institutions must track and measure success to find the most viable engagement opportunities and determine how to expand existing industry relationships.

While most institutions count metrics like the dollar value of contracts and the number of engagements, many fail to measure historical trends and gather feedback from industry to meet their corporate partnership goals. Instead of focusing solely on disconnected relationships across campus and existing faculty connections, institutions need to think more strategically about their industry engagements to find partners who can engage with them in deeper and broader ways. The most progressive universities seek sustainable partnerships that engage multiple stakeholders across the institution over time.

However, this can be difficult for universities to accomplish due to existing internal barriers in sharing information across campus, limited resources for corporate relations staff, and inadequate investment in technological capabilities. Institutional departments and units are often siloed internally which can stifle collaboration and communication. Additionally, institutions create perverse incentives for their corporate relations staff by encouraging them to focus solely on dollars—in this structure, staff often pursue shorter-term and smaller corporate transactions and forgo potentially larger, more lucrative engagements. It can also be costly and challenging to implement new technology across campus to holistically measure industry partnerships.

If a university continues to track only monetary metrics, their institution will lose essential revenue from corporate engagements and forgo partnerships with industry leaders seeking strategic and individualized relationships. Despite these challenges, colleges and universities must start tracking measures beyond these foundational metrics to distinguish themselves from competitors, develop intentional corporate relationships, aid their regional economic efforts, and secure best-fit partnerships for the future.

This research report is organized into three sections, by the level of progressiveness needed to measure the metrics in each stage of the Corporate Relationship Management Cycle:

- Fundamental metrics are the baseline and include monetary and outcomes-focused indicators most important to institutional leaders.

- Advanced metrics enable institutions to follow-up with and expand the most strategic industry partnerships available to them.

- Progressive metrics allow universities to improve existing engagements based on partner feedback and develop intentional marketing plans that highlight the institution’s unique strengths.

-

Fundamental metrics

Fundamental metrics are closely tied to monetary values, initial engagements, and executive leadership interest.

- Solicitate relationships

- Close deals

-

Advanced metrics

Advanced metrics create industry profiles for existing partnerships and highlight opportunities for growth.

- Cultivate leads

- Manage existing partnerships

-

Progressive metrics

Progressive metrics track marketing and feedback but require multiple stakeholders and advanced data practices.

- Evaluate growth opportunities

- Discover industry needs

Download the full research report, or explore the highlights below.

The need for holistic metric tracking in industry partnerships

Industry partnerships represent an integral way for colleges and universities to bring in much-needed revenue, connect students to local employment opportunities, invest in strategic research, and help their regional economy recover. However, companies are demanding more differentiated services that are specific to their unique corporate needs.

Additionally, industry partners are focused on developing fewer, more strategic university relationships, rather than securing separate university partners for research, corporate training, and recruitment goals. Corporate partners increasingly seek universities that can provide individualized, unique, and integrated services across and between these needs.

However, higher education institutions typically struggle to identify best-fit partners, distinguish how their individual strengths connect to the broader needs of a company, assess their current portfolio of corporate relationships, and grow existing industry partnerships. Universities have historically focused on dollar amounts and outcome measures only; over time though, these indicators can fail to demonstrate the nuance between short-term engagement success and enduring strategic partnerships.

Progressive institutions measure metrics beyond monetary indicators that give them insight into what value best-fit industry partners derive from their services and help shift their focus to a more holistic process for all partners.

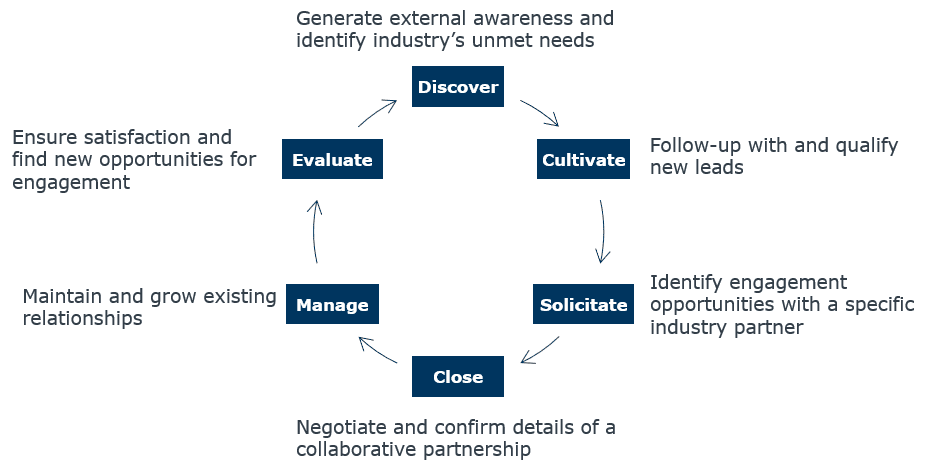

The Corporate Relationship Management Cycle, outlined below, can help institutions attain and sustain successful business partnerships through tracking and analyzing relevant metrics. The cycle outlines six distinct processes for industry relations success: Discover, Cultivate, Solicitate, Close, Manage, and Evaluate. Each step of the cycle requires universities to measure distinct metrics to ensure institutional and partnership success.

Corporate relationship management cycle

Fundamental metrics

Within the Corporate Relationship Management Cycle, fundamental metrics lie within the Solicitate and Close stages, where institutions find new partnership opportunities and negotiate the final details of industry engagements.

Solicitate phase

The Solicitate phase of the corporate engagement cycle identifies the mutual needs between a university and an industry partner to determine viable engagement opportunities. Institutional departments including the corporate relations office, career services staff, and technology transfer unit can each find relevant engagement opportunities based on the institution’s strengths and current offerings in addition to a company’s needs. The caliber and value of the proposed partnership will determine whether the company moves to the next step of the cycle where the contracts will be negotiated and finalized.

Key performance indicators

- The number of site visits to companies

- The number of company visits to campus

- The number and type of meetings the institution has with companies

- The roles of participants in those meetings

- The number of engagement opportunities identified

Key outcome measure

Number and percent of engagement opportunities that move to the next step of the cycle; the negotiation and close phase.

Reporting level

Ideally, analysis of these key performance indicators and outcome metrics is disseminated monthly to the corporate relations staff and their unit peers. The staff can then benchmark existing strengths at the institution and examine unmet industry needs to identify the most feasible engagement options and the best-fit company partners for these initiatives. These institutional stakeholders must understand which engagement opportunities they surface are relevant, useful, and effective to engage the company in a formal or more robust partnership and move onto the next fundamental stage in the cycle: Close.

Close phase

Following the Solicitate phase, when institutions determine relevant and viable partnership opportunities, universities must develop and confirm the details of a collaborative industry partnership to establish a formal relationship between the institution and a company.

Key performance indicators

- The average time to close a deal

- The value of deals

- The number and type (e.g., grant, sponsored research) of deals

- Trends in the number, value, and type of deals over time

- The contract value from new versus existing relationships.

It is important for institutions to analyze the correlation between the value of a contract and the time spent to bring it to a close. This identifies any inefficiencies within the office and calculates the return on investment for the various types of partnership opportunities.

Key outcome measure

- The number of engagements at this stage that move to a close

- The time required to finalize a deal

- The complexity and duration of deals

- The return on investment for the corporate relations team.

Reporting level

All levels of stakeholders value Close metrics. While this information is of particular interest to institutional executives at the institution, it is important to present the financial value of business partnerships for all units involved in corporate relations. Although the business office tends to manage the responsibility of negotiation of final contract terms, these indicators can help to demonstrate the dollar value of the corporate relations office. Additionally, these metrics allow the institution to track new partnerships and the advancement of current relationships. By auditing the number of proposals that move to the negotiation and close phase of the Corporate Relationship Management Cycle, the corporate relations team can also analyze the strength of their communication links with unit peers at the institution.

Consider offering some templated contracts to close deals more efficiently and signal institutional openness to industry partners, but keep in mind that these templates may not necessarily decrease contract speeds. For more information on tiered contract menus, review this research study on strategies to expand the value of partnerships.

Advanced metrics

Within the Corporate Relationship Management Cycle, institutions measure advanced metrics during the Cultivate and Manage stages, where universities must determine how to prioritize leads and steward existing partnerships for growth.

Cultivate phase

After new leads are generated from marketing campaigns or expanding existing partnerships, institutions must follow-up with and classify each potential engagement during the Cultivate phase.

Key performance indicators

- The number of leads per time period

- The source of new leads

- Follow-ups to new leads (e.g., background research, correspondence with industry)

- The time required to respond to and qualify a new lead.

Key outcome measure

The number and percent of leads worth advancing to next stage of engagement and the yield of new engagements.

Reporting level

The corporate relations office benefits from and values these metrics most. By analyzing Cultivate metrics, staff in the corporate relations office can understand the types of leads that advance to the next stage of engagement, Solicitate. These metrics can help the corporate relations office prioritize these types of partnerships and determine what types of sources generate the most leads, which in turn can inform marketing practices.

Use the Employer Lead Scoring Rubric to analyze metrics and prioritize partnership leads correlated with cultivation success. Bring together data to create an employer profile and determine weighted scores based on the potential of successfully securing a partnership. For example, many institutions prioritize employed alumni as a high-impact measure of institution fit, so staff may assign 1 fit score point for every three employees, on a continuous scale.

Consider offering some templated contracts to close deals more efficiently and signal institutional openness to industry partners, but keep in mind that these templates may not necessarily decrease contract speeds. For more information on tiered contract menus, review this research study on strategies to expand the value of partnerships.

Manage phase

Tracking metrics during the Manage stage allows institutions to meet their goals of creating sustainable and long-term business partnerships. The common business refrain—it is less expensive to grow existing business relationships than to pursue new engagements—applies here. After a formal partnership has been established, staff in the corporate relations office must work to guide, maintain, and grow existing relationships. For an industry partner, this could mean enrolling in new training programs, sponsoring internships or scholarships, or donating to research projects at the institution.

Key performance indicators

- The amount of correspondence and the number of meetings or events focused on recognition and appreciation, rather than soliciting new business

- The estimated amount of time staff spend corresponding with a partner over a quarter.

Key outcome measure

- Trends in the level of support from a partner

- Trends in the number of touchpoints with a company over time

- A company’s movement through a tiered framework

Reporting level

Both unit peers and the corporate relations office value Manage metrics, as they are the staff working directly in maintaining partnerships. These professionals can use this information to

determine where and when to extend resources. Companies with only one or a few interactions with the institution can be good candidates for intentional outreach offering additional services options, while those with high value or strong relationships may be ready to deepen or extend their commitment.

Develop a 360-Degree Relationship Management Dashboard to generate profiles of an industry partners’ relationship with the institution to centralize information, improve transparency, and find ways to expand existing partnerships. Compile information from relevant units across the university to holistically understand a partner’s level of engagement with the institution.

Progressive metrics

Progressive metrics give institutions a more holistic review of their institutional partnerships beyond monetary values. As a result, they can develop a more intentional marketing strategy and a more responsive engagement portfolio that meets the needs of their local community. Progressive metrics require multiple stakeholders across campus to share input and information, which can be difficult for institutions who have not invested in campus-wide, advanced data tracking software.

Institutions measure progressive metrics within the Discover and Evaluate stages of the Corporate Relationship Management Cycle. By finding areas of unmet need in the community and shifting internal practices at the institution to satisfy industry demands, institutions develop the most strategic industry partnerships to assist in their regional economic recovery.

Discover phase

In the Discover phase, institutions identify the unmet needs in their local community through advisory boards or external data analysis, determine what kinds of engagements can satisfy these unfulfilled needs, and market partnership opportunities. Marketing the institutional strengths to targeted external stakeholders, including government bodies, economic development groups, and local university alumni, helps create partnerships that meet the needs of the local community.

Key performance indicators

- Website traffic

- Webinar attendance

- Number of referrals

- Funds spent on advertising programs

- Number and quality of engagement activities or external events held

- Media mentions or attention

Key outcome measure

- The number of new inquiries from interested companies

- The return on investment from marketing spend (e.g., cost per click).

Reporting level

Unit peers and the corporate relations office value Discover metrics most, as these measures are integral for moving forward to the next stage in the Corporate Relationship Management Cycle—Cultivate—when follow-up to a new lead occurs. These indicators can help internal stakeholders determine which marketing campaigns were successful and what type of leads they generated.

The most progressive institutions develop corporate charters that host mentorship programs and social and professional development events for alumni who work at the same company. These charters not only engage busy alumni, but also provide opportunities to learn about the specific needs of a corporation or industry and generate additional partnership options. To begin, identify a small number of potential pilot companies with a critical mass of alumni employees. For example, Temple University requires a minimum of 75 alumni at a company in order to create a corporate charter relationship. Review this roadmap for additional strategies to source warm partnership leads, approach employers at times of critical need, and determine an employer’s needs to develop targeted training partnership proposals.

Evaluate phase

During the Evaluate step, corporate relations staff not only work with partners to ensure that they are satisfied with the partnership, but they also actively identify additional opportunities for engagement to create long-term, sustainable partnerships. Feedback from both internal and external stakeholders is essential to meet these progressive goals.

Key performance indicators

Surveys distributed to industry partners and unit peers at the institution. Survey questions could ask corporations to rate their overall partnership experience, evaluate communication times from the university, and list areas of additional support.

Key outcome measure

Feedback from surveys and discussions with industry partners and the impact of changes in processes at the institution.

Institutions can evaluate the impact of corporate feedback through expanded partnership agreements, such as the development of new academic programs to meet the corporation’s evolving needs, increased funding for research engagements, or the expansion of an internship program at a partner company.

Reporting level

Unit peers and the corporate relations office care about these metrics most. Surveys can highlight important information on how to better serve industry partners and provide corporate relations staff and other university peers with evidence to develop mitigation tactics and strengthen partnerships. Additionally, the corporate relations office can use information from the Manage phase, such as a company’s movement through a tiered framework, to highlight opportunities for growth during the Evaluate stage.

Consider sourcing feedback from corporations beyond surveys to provide the highest quality relationships with industry partners. Kirkwood Community College invites 12 employers to participate in an annual focus group to determine their greatest training needs. After the focus groups produce 36 topics of interest, Kirkwood sends out a survey to all members of their consortium to vote on the nine most relevant topics. By conducting these focus groups annually, Kirkwood Community College can remain current with industry needs without changing their training curriculum throughout the year. For more information about strategies to become a more employer-responsive institution, watch this webconference.

This resource requires EAB partnership access to view.

Access the research report

Learn how you can get access to this resource as well as hands-on support from our experts through Strategic Advisory Services.

Learn More