Five myths about M&A that higher education leaders should recognize before evaluating opportunities

The events of 2020 have ushered in a new wave of predictions of mass consolidation in higher education, through mergers and acquisitions (M&A) and closures. Colleges and universities have been facing increasing cost pressures and enrollment challenges for years, and the COVID-19 pandemic amplified these pressures on many campuses. In turn, many institutional leaders are evaluating new strategies for financial viability, including M&A. While it’s hard to measure the prevalence of M&A considerations in the industry, since these conversations are typically kept under close wraps, a recent survey of college and university presidents indicated that over 16% of institutions had explored an M&A opportunity in the past year.

While interest in M&A has spiked, many leaders remain uncertain about how it might fit into their institutional strategy. Part of this stems from stakeholder misconceptions of M&A in higher ed: Board members, for example, may have experience with M&A in other industries but fail to recognize regulatory and cultural factors that make it difficult to apply corporate best practices in a higher education context. Meanwhile, other institutional stakeholders may misinterpret media narratives around M&As in higher ed, leading to overstated expectations around the ease, likelihood, or impact of a potential transaction.

To help leaders accurately assess M&A’s role in their institutional strategy, EAB has identified and debunked the five most common industry-level myths that can misguide institutional strategy.

Myth I: The M&A playbook in higher ed mirrors other industries

Board members and leaders with experience in other industries often believe that the higher ed M&A market operates like private enterprise. In fact, many private sector approaches to M&A are not viable due to unique higher education factors, including the following:

- The importance of brand and reputation on enrollment, alumni, and local communities constrains deals and reduces potential partners, even if there is a compelling financial case.

- Shared governance gives internal stakeholders (e.g., faculty) the power to scrutinize and, in some cases, veto deals.

- Unlike the private sector, higher ed has weak financial incentives and limited resources to facilitate transactions, including a lack of equity stakes or a viable Chapter 11 restructuring pathway.

- Even if higher ed leaders can successfully navigate these barriers and propose deals, they still must overcome industry-specific regulatory and accreditation hurdles to complete transactions.

That doesn’t mean there aren’t ways that higher ed can deploy private-sector strategies. College and university leaders should seek to emulate private-sector approaches to thoroughly vetting the value proposition and employing extensive due diligence activities before initiating deals.

Myth II: M&A is the only viable path forward for some institutions as the demographic cliff approaches

In some parts of the country, the supply of seats at higher education institutions is projected to eclipse demand for those spots later in this decade. Leaders of some institutions in these regions worry that M&A may be their institution’s most viable option for survival amid projected enrollment declines.

But while merging, acquiring, or selling to another institution may be a sound strategy for some, M&A is not the only path forward in a consolidating industry. Leaders can look to grow alternative revenue streams through entering new markets or monetizing assets, “right-size” cost bases to reflect a shrinking enrollment pipeline, or explore other forms of interinstitutional partnerships to lower costs and grow revenue. These partnerships include consortia focused on sharing administrative functions through economies of scale to strategic alliances and joint ventures that leverage network effects to improve competitiveness and enter new markets.

Myth III: Traditional residential institutions are most ripe for consolidation

Education leaders often assume that M&A activity typically focuses on traditional undergraduate institutions and programs due to the market pressures they face. Although deals do sometimes involve residential undergraduate programs, demand for M&A in the past decade has been disproportionately concentrated in the adult and graduate market. As the adult learner market has grown more national and increasingly virtual, some institutions have found greater opportunities to lower costs and increase enrollment through M&A. In contrast, the fixed costs of the residential experience (e.g., facilities, place-bound faculty and staff) and geographic constraints can limit M&A benefits and opportunities in the traditional residential space.

Moreover, programs or institutions serving the adult-learner market have been prime for acquisition because they can create alternative revenue pathways that can mitigate the risks of a changing undergraduate enrollment pipeline. To that end, some well-resourced institutions have chosen to buy rather than build their way into the adult learner market through targeted acquisitions, as Purdue did when it purchased Kaplan in 2018.

Myth IV: M&A will solve higher ed’s most pressing challenges

Some industry consultancies argue that M&As can help institutions solve some of the higher education industry’s greatest challenges, such as affordability and cost growth. This claim is not entirely grounded in fact. At best, M&A can be one of many necessary steps to address these challenges and, at worst, can exacerbate them.

For example, research suggests that M&As regularly lead to increases in tuition and fees rather than lowering student prices, with estimated average increases between 5-7% following a deal. On the cost growth front, many of the cost savings achieved through M&As are one-time savings and often lack sufficient economies of scale to lower longer-term cost structures. This is not to say M&A cannot help institutions make progress addressing systemic challenges, but it is not a standalone solution.

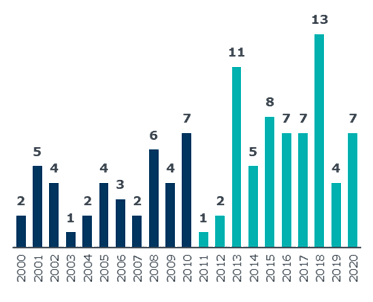

Myth V: M&A activity has already risen dramatically

Some commentators have predicted that the increase in M&A activity over the last decade foreshadows a massive spike in activity ahead. But those observations are often exaggerated: while there has been an uptick in M&A activity since 2010, it hasn’t been nearly as extreme as some claim. From 2000 to 2010, there was an annual average of 3.6 transactions per year between 4-yr institutions. That increased to an annual average of 6.5 from 2011 to 2020¹. This means that the uptick in M&A in the past decade has directly involved less than 2.8% of the 2,345 public and non-profit 4-yr institutions in the United States. Importantly, public system consolidation in some states (e.g., Georgia) accounted for a substantial proportion of that increase between the two decades.

As we look ahead into next decade, leaders can expect industry-wide M&A activity to stay elevated and likely increase, as the population of 18-24-year-olds declines and demand for higher education shrinks accordingly. However, given the size of the industry, we predict that the number of institutions involved will remain minimal.

Fewer M&As than soundbites suggest

M&A transactions involving public and non-profit 4-year degree-granting institutions, 2000-2020¹

¹2020 data is a preliminary estimate and may not represent all transactions that have closed.

More Resources

The six attributes of agile institutions

EAB’s Higher Ed State of the Sector