The five levels of financial performance to guide proactive planning in higher education

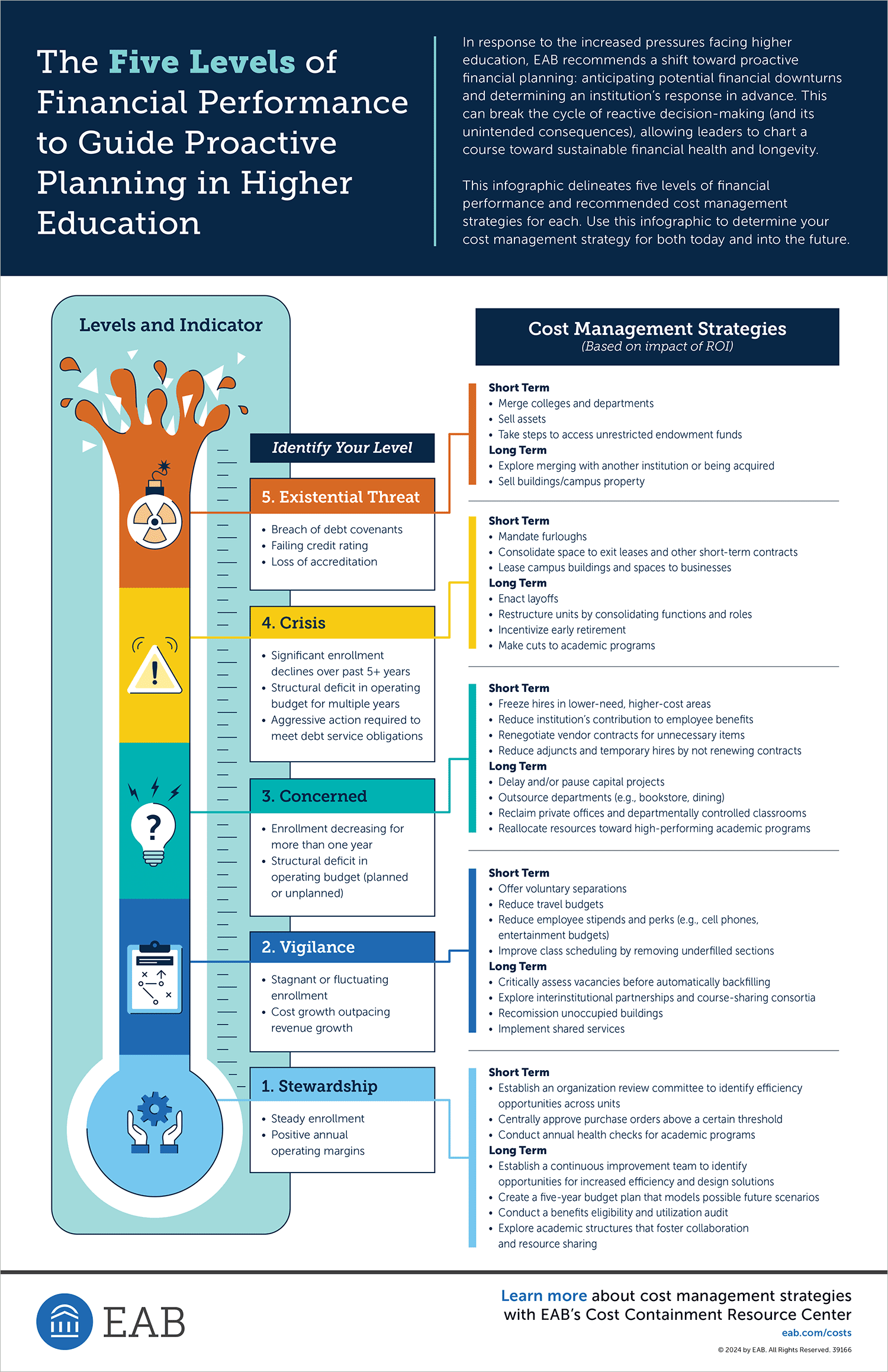

In response to the increased pressures facing higher education, EAB recommends a shift toward proactive financial planning: anticipating potential financial downturns and determining an institution’s response in advance. This can break the cycle of reactive decision-making (and its unintended consequences), allowing leaders to chart a course toward sustainable financial health and longevity.

This infographic delineates five levels of financial performance and recommended cost management strategies for each. Follow the guidance below on how to use this infographic. Below you will also find real-world examples of institutions successfully deploying cost management strategies to improve financial resiliency.

Three ways to use this infographic:

- Identify the level that best fits your institution’s current financial status and compare your current cost management strategy against the tactics in that level to identify gaps and new ideas.

- Once you’ve determined your current financial level, examine the level above. If your institution had to shift to that new level, which cost management tactics would you deploy? Consider locking in those decisions before that level becomes a reality.

- Use the infographic to help other campus leaders understand the strategies needed to achieve financial sustainability.

-

Stewardship

Despite positive operations margins, Marquette University seeks cost savings now to prepare for a less secure future, planning $31 million in cuts to its operating budget between 2024-2030.

-

Vigilance

In preparation for state demographic declines, the University of Central Arkansas has offered voluntary separations to right-size its staffing levels.

-

Concerned

Drew University achieved $1.2 million in savings by reducing its contribution to employee retirement plans from 10% to 8%.

-

Crisis

Hampshire College restructured units around a new curriculum, reduced faculty and staff, and discontinued efforts that were not “mission-centered”, including independent research centers. Since 2021, they have increased enrollment by nearly 60% and estimate they will eliminate their budget gap by 2026.

-

Existential Threat

Delaware State University acquired Wesley College in 2021. In lieu of a purchase price, Delaware State gained Wesley’s campus, assets, and 14 new academic programs, but also took on their liabilities.