Alternative Pricing Strategies for Colleges and Universities

This project performs in-depth analyses of the alternative college and university pricing strategies in the market and how an institution would evaluate whether or not to pursue any given strategy.

The pricing landscape today is challenging. Colleges and universities face acute financial pressures, and families are struggling to afford college. Yet institutional revenue and affordability are just two of many factors schools must weigh in setting prices. Pricing strategy must also align with—and can support—targeted institutional goals, from expanding top-of-funnel consideration to targeting specific student segments. This has created an environment that has university administrators wondering whether alternative pricing strategies might help inflect strategic enrollment goals and increase net tuition revenue.

This resource provides in-depth analyses of alternative pricing strategies, as well as a disciplined decision guide to help college and university leaders determine whether to pursue a given strategy.

Branded free tuition

A branded free tuition program is a scholarship that promises free tuition—as well as fees and room and board, in some cases—to all students from households below a designated income threshold. While many schools already provide free or extremely low tuition to certain student segments, there is often a lot of uncertainty among these segments about what aid is available and who is eligible.

These programs simplify the affordability conversation and encourage consideration by low- and middle-income students who are more likely to be dissuaded by high list prices.

Branded free tuition programs typically function like last-dollar scholarships, in which the amount awarded to students takes into account any additional funding or grants they are eligible for.

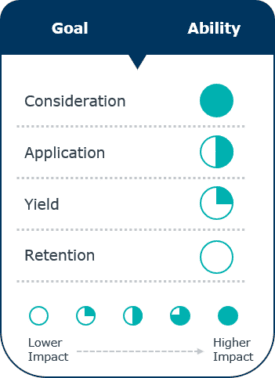

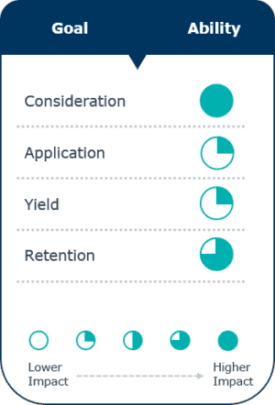

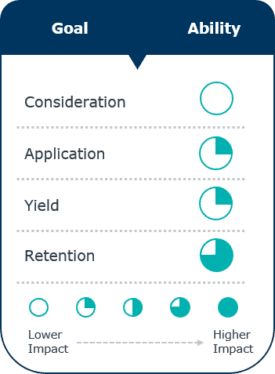

How branded free tuition programs help achieve enrollment goals:

-

Increase interest among students who mistakenly think they can’t afford it

-

Overcome concerns about fit and ability to increase applications and matriculation

-

Forestall competition from free and lower-cost alternatives

-

Capitalize on alignment of mission and PR benefits of free tuition programs

Price matching

Price matches are branded scholarship programs that guarantee qualified students will be charged the same tuition and fees as designated public institutions, typically flagships. Many students rule out private or out-of-state institutions solely on the assumption they will cost more than their in-state and public options, even when they might prefer or perform better in another setting.

Price match programs signal to students early and clearly in the search process that these institutions are affordable. By pegging prices to lower-list price institutions, these programs defuse sticker shock and reduce the uncertainty and concern about the price of college. As a result, both private and public institutions can make their way into the consideration sets of prospective students that otherwise would have written them off based on price.

Public and private variations on price match programs:

Private institutions

- Private institutions match the tuition of public flagships in their home state, neighboring states, or, in some cases, across the country

- Students often are required to be admitted to both the home institution and the selected flagship institution, but this should not always be necessary for eligibility

- Transfer students have additional eligibility requirements: minimum GPA and number of credits taken

Public institutions

- Public institutions match the tuition and fee rate of out-of-state flagships with higher prices than their own in-state tuition

- Eligibility based on residence and general admissibility requirements, not admission status at other institutions

- Aggressive marketing campaigns target out-of-state students

How price matches help institutions achieve enrollment goals:

-

Increase inquiry and application volume

-

Attract more underrepresented students

-

Recruit students that match high-ability profile

Tuition reset

A tuition reset lowers published list price, shifting an institution’s pricing model away from the traditional high-price, high-discount. Institutions generally use this strategy to attempt to grow tuition revenue by increasing headcount. The biggest boost a tuition reset can provide, however, is limited to the top of the funnel: getting into the consideration sets of more students, especially those dissuaded by sticker price.

While resets seem like a fairly straightforward solution, they are more complex in practice. Institutions might see gains in retention and applications in the year following a reset, but mixed enrollment and revenue results in the long-term often mitigate those impacts.

Under the right circumstances, a tuition reset can work. But institutions must develop a comprehensive long-term strategy to stave off the large revenue losses that can ensue if headcount doesn’t grow as anticipated and navigate a new market identity and competition pool. They must also acknowledge that a reset does little more than get the school into more consideration sets—all the work along the rest of the funnel remains the same.

What tuition resets can achieve when things go right:

-

Increase consideration from students eliminating institutions on sticker price

-

Get a second look from affluent families ruling out private institutions

-

Increase retention among students experiencing outer-year price shock

Tuition and price guarantees

Tuition and price guarantees are programs by which an institution makes a commitment to hold some part of their cost of attendance (COA) constant across the time—generally capped at four years—that students are enrolled at the institution. Tuition is raised annually for incoming students, but then held constant at that level for each entering cohort (i.e., their price is locked in once they enroll).

These programs provide predictability for incoming students and families, and lessen outer-year price shock, which helps address financial attrition. They do not, however, generally lower the overall cost of attendance, so they should not be considered an affordability measure.

These programs allow for messaging about transparency and predictability in the admissions process, but also require explaining why costs are comparatively higher in the first year, compared to peer institutions.

How tuition and price guarantees can help achieve enrollment goals:

-

Diffuse outer year price shock and reduce financial attrition

-

Appeal to planning-minded families with cost predictability

-

Deliver a differentiated pricing message in recruitment conversations

Income share agreements

Under an income share agreement (ISA), institutions award upfront funding to students on the condition that they pay a fixed percentage of their future earnings for a specified period of time post-graduation until a repayment cap or time limit is met.

By diversifying financial aid options beyond loans, ISAs can help students who are ineligible or maxed out on traditional aid offerings. In that sense, ISAs are best fit to cover the gap between financial aid and what a student is able to pay. ISAs, however, do not lower the overall cost of attendance. Students are still required to cover today’s cost with future obligations.

ISA contracts do not always require repayment in full. If a student makes the required number of payments and does not fully repay the amount obtained through the contract, the contract is nonetheless fulfilled. Institutions fund that risk of nonrepayment when students with higher salaries pay back more than the amount borrowed.

How ISAs can help institutions achieve enrollment goals:

-

Help students with financial need gaps persist through graduation

-

Signal confidence in post-grad outcomes

-

Support niche student demographics

-

Attract funding from investors and donors

Differential tuition

Differential tuition is the purposeful variation of undergraduate tuition rates by program, course, course level, modality, or residency. This pricing model recognizes the differences among programs’ operational costs and audiences’ willingness or ability to pay.

At its basic level, most institutions already have some type of differential tuition (e.g., charging higher tuition rates for out-of-state students than in-state, course fees). Increasingly, however, institutions are further differentiating price by charging different rates for different programs based on their costs or what students are willing and able to pay.

Differential tuition as a pricing strategy is still evolving, but EAB expects more institutions to pivot to this model.

There are multiple ways institutions can implement differential tuition based on the academic college, program, or major in which a student is enrolled. Each of these methods (tuition, fees, or financial aid) comes with advantages or disadvantages that become more pronounced as the amount of the differentiation grows. As colleges and universities struggle to realize the net tuition revenue gains needed to cover costs, and the returns of basic discounting diminish, differentiating price by academic area is one of the last levers administrators have to pull.

How differential tuition helps achieve institutional goals:

-

Maximize tuition revenue by leveraging market demand for programs

-

Self-sustain programs with high operating costs

-

Reallocate revenue toward new and expanded programs and services

-

Cross-subsidize lower-demand but mission-critical programs

This resource requires EAB partnership access to view.

Access the tool

Learn how you can get access to this resource as well as hands-on support from our experts through Strategic Advisory Services.

Learn More