3 Data Insights from Higher Ed Advancement Shops

Over the past decade, EAB’s Advancement Benchmarking initiative (formerly known as the Advancement Investment and Performance Initiative, or AIPI) has uncovered key drivers of successful fundraising, with staffing consistently emerging as a critical factor. In 2023, our latest analysis revealed additional insights that set high-ROI advancement shops apart, emphasizing the need for strategic staffing, efficient gift cultivation, and a deep understanding of shifting giving patterns.

The findings on this page explore how top-performing institutions leverage staffing to significantly enhance their outcomes, excel in major gift throughput, and navigate a challenging fundraising landscape. By understanding these dynamics, higher ed advancement professionals can make informed decisions that drive growth and success at their institutions.

Scroll to explore the findings below, or jump to the section you’re most interested in:

1. Increased investment and staffing drive fundraising production

-

+909K

Every additional FTE adds, on average, $909K to annual production totals.

No other metric matches the predictive power of staffing when determining fundraising outcomes. EAB’s analysis shows that the high-ROI shops are nearly twice as large as low-ROI ones.

This data, collected through EAB’s Advancement Benchmarking initiative in fiscal year 2023, can help advocate for increased staffing or investment. The data reveals significant fundraising growth for institutions with more investment and staffing.

| Staff size | Average advancement investment | Average fundraising production |

|---|---|---|

| Under 30 | $2.8M | $11.7M |

| 30-49 | $5.5M | $39.0M |

| 50-99 | $11.8M | $62.2M |

| 100-149 | $18.0M | $148.5M |

| 150+ | $39.2M | $290.7M |

Median high-ROI advancement shop nearly twice as large as median low-ROI shop

Average number of FTEs in high- and low-ROI advancement shops

-

99

High-ROI

-

54

Low-ROI

2. High-ROI shops prioritize major gift volume and high-net-worth prospects

A decade of EAB’s Advancement Benchmarking has consistently demonstrated the strong relationship between staffing and fundraising production. In 2023, our analysis identified two additional insights that distinguish high-ROI advancement shops from their peers.

First, high-ROI shops excel in major gift throughput. These institutions don’t just wait for mega-gifts to hit their goals; they focus on efficiently cultivating and closing major gifts across all tiers. By incentivizing major gift officers to maintain high productivity and quick portfolio churn, these shops consistently secure a higher number of major gifts.

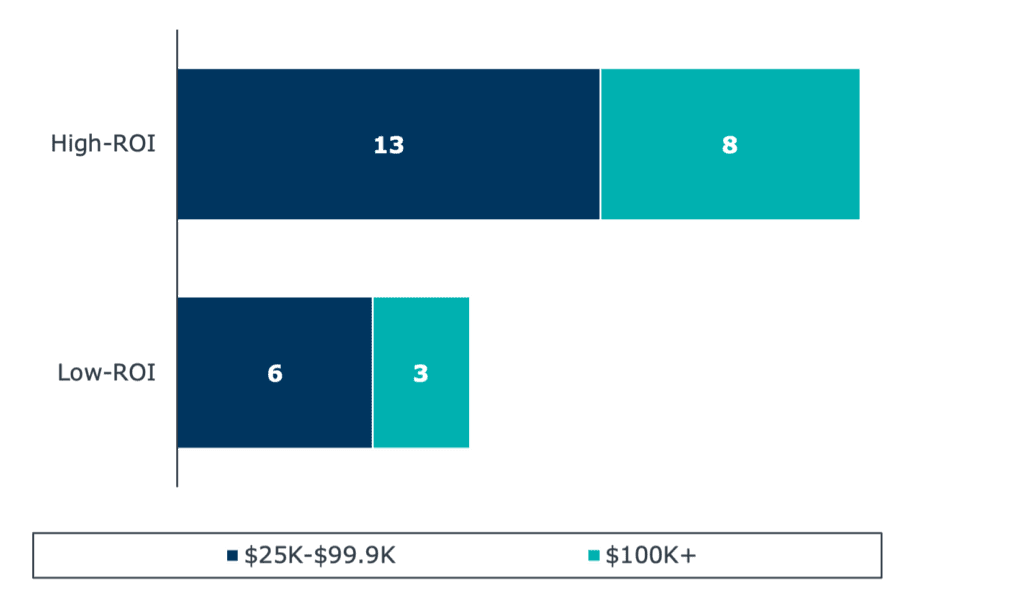

High performers focus on major gift throughput

Number of major gifts closed annually per major gift officer, at high-ROI shops vs. low-ROI shops

Second, high-ROI shops are particularly adept at engaging high-net-worth prospects. They understand that cultivating these potential top-tier donors is critical to long-term fundraising success.

High-performers engage a larger share of high-net-worth prospects

Percentage of high-net-worth households giving at any level in the last five years, at high-ROI shops vs. low-ROI shops

- High-ROI: 42%

- Low-ROI: 30%

3. $1M+ gift bands drive modest fundraising decline in 2023

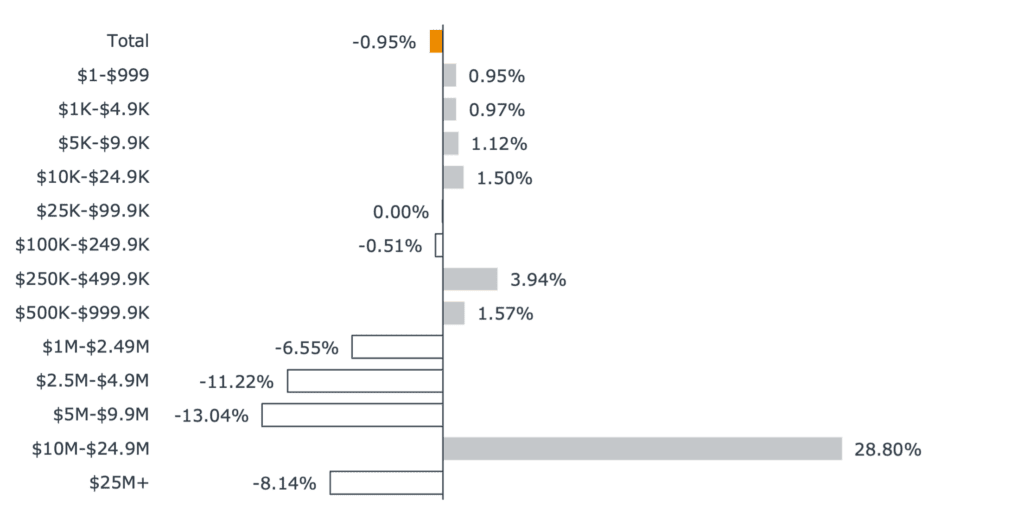

As advancement professionals continue to navigate a challenging fundraising environment, understanding recent shifts in giving patterns is critical for strategic decision-making. This data, collected through EAB’s Advancement Benchmarking, compared FY2022 and FY2023 giving in 13 different gift bands.

The data reveals growth in six of the eight gift bands below one million dollars, while four of the five gift bands above one million dollars experienced a decline. Overall, total giving decreased by 0.95% from 2022 to 2023.

Dollars below $25K up, mid-level major and principal giving down

Average percent change in dollars by gift band, FY2022-FY2023

-

+28.8%

Despite declines in most gift bands above one million dollars, dollars from gifts between $10M and $24.9M grew substantially in FY2023. This indicates strength in securing principal and mega gifts, though historical EAB data suggests that gift bands above $10M are often volatile year-over-year.

This resource requires EAB partnership access to view.

Access the tool

Learn how you can get access to this resource as well as hands-on support from our experts through Advancement Advisory Services.

Learn More