Consolidation in higher education on the rise? What campus leaders need to know.

Higher education faces mounting financial pressures due to declining state funding, decreased enrollment, and increased tuition discounting. State funding for higher education has declined by 25% since the Great Recession, while costs have risen by an average of 5.2% annually. In a recent EAB survey, 37% of senior university leaders indicated that their institutions are facing structural deficits.

To address these challenges, 16% of university presidents have discussed merging with another institution in the last year. EAB has also seen a rise in M&A inquiries over the last six months, with several leaders actively engaged in consolidation conversations. These factors suggest the market is primed for consolidation—but what does the data show?

Headlines point to M&A mania in higher ed, but data suggests modest increases

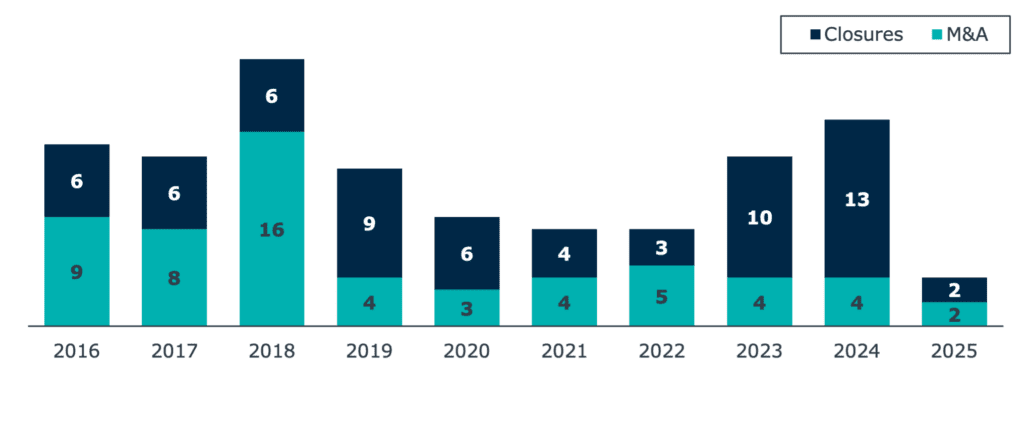

EAB’s analysis shows a slight increase in M&A activity, but not nearly as dramatic as the increasingly frequent headlines might suggest. Overall, M&A activity has increased since 2000 with 67 recorded deals from 2000–2015 compared with 59 since 2016. This represents an increase from just over four M&A deals per year to nearly six, a two-thirds increase.

M&A transactions and closures, 2016–2025

*2024 and 2025 data current as of June 3, 2024

Closures on the rise as M&A activity levels out

Notably, there has been a distinct shift away from M&A and toward closures. M&A activity has leveled out since 2019, hovering between three to five per year. By comparison, closures have increased significantly, with 74% more closures than M&As since 2020 (i.e., 40 vs. 23). These institutions cite post-pandemic recovery issues, enrollment declines, and financial challenges as the main reasons they closed.

While overall activity has increased slightly, the trend has shifted away from M&A and toward closure. In 2024 alone, 13 closures have been announced, including schools like Wells College and Birmingham-Southern.

-

Related resource

Diagnose your institution’s current financial state and identify cost management strategies with EAB’s infographic.

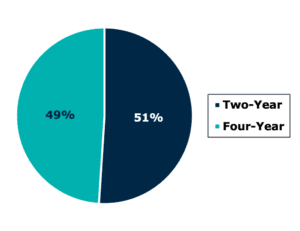

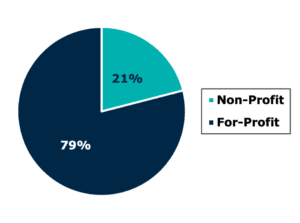

Majority of closures are two-year and for-profit institutions

While these trends may concern higher education leaders, important patterns emerge about the types of institutions involved. Of nearly 4,000 U.S. higher education institutions, 777 have closed since 2010, with 51% being 2-year institutions and 79% for-profit organizations.

Two-year vs. four-year closures

Non-profit vs. for-profit closures

N = 777

M&A only one of many partnership options between institutions

Despite recent increases in closures and consolidation in higher education, most institutions remain in operation. Yet, faced with increased financial pressure, many institutions are looking for new partnership opportunities. They recognize that financial challenges also present an opportunity to consider a wider spectrum of partnerships to share resources.

Spectrum of partnership pathways in higher education

From least to most integrated

-

Consortia (least integrated)

– Multiple independent institutions share resources and services

– Partnerships typically focus on administrative services

-

Strategic alliances

– Multiple institutions enter a collaborative while remaining independent

– Partners integrate resources and services, but also cooperate on revenue opportunities

-

Joint ventures

– Two or more institutions form a shared entity to generate revenue

– Most ventures take form of joint academic units

-

Reimagined systems

– Multiple institutions affiliate by sharing services and strategy

– Affiliated institution may retain its own brand, board, and legal entity

-

M&As (most integrated)

– Two or more institutions combine, or one absorbs the other

– Entities fall under unified control and governance structure

Reimagined systems are an option for similar institutions to preserve their unique identity. For example, the Church of Jesus Christ of Latter-day Saint’s Church Educational System (CES) was created to sit over three stand-alone universities (including Brigham Young University). The CES serves as a central board of trustees governing each institution, while the schools remain separate legal entities.

Institutions in consortia and associations are also well-positioned to adopt an integrated system structure in the future since they already collaborate on services and technology.

-

Related resource

Find more information on interinstitutional partnerships and case studies from successful arrangements in EAB’s Compendium of Interinstitutional Partnerships.

More Blogs

How higher ed leaders are diagnosing—and fixing—administrative gaps

4 higher ed alternative revenue ideas that won’t deliver—and what actually will