Avoid External Funding and Rely on Strategic Investment for New Program Launch

Colleges and universities are setting ambitious revenue growth goals for online and other adult-serving programs. As the traditional undergraduate population declines, serving alternative audiences has become an imperative. But when higher ed leaders consider the launch of a new online program, they face two complex questions:

- How do we create capacity quickly to launch and administer new programs at scale?

- How do we find the capital necessary to invest in new staff, technology, or faculty when budgets are already strained?

Faced with seemingly insurmountable hurdles, leaders look to external partners like online program managers (OPMs) to support the development and launch of new programs. While providing access to capital and capacity to support scaled programs, OPM partnerships also bring heated political debates to campus: Why are we sharing millions of dollars with a for-profit partner? As I overheard a business officer state at a recent conference, “these OPMs charge us usury rates for capital, but we don’t always have another feasible option.”

Strategic investment enables alternatives to risky external partnerships

The good news is that higher ed has found a feasible alternative to external partnerships: strategic investment. EAB analysis of benchmarking data collected on COE units has found a strong correlation between maintenance of a strategic reserve fund and long-term revenue outcomes.

OPMs support the launch of new programs by leveraging their marketing expertise to target prospective students. But a college with its own reserve fund can proactively invest in marketing capacity and build a transparent pipeline of prospective students. Likewise, universities can invest in technology platforms or hire instructional designers to reduce their dependency on external partners. In short, a reserve fund allows institutional leaders to:

- Invest in staff capacity

- Seed the launch of revenue-generating programs

- Support cutting-edge learning technologies

Reserve funds help COE leaders support faculty-driven program launches

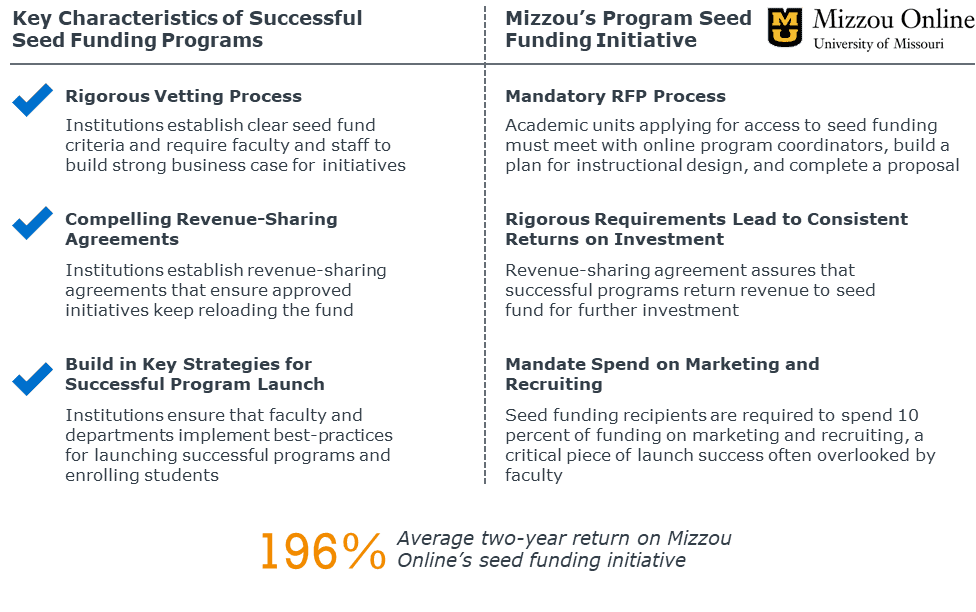

COE leaders may also hesitate to leave online program development and launch entirely to faculty and college administrators. If COE leaders lack direct authority over academic staff, reserve funds serve as a powerful incentive for collaboration, and allow COE units to act like an “internal OPM” of sort. University of Missouri’s Mizzou Online does just that, using their program development seed funding to nudge faculty and academic administrators to launch new programs using some of the essential disciplines learned over years of practice.

To access seed funds from Mizzou Online, faculty and academic leaders must submit a proposal for approval. While most proposals in the RFP process are ultimately approved, rounds of revisions help program leadership to develop a comprehensive, long-term plan for developing the curriculum and work with instructional designers to meet launch deadlines.

COE leaders often lament that academic partners overlook the importance of marketing new program launches. The build it and they will come mentality no longer suffices, so Mizzou Online embeds a marketing budget in their seed funding. Mizzou Online mandates that 10% of the program seed fund finance marketing the new program launch, ensuring that a haphazard outreach strategy does not limit early term enrollments.

Building these business disciplines into the seed funding initiative helps new programs quickly enroll students and generate net revenue. On average, Mizzou Online nearly doubles its initial investments in new online programs, creating a self-sustaining investment fund that supports a cycle of growth.

More Resources

The Realities of Graduate Certificate Programs