How to find the next generation of major gift donors

Setting our sights on tomorrow's prospects

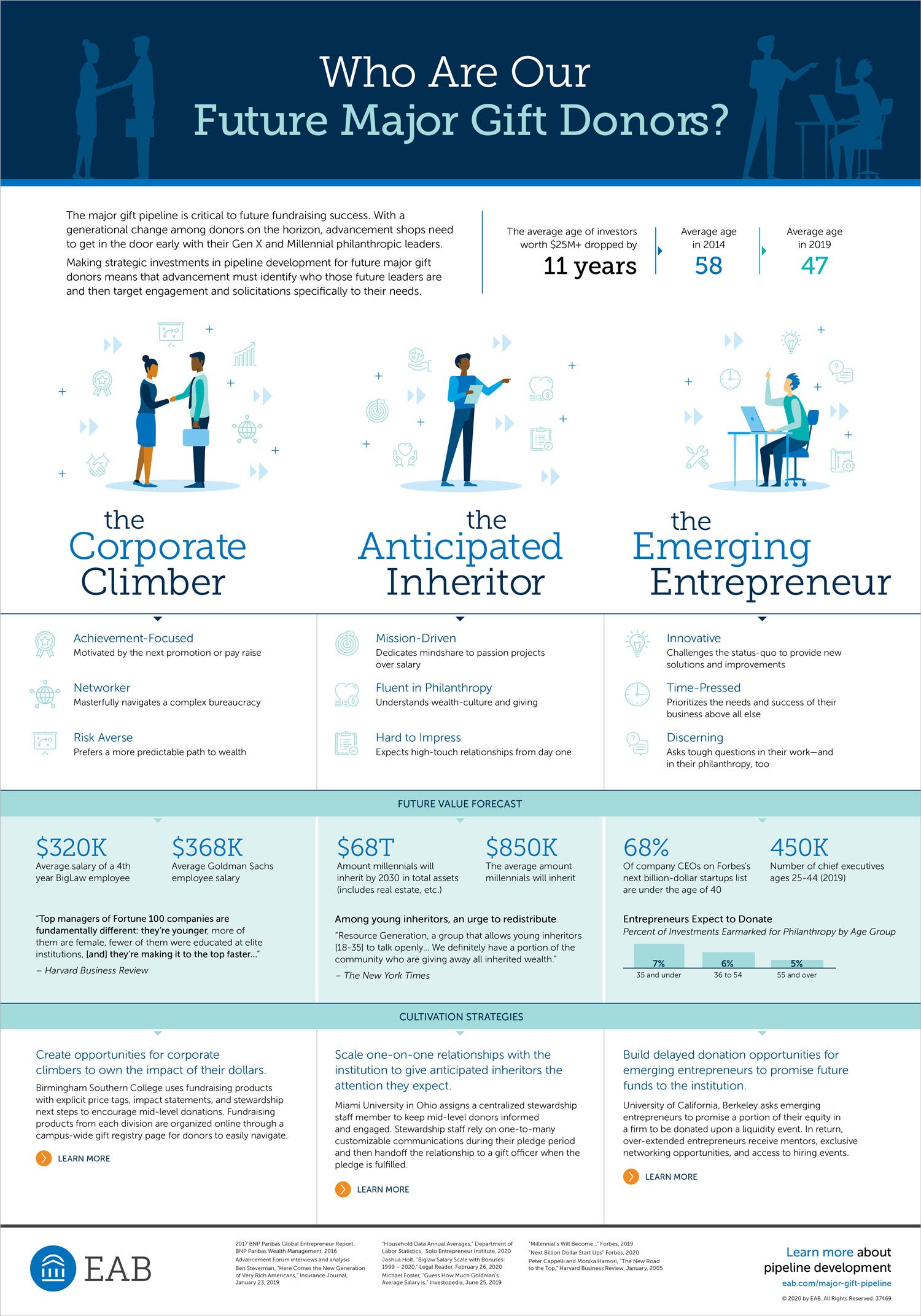

The major gift pipeline is critical to future fundraising success. With agenerational change among donors on the horizon, advancement shops needto get in the door early with their Gen X and Millennial philanthropic leaders.

Making strategic investments in pipeline development for future major giftdonors means that advancement must identify who those future leaders areand then target engagement and solicitations specifically to their needs.

Sources

- 2017 BNP Paribas Global Entrepreneur Report, BNP Paribas Wealth Management, 2016

- Advancement Forum interviews and analysis

- Ben Steverman, “Here Comes the New Generation of Very Rich Americans,” Insurance Journal, January 23, 2019

- “Household Data Annual Averages,” Department of Labor Statistics, Solo Entrepreneur Institute, 2020

- Joshua Holt, “Biglaw Salary Scale with Bonuses: 1999 – 2020,” Legal Reader, February 26, 2020

- Michael Foster, “Guess How Much Goldman’s Average Salary is,” Investopedia, June 25, 2019

- “Millennial’s Will Become…” Forbes, 2019

- “Next Billion Dollar Start Ups” Forbes, 2020

- Peter Cappelli and Monika Hamori, “The New Road to the Top,” Harvard Business Review, January, 2005

More Resources

5 Reasons Advancement Leaders Must Prioritize Data

The omni-channel advantage