4 reasons your labor market analysis isn’t capturing employer demand for graduates

Maybe you’ll find this situation familiar: you’ve heard from faculty and industry leaders about strong and growing demand for a particular program. But when you receive an analysis of job postings data quantifying demand for that program—whether from internal researchers or EAB’s Market Insights team—the data is not exactly what you were expecting. For example, the labor market analysis may show low demand or decreasing job postings over recent years.

THE 50 MOST IN-DEMAND SKILLS FOR GRADUATES OF YOUR MASTER’S PROGRAMS

While this type of finding might come as a surprise, there are explanations for why the labor market analysis might not showcase the demand your team was expecting to see. Here are four key reasons why labor market data may not be capturing a strong need for program graduates.

1. Online job postings may not surface employer demand.

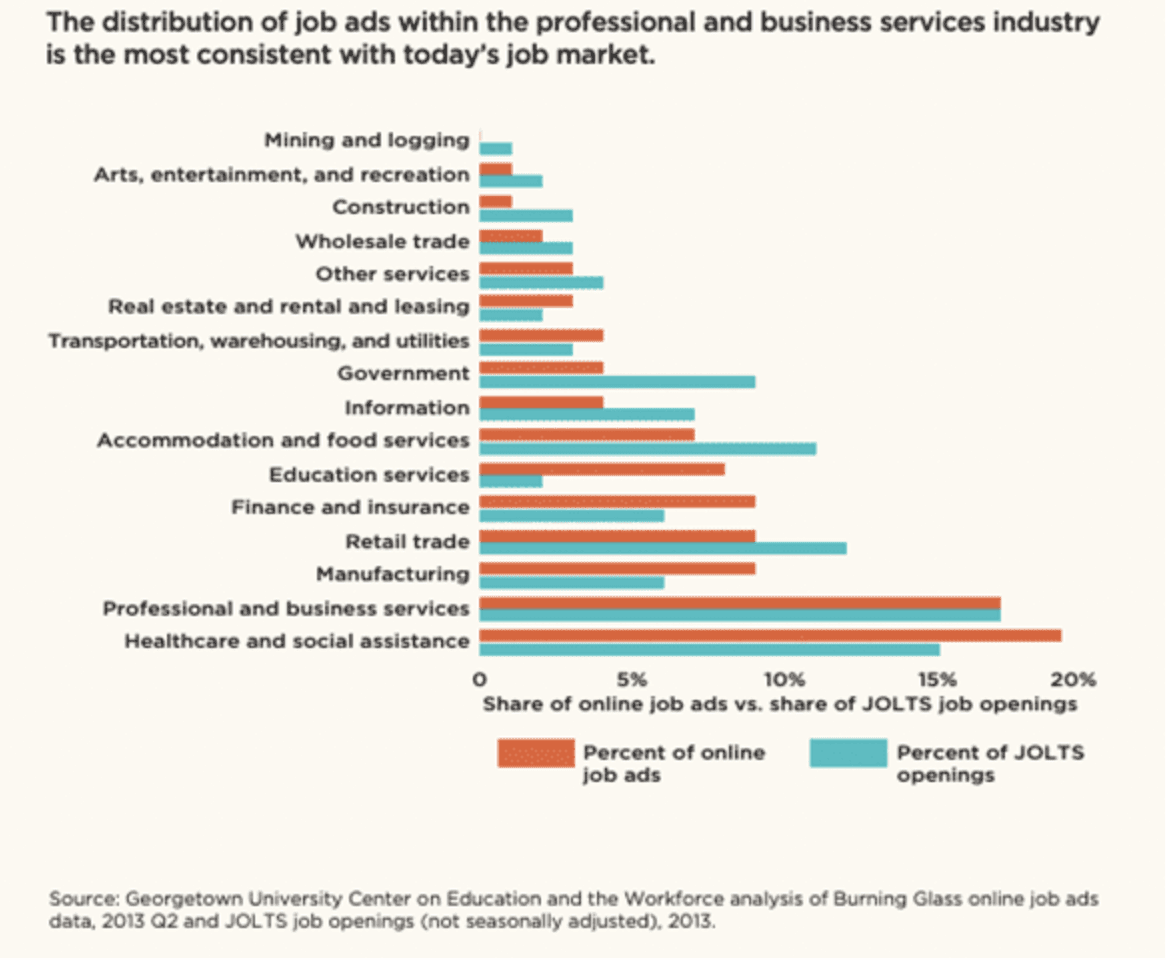

It is important to note that online job postings are not perfectly representative of all employer demand. Labor market data often prioritizes online job postings, so any positions advertised through other channels will not be represented. While past research indicates 60% to 70% of all job openings are posted online, and between 80% to 90% of postings requiring applicants with a bachelor’s degree are posted online, “white-collar” office and STEM jobs account for the majority of these postings.

Additionally, some industries like arts, entertainment, and recreation have a greater proportion of self-employed individuals who operate on a freelance and/or contract basis. Therefore, job openings in select industries and occupations may be underrepresented in online job postings.

2. Strong national or regional employment trends don’t always equate to strong local demand.

It’s possible that national and/or regional employer demand isn’t translating into the local labor market. Maybe there has been chatter about a certain degree leading into a fruitful labor market, and while national employer demand trends are indicating a strong and growing need for relevant professionals, your local area is experiencing stagnant growth in that field. For example, employer demand for cybersecurity graduates is high nationally and in specific states such as Virginia and Maryland (given the number of government agencies located in the region), but low in states such as Montana, West Virginia, and Mississippi.

WHY GROWING EMPLOYER DEMAND DOESN’T GUARANTEE SUCCESS FOR CYBERSECURITY PROGRAMS

3. Demand has yet to spike for a new field.

It might be the case that the program under review is ahead of the game, and historical demand is not representative of what’s to come. A blog post from my teammate Lauren Edmonds shares an example of research conducted in the mid-2010’s on an institution wanting to develop a program in individualized medicine and genomics. Without existing programs to reference, the EAB research team conducted interviews with experts in the field and explored industry literature. The team’s research found a degree on the verge of success but with limited historical employer demand.

3 TIPS FOR INNOVATIVE PROGRAM DESIGN

4. Demand isn’t as strong as individuals’ experiences lead them to expect.

The possibility always exists that the labor market isn’t what you expected to find. That’s why we analyze labor market data in the first place: sometimes the data surprise us. Considering the situations above, however, ensures you don’t rush to abandon a program that could still hold opportunity.

To investigate if other market data supports program development, even if current employer demand data does not, check out the other data sources in our New Program Launch Guidebook. If no data source indicates demand for your program idea, you might be in situation 3 and there simply isn’t need for your program right now. Or, if there is demand articulated in other ways, you could be in case 1 or 2, where jobs opportunities are shared and filled through networking or self-employment, or national and regional demand is not reflected in your local area.

Program launch is always risky and is even more so when employer demand data does not indicate a strong and growing labor market. However, using tools like the New Program Launch Guidebook and then incorporating research-backed marketing practices reduces the risk and contributes to successful program launch.

More Blogs

The big bets that actually drive online enrollment growth

How to use state demand data to launch or revitalize programs