College costs: How enrollment teams can address parent and student concerns

Enrollment professionals are at the forefront of one of the most important—and challenging—conversations families face: the cost of higher education. Parents and students are both deeply concerned about affordability, but they often struggle to communicate their concerns to each other. The good news? Our surveys of more than 1,600 parents and 20,000 students show that they’re more aligned on this issue than they realize, and there are many ways that you can support parent-student dialogue around college costs.

Read our full insight paper from our 2024 Parent Survey here

Parents and students are more aligned than they think on cost concerns

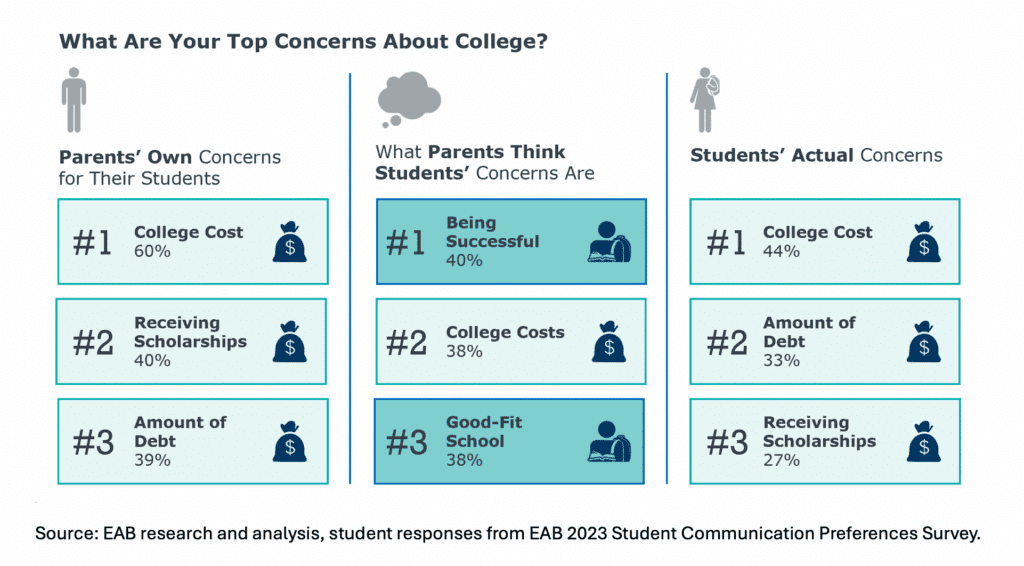

Our surveys of parents and students show that both groups rank cost as their top concern when considering higher education, and financial issues are the top three concerns among both parents and students. However, there’s a perception gap: parents may not fully grasp how much their children worry about the financial burden, expecting them to focus on how successful they’ll be and whether or not the school is a “good fit.”

For parents, these concerns arise as they worry about the long-term impact of college expenses on their own finances, such as their ability to retire after paying for college. Students are equally concerned about the potential debt they’ll incur and whether their college investment will pay off, which has taken a toll on student mental health. There is an opportunity for enrollment teams to help bridge this communication gap by acknowledging their shared anxiety and facilitating productive conversations that address cost misconceptions along the way.

Helping families helps you achieve your enrollment goals

In enrollment, you have the unique opportunity to guide families through one of the most significant decisions they’ll ever make. By offering clear, consistent information across platforms, especially in print, you can help parents and students recognize their shared concerns and collaborate more effectively. This approach not only aligns their perceptions but also empowers them to make informed decisions about college costs.

Conversation Starters on College Cost

Don’t shy away from facilitating financial conversations with families. These conversations can help address concerns and alleviate anxiety by exploring financial aid options, clarifying misconceptions, and emphasizing the true (net) cost of college —as opposed to the advertised “sticker price.”

- “Have you and your student discussed what ‘affordable’ means to your family?

- “Based on the research you have done so far, what is your current expectation of how much it would cost to attend our school?”

- “What do you hope to understand better about college costs and financial aid?”

- “What types of financial resources are most important to you (e.g., scholarships, grants, work-study)? How can we ensure you have the information you need before applying?”

- “Based on your application, are you aware that you’re eligible for [scholarship/aid opportunity here]?”

Parents are anxious about understanding college cost

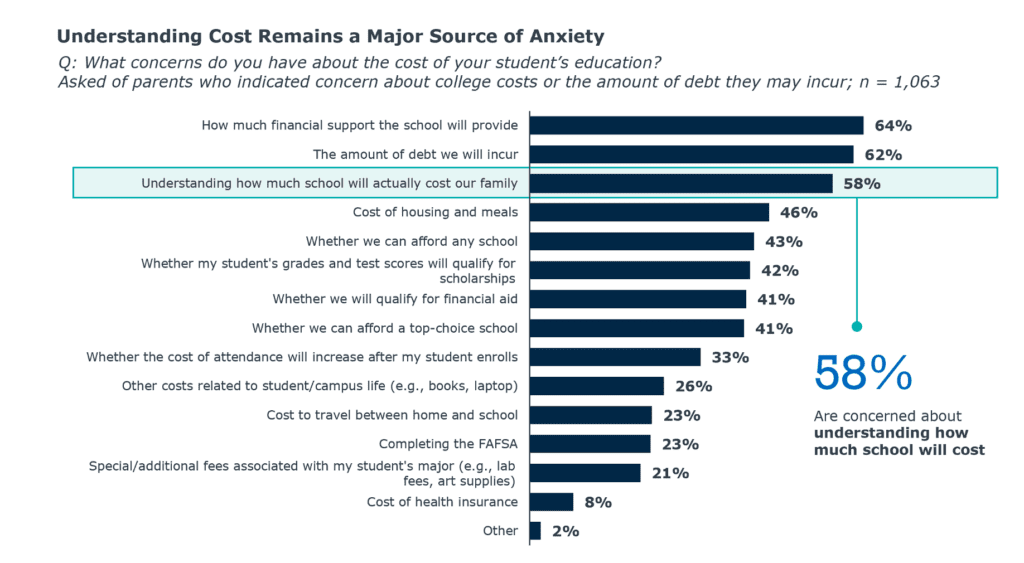

Our survey confirms that parents have a lot of questions about how much college will cost. Economic uncertainty and rising inflation have significantly increased the cost of living, making the already substantial expense of higher education even more burdensome. Additionally, parents are increasingly aware of the long-term impact of student debt, with many wary of the financial strain that loans could impose on their family. By addressing these concerns head-on and offering clear information, colleges can build trust with families, improving student enrollment with financial transparency and fostering a more informed decision-making process.

The recent issues with have also created confusion and delays, leading to further anxiety about the actual cost of college. Combined with a growing scrutiny of the value of a college degree and its return on investment, these factors have intensified parents’ focus on understanding and managing college expenses.

Helping parents and students understand net cost can help. There has been some improvement: 63% of parents in 2024 said that they evaluate net cost, up from 59% in our 2022 survey. This modest gain may be attributed to a rise in national dialogue around student loans and FAFSA changes, which shows us how vital it is to communicate with parents on cost. However, 58% of parents report they’re concerned about understanding how much school will cost—indicating that there’s still room for improvement.

Add dedicated parent messaging to your outreach with Enroll360

Why print collateral still matters in a digital world

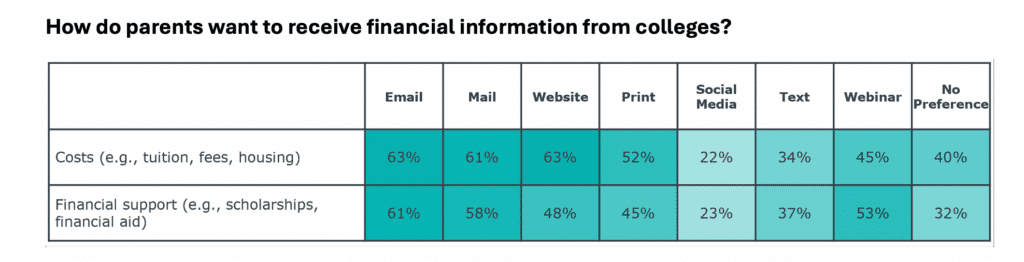

At EAB, we know that the right message, at the right time, delivered in the right manner is an effective communication mantra. But to be successful in reaching parents, you need to understand what parents think about the nuances of communication channels, timing, and format. This is why we also surveyed parents on their communication preferences for cost and financial aid information in particular (among more than a dozen other topics, which you can find in the full insight paper).

As digital platform usage continues to surge, the importance of print materials might seem diminished, but they remain a vital tool for clear communication, especially regarding financial details. Print collateral provides a tangible, easily digestible format that can help facilitate the conversation between students and parents.

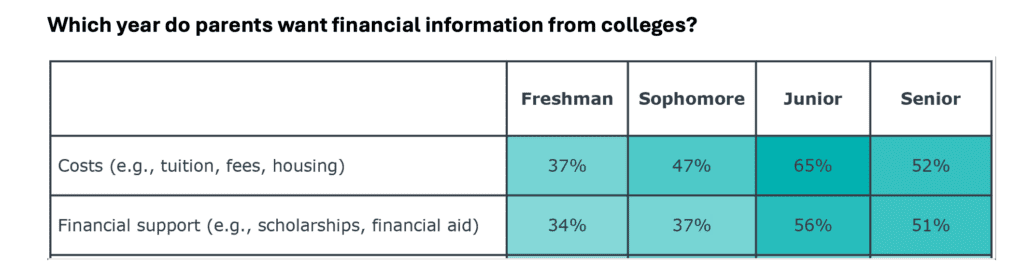

Parents increasingly seek financial and cost information from colleges during their child’s junior and senior years, when decision-making becomes critical. Concern about tuition, fees, and housing peaks at these stages, with many families eager to understand the financial implications before making a final choice. Notably, parents prefer receiving this information through traditional channels, with email and mail being the most favored

Detailed brochures, financial aid guides, and cost breakdowns offer families a physical resource they can review together. These materials simplify complex financial information, making it more accessible for everyone involved. Many parents prefer mailed collateral and handouts because they can digest the information at their own pace, revisit details when needed, and discuss the content with their children. Among a plethora of digital notifications, a mental to-do list, and the unexpected happenings of day-to-day life, a postcard on the fridge from your institution is a tangible reminder to take the next step. Utilize the resources below to plan for or round out your print communications.

Print collateral ideas that address parents’ cost concerns

These recommendations are based on our survey findings and provide actionable strategies to address parents’ concerns about college costs.

- More parents are considering the net cost of college versus sticker price. To support this type of analysis, create a financial guide including a breakdown of net costs, scholarships, and example financial aid awards, so families have a clear understanding of their financial commitments.

- Parents across all demographics are anxious about understanding complex cost information. Provide easy-to-read charts and graphs that illustrate the total cost of attendance, including tuition, fees, room and board, and other expenses.

- More than half of students and families had trouble submitting their FAFSA. Use EAB’s FAFSA submission resources for drag-and-drop handouts that help students and families navigate complex financial aid decisions. You can also offer a printed FAQ sheet addressing common financial concerns, such as understanding financial aid packages, student loans, and finding additional funding sources.

Helping families helps you achieve your enrollment goals

In enrollment, you have the unique opportunity to guide families through one of the most significant decisions they’ll ever make. By offering clear, consistent information across platforms, especially in print, you can help parents and students recognize their shared concerns and collaborate more effectively. This approach not only aligns their perceptions but also empowers them to make informed decisions about college costs.

More Blogs

15 more campus visit tweaks that win over students

What Blockbuster can teach enrollment leaders about AI-powered college search