How to understand higher education enrollments in economic recessions

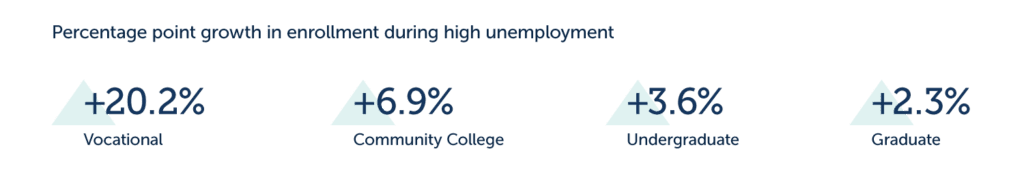

The tendency for higher education enrollments to increase as the economy declines, a countercyclical trend, is well documented. But not every institution benefits equally from these additional students.

For community colleges and vocational institutions, high unemployment is likely to boost enrollments. However, enrollment heads at four-year institutions should be more cautious. The Great Recession had a far smaller impact on baccalaureate and graduate enrollments.

Grad Enrollment Increase During Last Recession Low Compared to Sub-Baccalaureate

Vocational institutions and community colleges most exposed to countercyclical trends

About 70% of countercyclical students enrolled in community colleges and vocational institutions during the 2008 recession, boosting enrollments. But as the economy recovered, these sectors also lost students. Since 2010 student counts have declined by 2-6 percent each year for community colleges, and by as much as 12 percent a year for vocational institutions.

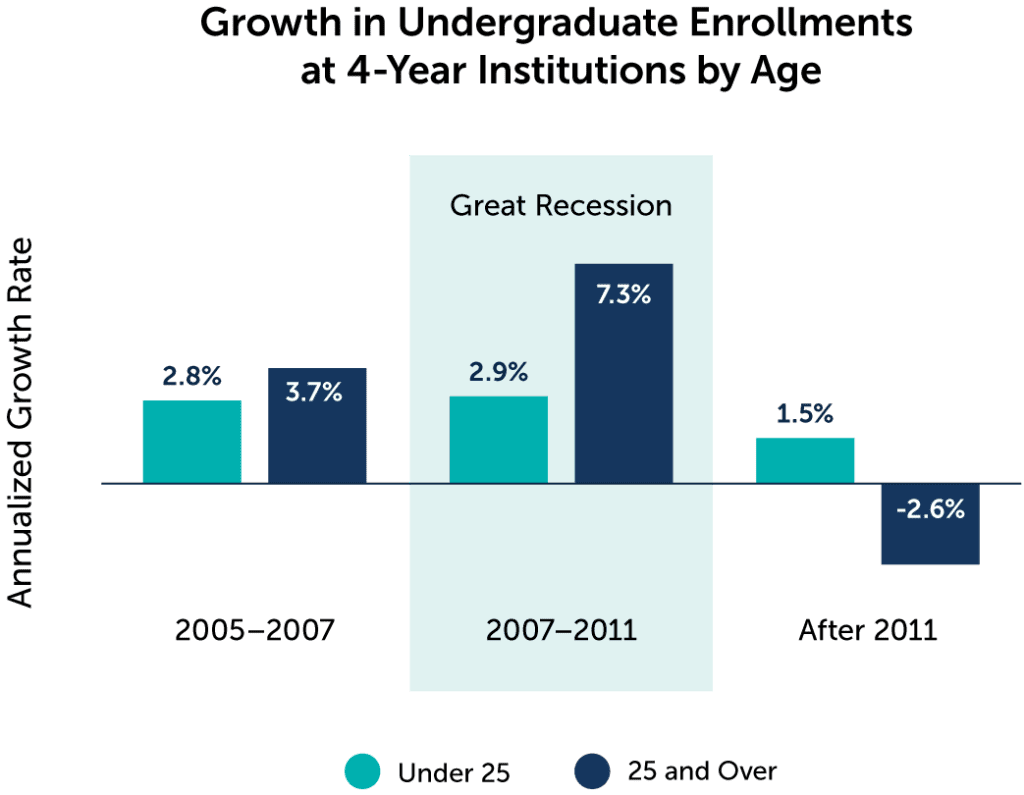

Adult degree completers boost baccalaureate enrollments

Countercyclical growth in undergraduate enrollments at four-year institutions came from older students, many of whom were completing a degree after stopping out of college. From 2007 to 2011, the number of students 25 and older increased by more than 7% each year on average, while growth in traditional students barely changed.

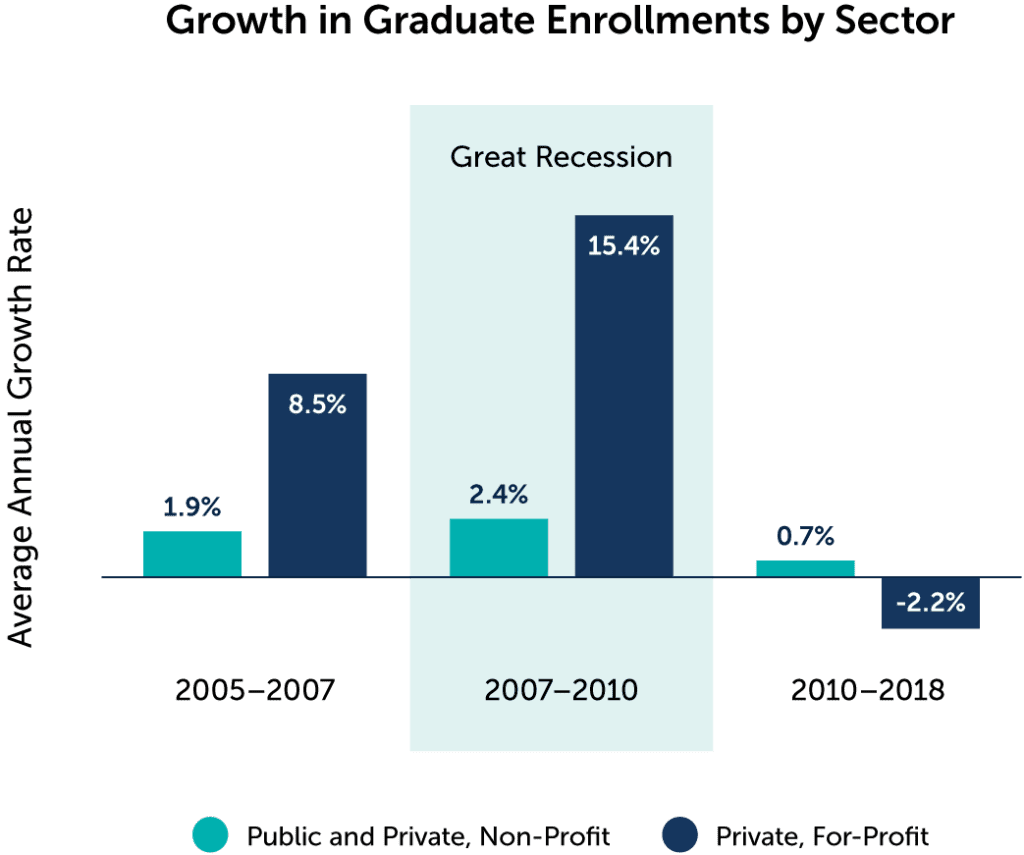

Limited countercyclical boost for graduate programs

The recession increased graduate enrollments only slightly, and disproportionately at for-profits. The impact was small because most unemployed workers in the last recession lacked the bachelors degrees necessary to enroll in a graduate program.

Why 2020 is not a rerun of the great recession

While historical trends suggest that enrollments could increase this fall, there are four main reasons university leaders should be cautious about expecting 2008 trends to repeat themselves:

- An online-only fall semester could dissuade traditional students, offsetting gains from unemployed workers.

- Anticipating a quick recovery, workers may hold out on reskilling plans.

- Fewer FAFSA completions and no Pell Grant expansion mean fewer students will have access to financial aid, squeezing enrollments.

- Unemployed workers may look instead to alternative providers for their education needs.

More Resources

College Search in the Age of AI

The New Rules of Engagement for Enrolling Today’s Adult Learners