Minimize Financial Attrition

Financial factors are often a key player in students’ success in college. Currently only 26% of students from the bottom quartile of income who begin post-secondary education exit with a bachelor’s degree within six years, compared with 59% of students from the top quartile. Colleges and universities have both a moral and financial imperative to do everything in their power to ensure finances aren’t the primary cause of attrition for most students. Read on to learn how.

Identify students at risk of financial attrition

EAB analysis shows that low income status is not necessarily the best indicator that a student is at risk of financial attrition. Due to the way aid is packaged, it’s possible that some students just above the Pell cutoff may have larger “gaps” than Pell-eligible students. As a result, some progressive institutions have adopted a more robust methodology for identifying at-risk students.

Read our insight to understand the perspective and challenges of a Pell Grant recipient.

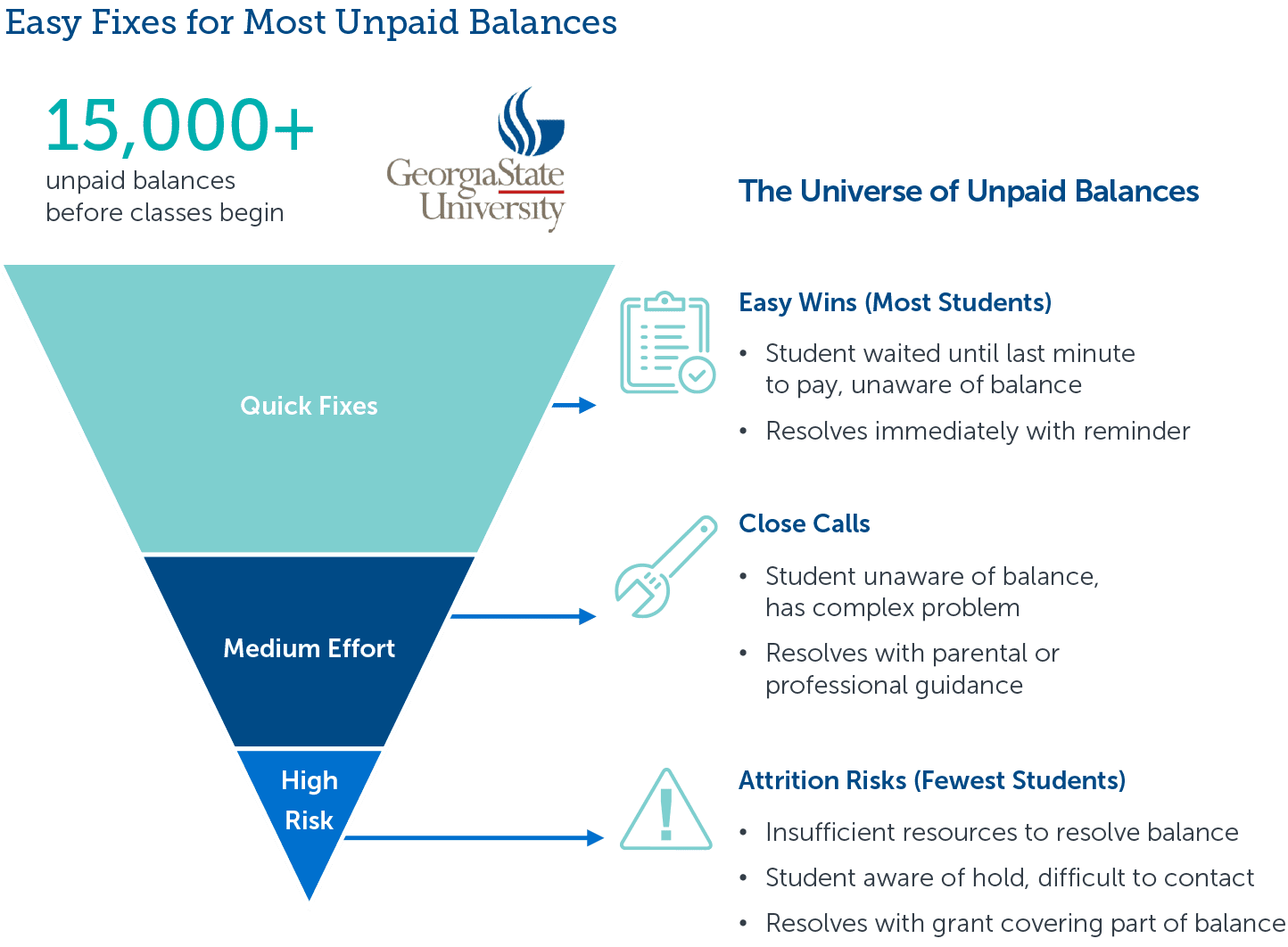

Establish a bursar hold forgiveness program

Registration holds are a common practice used to ensure that students are incentivized to resolve issues with student accounts, parking tickets, and student conduct, among others. But often, these holds remain unresolved and block students from registering for courses altogether, catalyzing a series of events that increase attrition rates.

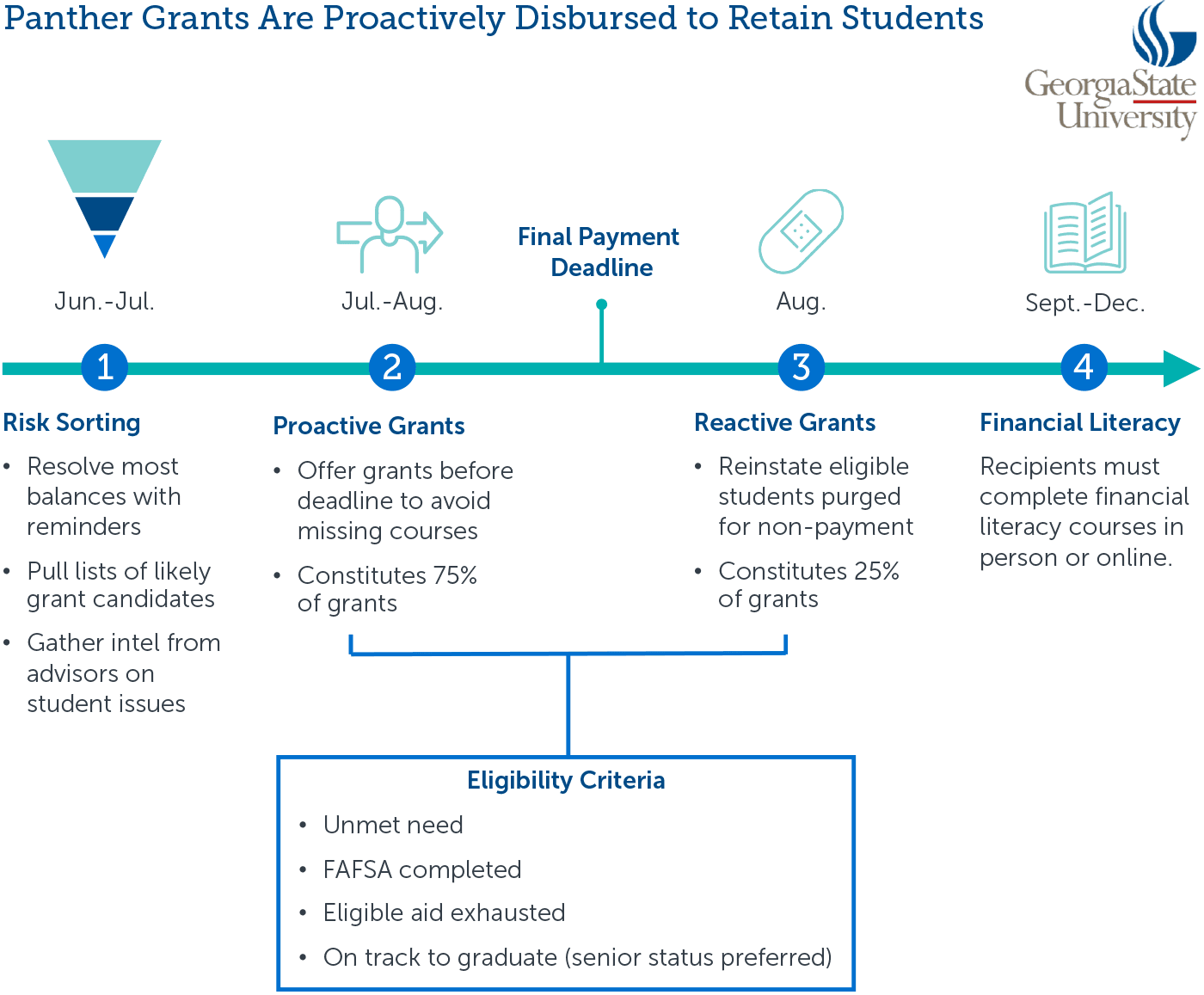

Target emergency grants to the right students

Many colleges and universities have realized students are stopping and dropping out due to unexpected financial circumstances. As a result, more institutions are offering microgrant programs that can help students when unexpected situations arise, such as a broken car or a medical expense. For these students, small targeted grants, usually less than a few thousand dollars, can keep them in school and on the path to graduation.

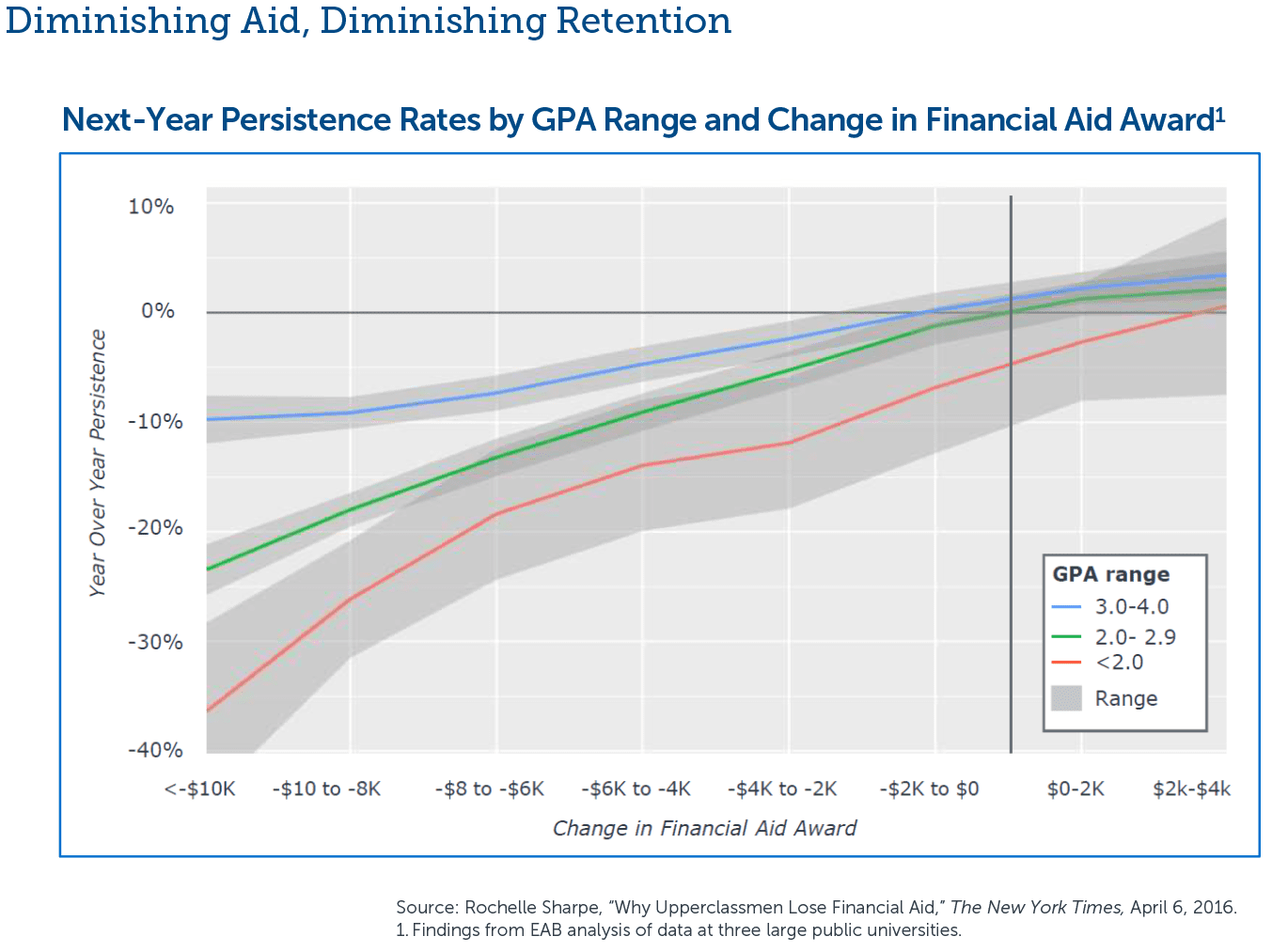

Prevent lost merit aid from causing attrition

One of the strongest predictors of attrition is a loss of merit aid. Merit aid typically comes with first-year GPA requirements that leave little margin for error and no time for course-correction. A student who struggles adapting to college in the first semester, but pulls it together for the second, may find themselves paying a significantly higher bill in year two.

This resource requires EAB partnership access to view.

Access the roadmap

Learn how you can get access to this resource as well as hands-on support from our experts through Strategic Advisory Services.

Learn More