What’s driving growth in adult learner revenues?

A major highlight of my past year has been relaunching our Organizational Benchmarking offering within Professional and Adult Education Advisory Services (I also landed Eras Tour tickets but that’s less relevant to what comes next). We launched our initial survey in 2012 and advised hundreds of PCO leaders based on that data across the decade. But times have changed, and so has our approach. The relaunch enabled us to invest in more comprehensive data collection which allowed for richer data analysis. We’ve been hard at work on that analysis and I’m eager to share some of our early insights.

We’ll need some definitions first. A key feature of our organizational benchmarking work has always been going beyond the benchmarking to determine what’s driving the success of top-performing PCO units. With that in mind, we’ve focused much of our analysis on understanding the characteristics of a “high-revenue” PCO unit relative to others. We’ve defined respondents within the following categories:

3 early insights from our 2024 Organizational Benchmarking Survey

1. Strategic investment funds remain critical to growing revenue.

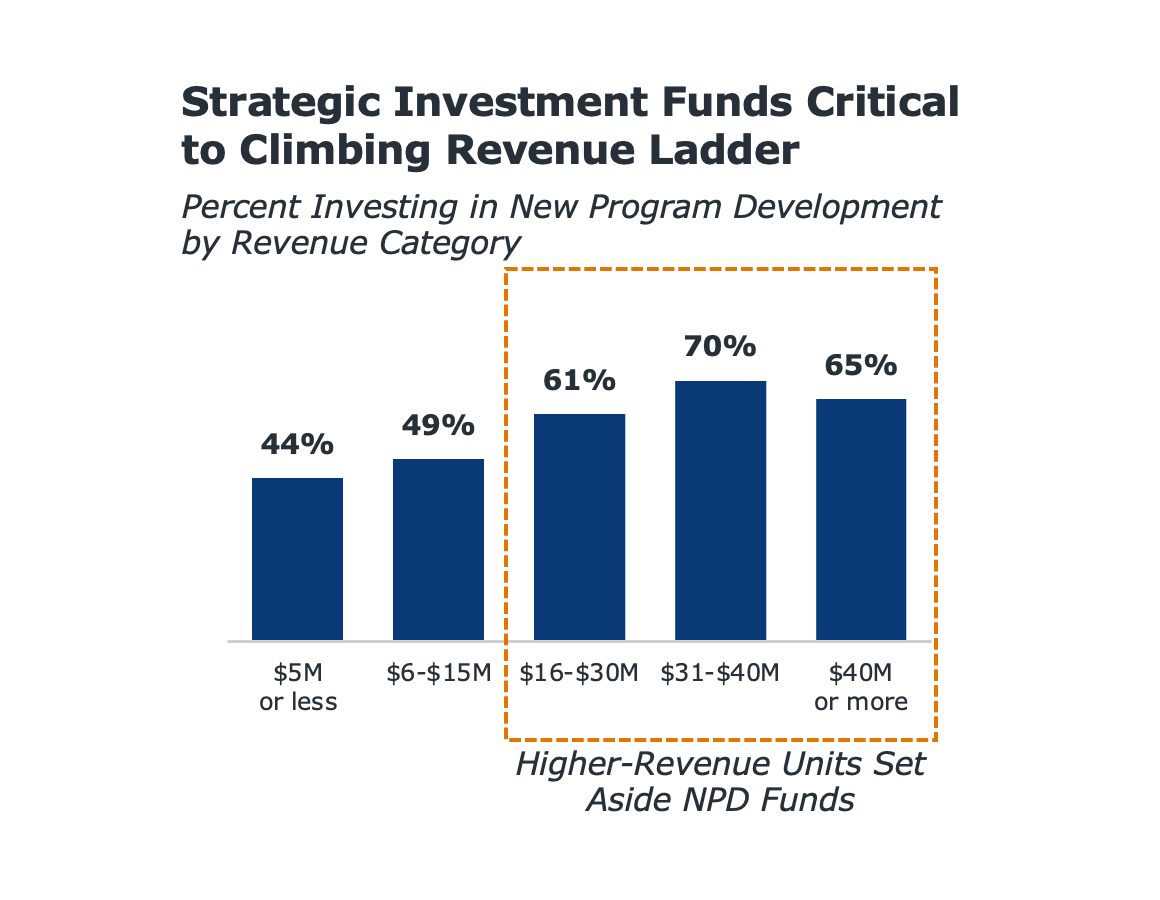

The importance of a strategic investment fund has been a consistent finding across our years of organizational design research. Maintaining a fund for strategic investments allows your unit to prioritize spending for future success, whether that’s seeding the launch of new revenue-generating programs or implementing cutting-edge learning technologies. Historically, we’d concluded setting aside funding for new program development was key to high revenue.

Our latest analysis confirms this is critical: 83% of high-revenue units can maintain a strategic fund, while only 25% of low-revenue units can.

Maintaining a strategic investment fund is also far less common than we’d like to see given that importance; only 47% of respondents overall have the ability to maintain a strategic investment fund.

Authority is only part of the equation—having a fund won’t get you far without money in it. If you’re struggling to identify where those dollars are going to come from in an already tight financial environment, we’d recommend exploring two approaches to funding a strategic reserve:

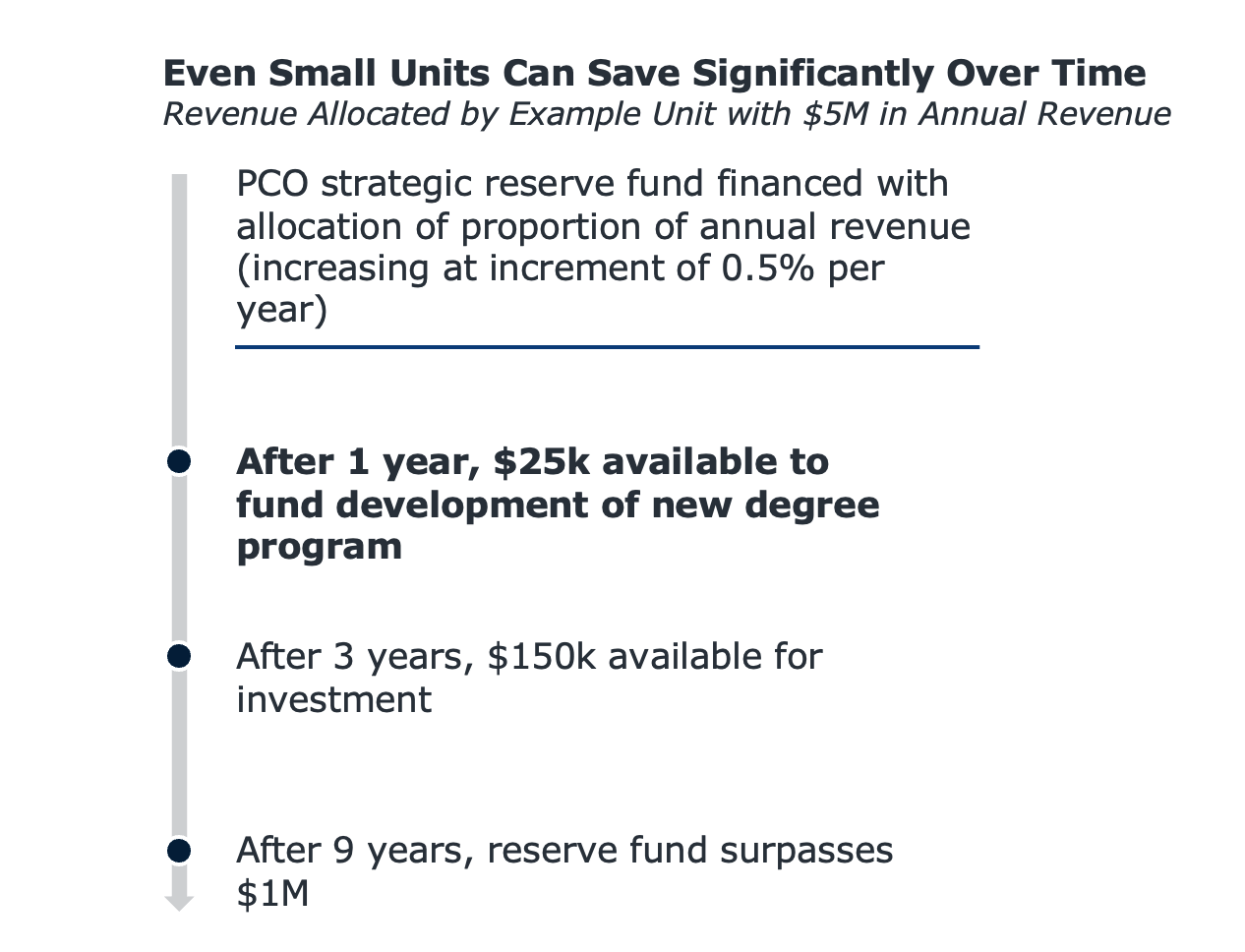

1. Start small and build over time. Even for a low-revenue PCO unit, dedicating a very small percentage of your annual revenue to strategic investment to start and increasing that very incrementally over time will result in significant funding available. Allocating 0.5% of $5M in revenue to strategic investment to start, and adding another 0.5% each year, builds an annual $150,000 strategic investment fund in only three years.

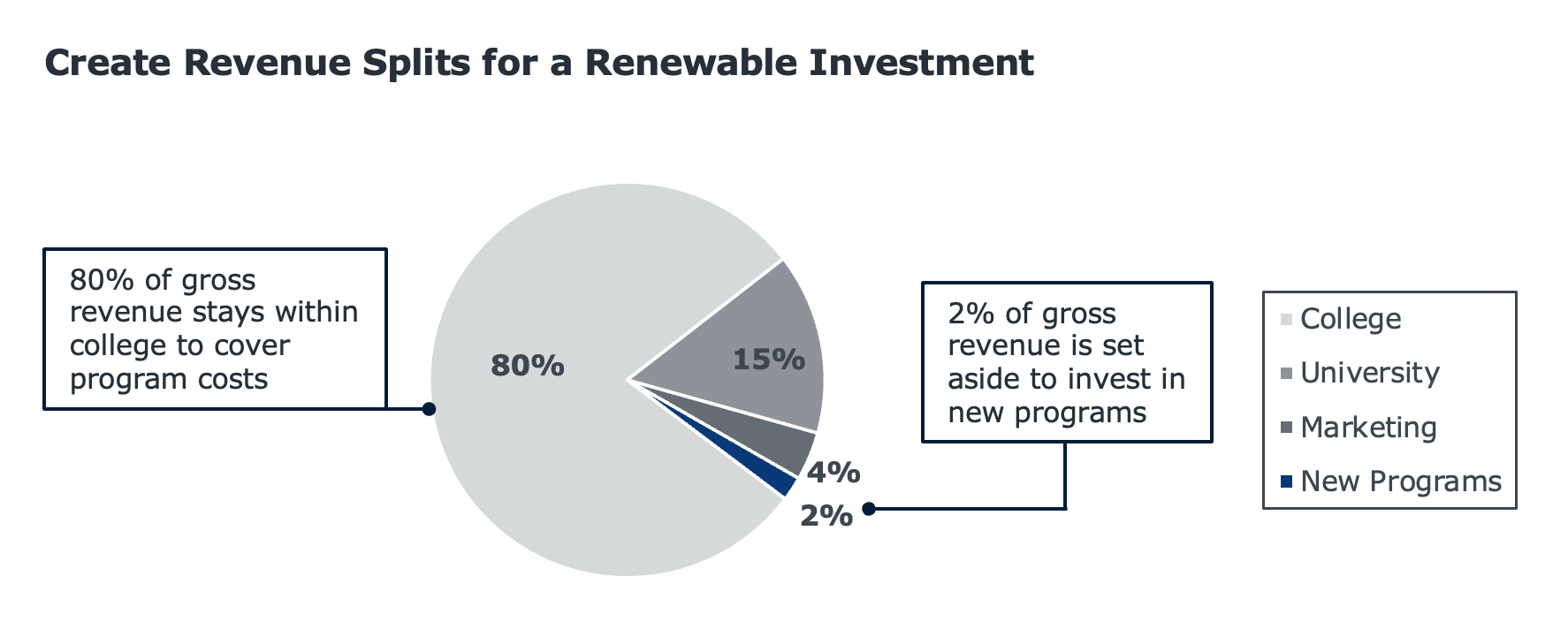

2. Build a strategic investment fund contribution into your internal revenue share agreements.

Most revenue share agreements focus on splitting revenue between the academic unit, the PCO unit, and in some cases the central university administration. Ensuring the PCO unit’s share encompasses a portion for the strategic reserve in addition to their costs incurred creates a strategic fund built on past success.

Speaking of revenue share agreements…

2. Internal revenue share agreements are underutilized for growth.

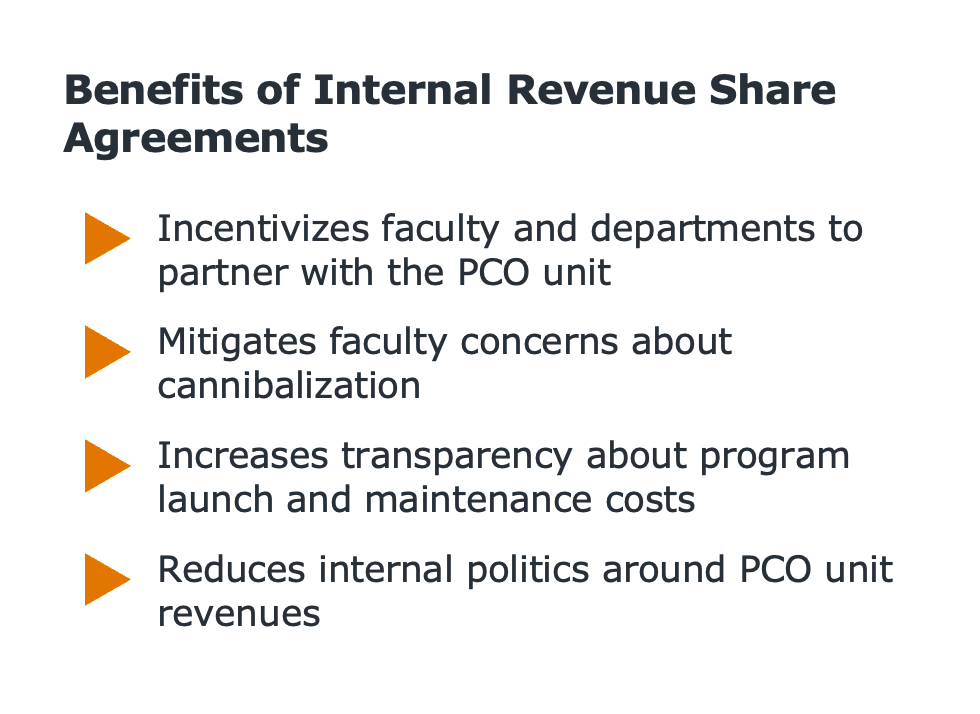

Partnering with academic units to operate PCO programs often involves a carefully choreographed dance, and revenue share agreements can be a big part of that. Our data show when internal revenue share agreements are in play, it’s more likely those PCO units are achieving higher revenues overall; these agreements are more common at high- and mid-revenue units (67% and 72%, respectively, vs. 50% among low-revenue units).

Sharing the program revenue brings four primary benefits:

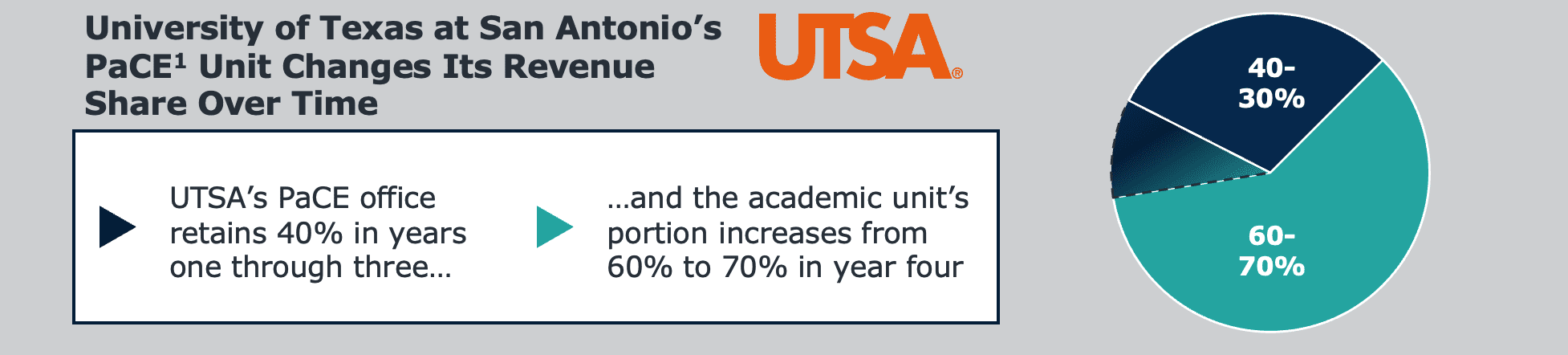

Despite these benefits, only 59% of this year’s survey respondents use revenue share agreements. We’ve been recommending revenue share agreements for well over a decade and have been watching more innovative approaches appear over time at savvier PCO units. The Professional and Continuing Education office (PaCE) at the University of Texas at San Antonio, for example, evolves their revenue share agreement across a program’s lifecycle. PaCE retains 40% of revenue for a program in its first three years, when they’ve invested the most in developing and marketing a program. Starting in year four, that share changes to 30% to recognize their decreased costs.

3. High-revenue PCO units perform an array of services in-house but leave four specialized services to other units.

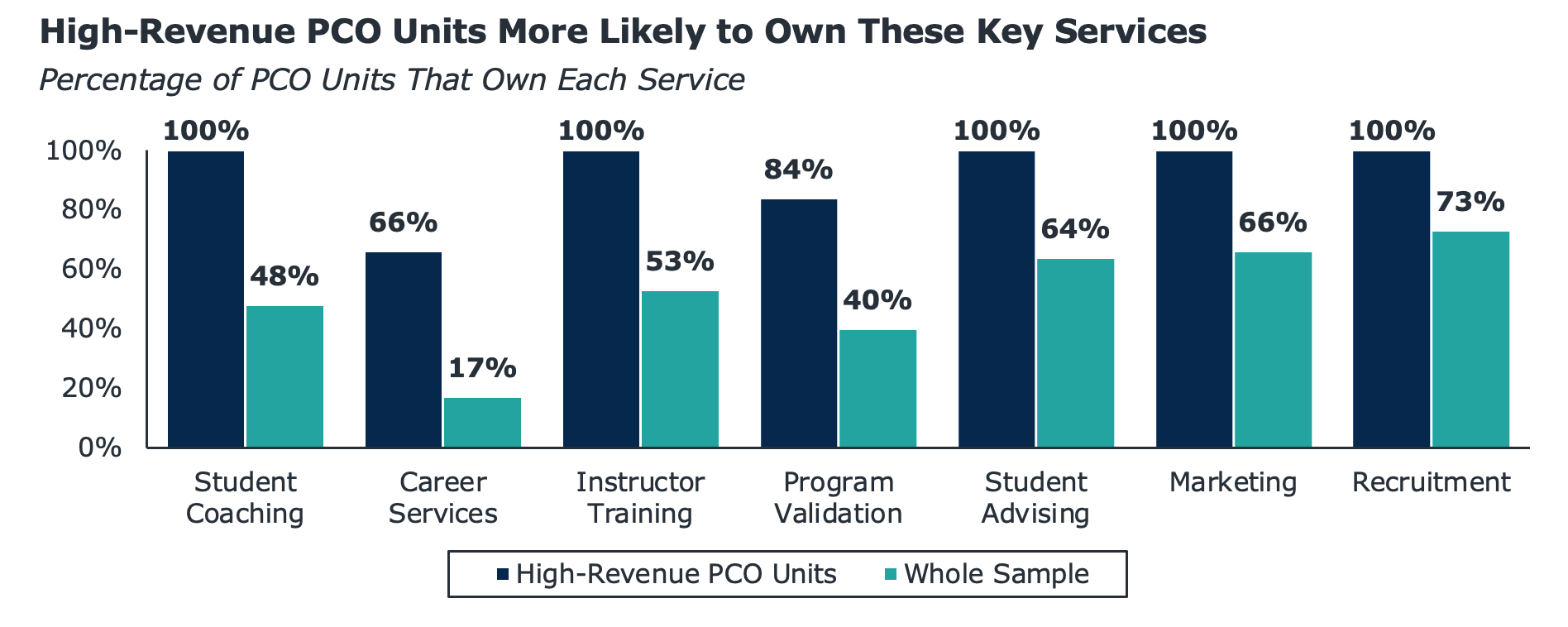

Lastly, one of the most popular and pressing questions when we’re working with partners on PCO organizational design is which services to build in-house and which to rely on the larger institution to provide. We found seven key services more likely to occur in-unit at our high-revenue PCO units.

Across these services, there’s a common distinction: PCO units and students have different needs than a traditional first-time, first-year population would. One hundred percent of high-revenue units own marketing and recruitment for their programs, which is essential so these marketers and recruiters can prioritize strategies targeting adult learners. Instructor training, another service universal among high-revenue units, also differs dramatically when online delivery is far more common than within a core campus and requires intentional preparation.

In contrast, the four services most often left to other specialized units on campus are services with consistent needs across student populations. Financial aid, for example, requires highly specialized knowledge and awareness of best practices and regulations. Adult learners can still benefit from PCO staff who connect them to these larger units, but specialists in each area perform their dedicated function and prevent duplicative hiring within the PCO unit.

Digging into our new organizational benchmarks dataset has been enlightening, and we’re not done yet. We’ll be continuing analysis of last year’s survey responses across the summer and sharing the hallmarks of a high-revenue PCO shop at our fall roundtables. We’ll also be kicking off the next round of the survey with a focus on PCO unit operations as well as updating data on your fiscal year 2024 outcomes and accomplishments.

More Blogs

The big bets that actually drive online enrollment growth

How to use state demand data to launch or revitalize programs