Pricing and aid strategy in the OBBB era

For enrollment leaders, the pricing and financial aid conversation has always required careful balance. In the One Big Beautiful Bill (OBBB) era, that balance is becoming harder to maintain.

We are entering a new phase of accountability in higher education. For over a decade, certain programs and institutions were singled out for scrutiny, while degree programs at nonprofit and public institutions were largely insulated. That era is ending. Pricing and aid decisions are no longer background operational choices. They are central to enrollment strategy and institutional risk management.

A policy environment that reshapes enrollment risk

Recent negotiated rulemaking clarified some long-standing questions, but it also introduced new constraints that enrollment leaders must plan for now. On the PLUS loan front, legacy provisions provide temporary protection for currently enrolled students, but future cohorts will face tighter caps and eligibility limits.

This matters because PLUS loans have historically helped families bridge affordability gaps across a wide range of income and asset profiles. Modeling shows that many borrowers already exceed proposed annual or aggregate caps. As those limits take effect for new students, institutions will feel the impact in enrollment decisions, yield behavior, and tuition revenue.

The challenge is not simply regulatory compliance. It is understanding how changes in federal lending options reshape who can enroll and persist. That is especially true for institutions that rely heavily on PLUS borrowing to support access.

At the same time, accountability measures tied to earnings outcomes are expanding beyond the for-profit and nondegree sectors. Earnings tests and ROI disclosures are increasingly visible earlier in the student journey, including during FAFSA completion. While many four-year institutions may not be immediately affected, the direction is clear. Affordability, outcomes, and value perception are now tightly linked in enrollment decision-making.

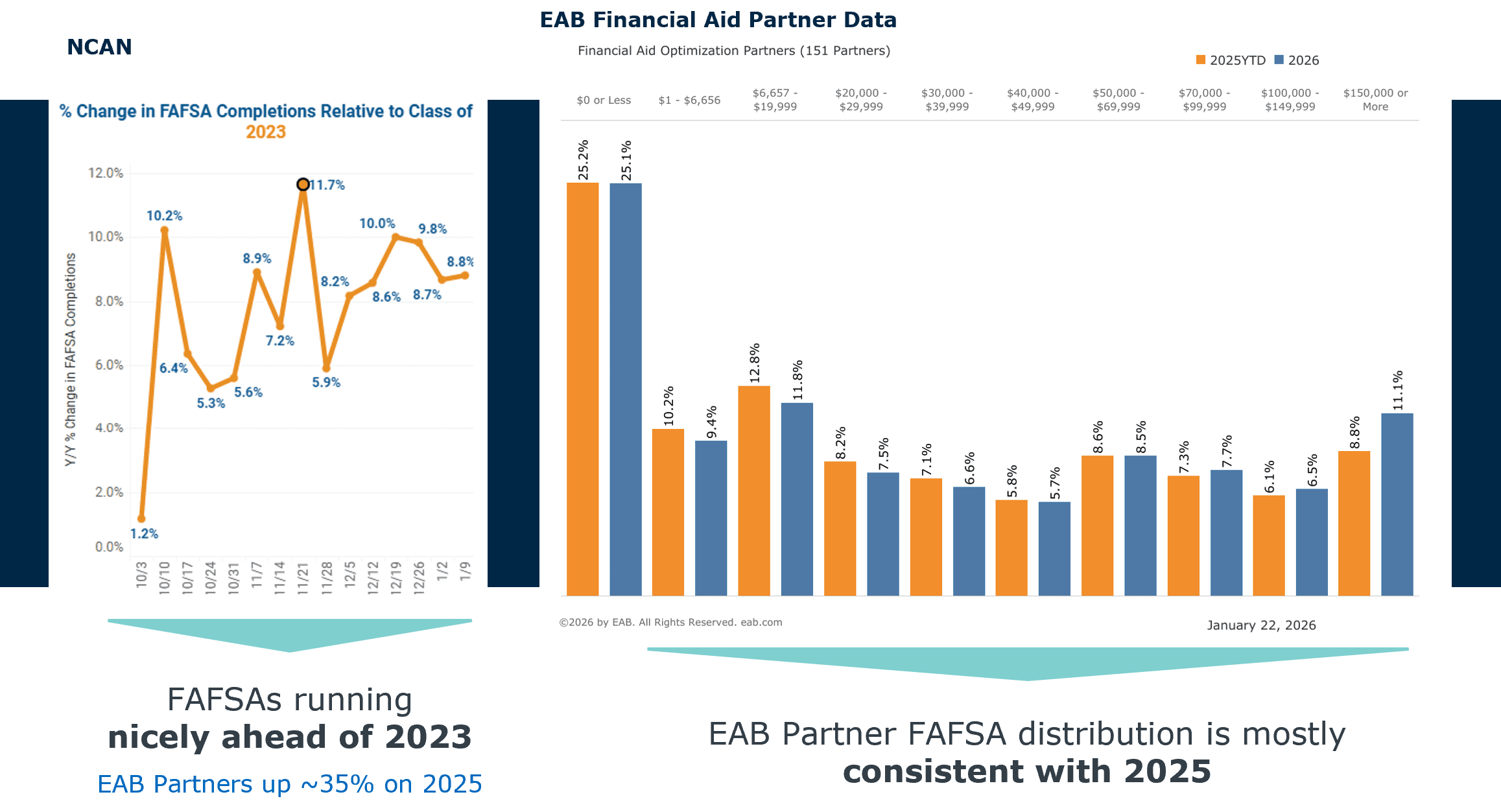

FAFSA stability helps, but uncertainty remains

There is encouraging news on the FAFSA front. Early FAFSA 2.0 data shows filings tracking ahead of recent cycles, with SAI distributions that look largely consistent year over year. After several turbulent years, that stability matters for enrollment planning.

A look at FAFSA 2.0 progress

But a functioning FAFSA does not eliminate uncertainty. Aid eligibility does not always translate into affordability, particularly as federal and state funding conversations continue. Programs like SEOG and Federal Work-Study remain subject to ongoing budget negotiations, and institutions must plan for multiple funding scenarios at once.

If there are disruptions to processing or increased strain on campus resources, it creates challenges for students and for institutions trying to plan ahead. Policy volatility quickly becomes an operational issue, affecting staffing, systems, communication timelines, and yield management.

Market shifts are changing the enrollment funnel

Federal policy is only part of the story. At the same time, enrollment leaders are navigating meaningful market shifts that directly affect pricing and aid strategy.

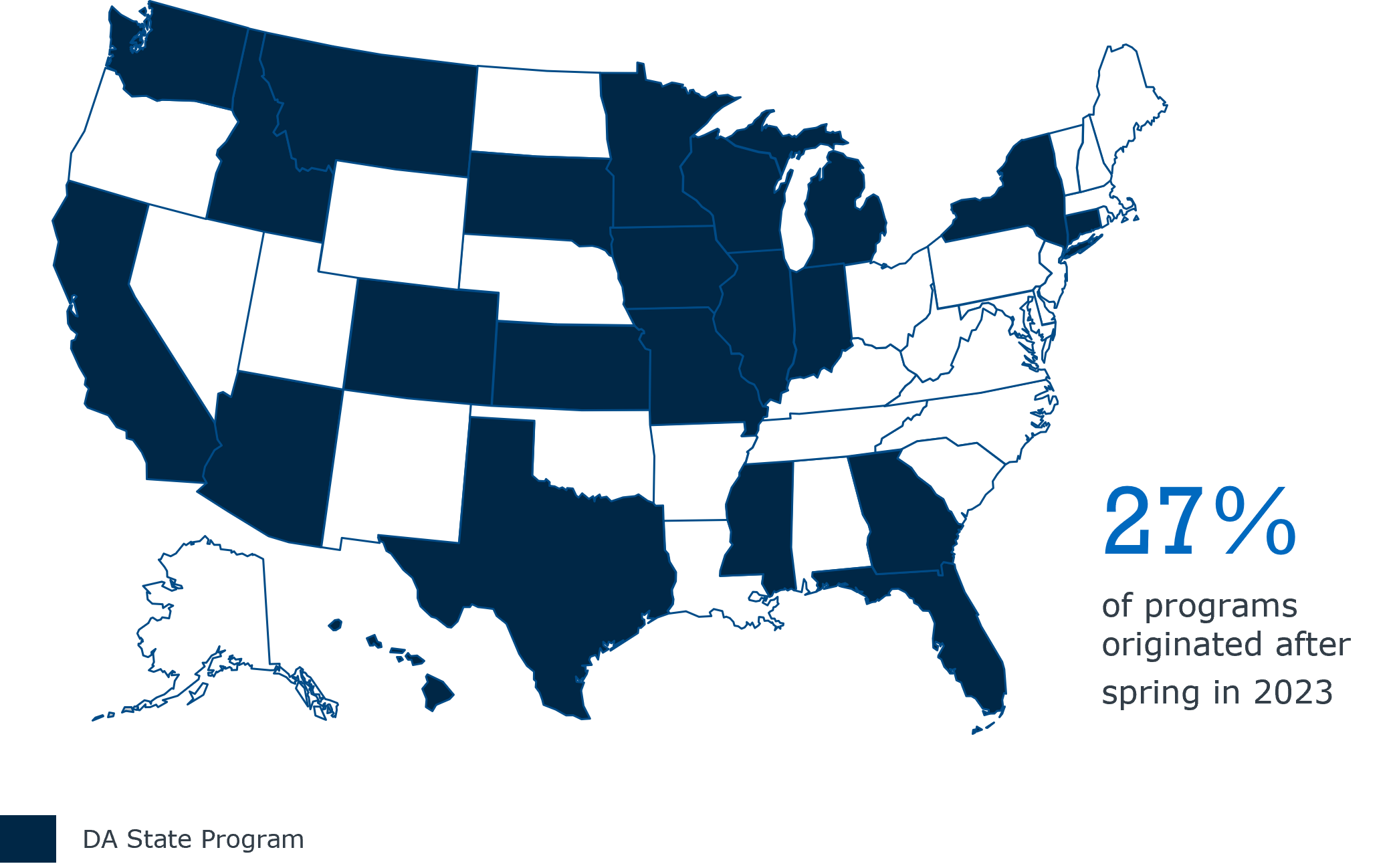

Direct admission is one clear example. State-run and institution-led direct admit programs have expanded rapidly, contributing to early application growth in many markets. These programs can widen the top of the funnel, but they also change yield dynamics and increase the importance of precise financial modeling. More admits do not automatically translate into more enrollments.

Promise programs are another growing strategy. By signaling affordability through income-based guarantees, institutions aim to reduce sticker shock and expand access. These programs can be powerful, but their impact depends heavily on design. Eligibility thresholds, geographic scope, and interaction with existing aid structures all matter. Poorly scoped promise programs can introduce financial risk, while well-designed ones can support both enrollment and mission goals.

What these strategies have in common is complexity. They change who applies, who enrolls, and how aid dollars are distributed across the class. Adopting them without a clear understanding of trade-offs puts institutions at risk.

Why leading institutions are modeling before they move

In this environment, more institutions are rethinking how they approach pricing and aid decisions. Static models based on historical averages are no longer sufficient. Instead, leaders are using iterative modeling to test scenarios before committing resources.

In my work with institutions, I often walk leadership teams through scenarios such as increasing need-based aid for students just outside Pell eligibility or adjusting merit awards for specific academic bands. In some cases, additional aid spend drives higher enrollment and net revenue. In others, the financial outcome is flatter but aligned with academic or mission priorities.

There is no single right answer. What matters is having visibility into how changes affect enrollment, discount rate, and revenue before decisions are finalized. That includes modeling external shifts like changes in federal aid or tuition increases alongside internal strategies such as direct admit or promise programs.

If institutions are not digging into these data points, they are effectively flying blind. For enrollment leaders responsible for balancing access, revenue, and long-term institutional health, that is not a sustainable position.

Monitoring mid-cycle is now a leadership responsibility

Even the best models are only as valuable as the monitoring that follows. Increasingly, enrollment leaders are recognizing that assumptions made early in the cycle must be revisited as real data comes in.

Dashboards that integrate admissions, aid, yield, and demographic indicators allow teams to assess whether the class is tracking as expected and to adjust when it is not. This visibility also supports more nuanced communication with students and families. Household-level income and financial indicators can help institutions tailor FAFSA outreach and affordability messaging based on likely eligibility and need.

This shift is as much cultural as it is technical. Pricing and aid strategy no longer sit solely within financial aid or institutional research. They require shared ownership across enrollment, finance, and academic leadership.

Reframing the pricing and aid conversation

The OBBB era requires a new approach to pricing and financial aid. Federal policy shifts, market innovation, and increased accountability are converging in ways that make intuition and legacy practices insufficient.

Institutions that succeed will treat pricing and aid as dynamic strategy, informed by data, tested through modeling, and monitored continuously. The challenge is not simply reacting to change. It is anticipating it and leading through it with clarity and discipline.

Navigate the new pricing and aid reality with confidence

Our Enroll360 Aid team works with enrollment leaders to model risk, test trade-offs, and plan for policy-driven change. Connect with us to explore how data-driven strategy can support your enrollment and revenue goals.

More Blogs

What Blockbuster can teach enrollment leaders about AI-powered college search

Students are engaging earlier. Enrollment strategies should follow.