Resources

Featured Resources

Insight Paper

College Search Trends Across Space and Time

This insight paper delves into college search trends in the application process among first-time undergraduates at four-year institutions.

Enroll360

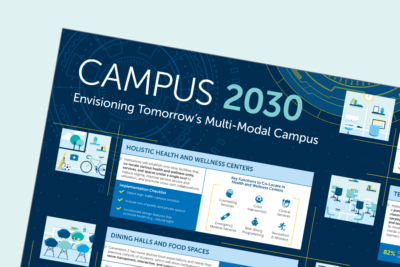

Infographic

Campus 2030: Envisioning tomorrow’s multi-modal campus

Explore our infographic to learn about the future of the multi-modal campus and how seven spaces will change…

Strategic Advisory Services

Research Report

The Rise of the Chief Wellness Officer

Chief Wellness Officer (CWO) positions have grown rapidly across the past few years due to growth in appreciation…

Strategic Advisory Services

Recent Blog Posts

More Blog Posts

Blog Post

4 reasons your university should invest in a permanent process improvement team—and how to maximize its impact

Higher Education Strategy Blog

Blog Post

Your digital marketing strategy is probably outdated—here’s how to fix it

Adult Education Blog

Blog Post

How graduate enrollment leaders—and prospective students—are using AI

Adult Education BlogLatest Podcast Episode

More Episodes

Podcast

Under Pressure: Grad Enrollment Pros Sound Off

Experts share findings from the latest EAB-NAGAP survey of graduate enrollment professionals.

Podcast

How Graduate Enrollment Teams Are Adapting

Experts share findings from EAB’s latest benchmarking survey of nearly 350 graduate enrollment professionals.

Podcast

How to Empower Student Success Through Peer Tutoring

Experts discuss how to build a peer tutoring strategy that improves academic outcomes as well as retention and…

Latest Partner Resource

Insight Paper

Case Studies: AI-Powered Data Management in Higher Ed

Generative AI has sparked widespread interest across industries. But in higher education, its adoption has been cautious. As…

Edify