3 takeaways on the state of graduate enrollment from our survey of 1,200+ practitioners

As enrollment leaders know all too well, it’s an exciting but challenging time to work in Graduate Enrollment Management (GEM). Much has been made of the growth in grad enrollment in the last two years, but not all institutions are realizing this growth on their own campuses. And like most academic units, GEM is not immune from the staffing and mental health crises pervasive across institutions.

To better understand the state of graduate enrollment, we partnered with our friends at NAGAP to survey enrollment leaders across the last two years. Here’s what our surveys of 1,216 GEM professionals revealed about the state—and future—of graduate enrollment management.

Institutions are increasingly reliant on graduate enrollment

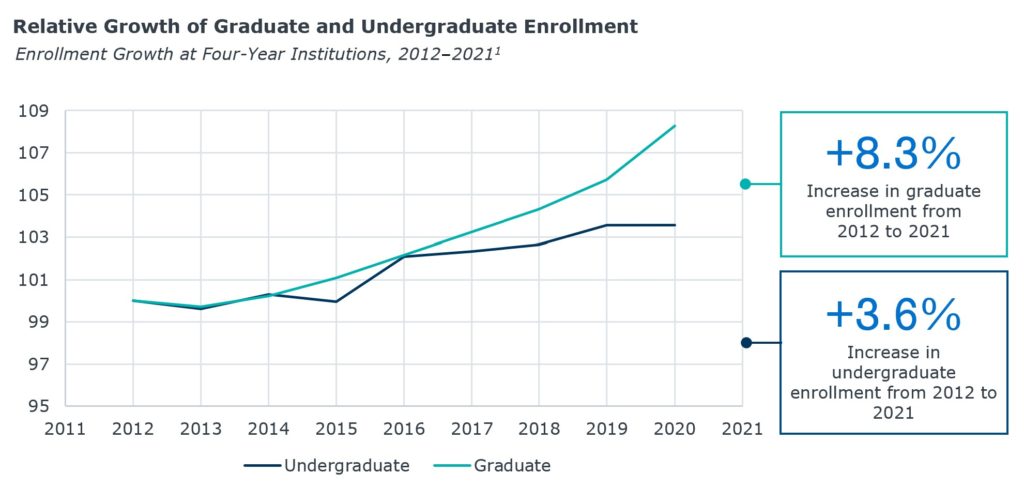

As enrollment leaders know all too well, growth in graduate enrollment was outpacing undergraduate enrollment increases well before the pandemic. COVID-19 only exacerbated this trend. Total graduate enrollment increased 8.3% from 2012 to 2021, while undergraduate enrollment grew more slowly at 3.6%.

Given this disparity, it’s no wonder that nearly half of our survey respondents said their institutions increasingly rely on graduate enrollment to make up for undergraduate enrollment shortfalls. But with this focus on graduate growth comes increased pressure—and in some cases, stress and burnout—for the teams charged with increasing grad enrollments.

-

47%

of survey respondents said their institutions increasingly depend on graduate enrollment to compensate for undergraduate enrollment shortfalls.

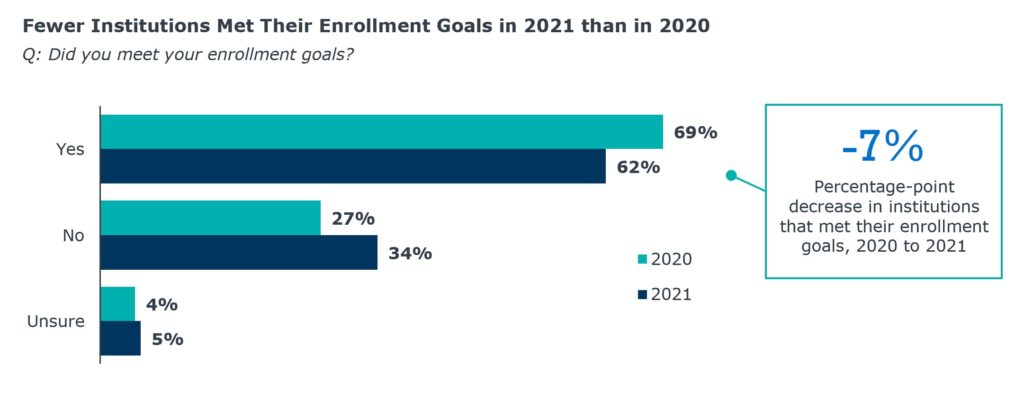

And it can’t be overstated that not all institutions enjoyed this pandemic-era growth in headcount. Our analysis indicates that 34% of institutions experienced an enrollment decline of at least 2.5% from 2019 to 2020. This trend is consistent with the findings from our survey of graduate enrollment leaders. In 2020, 27% of survey respondents said they did not meet their enrollment goals. This number only worsened in 2021, when 34% of survey respondents reported they did not meet their enrollment goals.

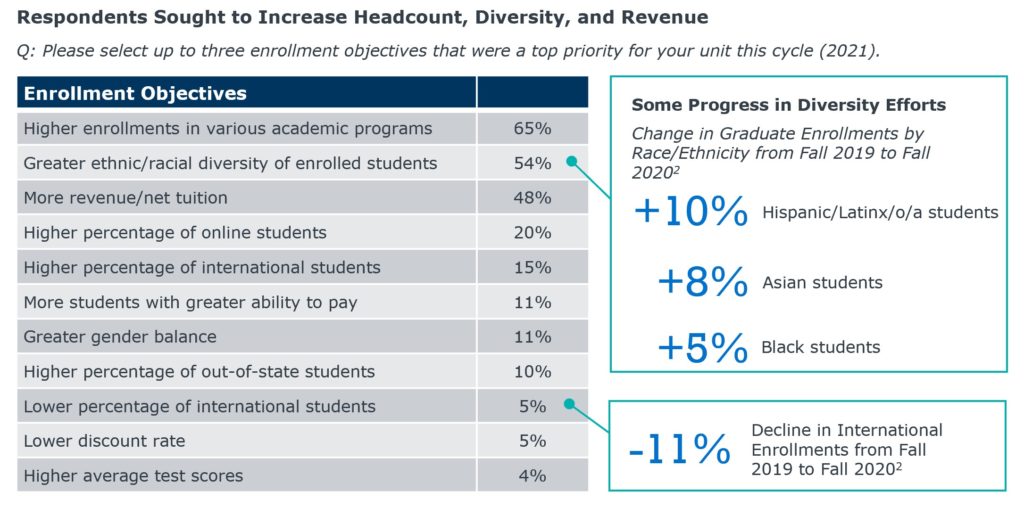

Enrollment leaders are highly focused on diversity—and they are seeing improvements

We also asked our survey respondents to identify their goals for the most recent cycle. In addition to growing enrollment and net tuition revenue, grad enrollment leaders named “increasing racial and ethnic diversity among enrolled students” as a top priority. And they were largely successful. From fall 2019 to fall 2020, enrollment in graduate programs from Hispanic/Latinx students increased 10%, while enrollment from Asian and Black students increased 8% and 5% respectively. In fact, the growth in enrollment among students of color was a key contributor to total grad enrollment increases during the pandemic.

But enrollment leaders also told us there is still much work for their institutions to do to fulfill their DEI promises. More than half of respondents said their institution’s communication of their DEI commitment was only slightly or moderately effective.

Graduate enrollment leaders are doubling down on marketing efforts

To meet ever-growing enrollment goals, survey respondents shared they are expanding marketing and recruitment efforts for their graduate programs. Fifty-five percent of respondents increased marketing efforts in 2020, and this number jumped to 66% in 2021.

HOW ONE SCHOOL GREW ENROLLMENT BY MORE THAN DOUBLE THE NATIONAL AVERAGE

An increase in recruitment efforts also means universities must contend with more noise in the market—and an increase in marketing costs. The box below includes the dollar amount several major players in online graduate education spent on advertising, marketing, and lead generation in 2020, based on our analysis of IRS 990 forms.

Although it’s not feasible for most institutions to devote these kinds of funds to marketing, the figures above are indicative of the growing focus on recruitment among graduate enrollment leaders—and the competitive market they are facing today.

More Blogs

The big bets that actually drive online enrollment growth

Big applicant pools don’t guarantee ideal law classes