When Grad PLUS disappears: What 8,000+ grad students said about paying for school

In my years leading enrollment strategy—and now in my work helping schools grow graduate, online, and adult enrollment—I’ve never seen a financial aid disruption hit graduate education as hard or as quickly as the elimination of Graduate PLUS loans. It feels like 10 years of change occurred in just a few months as a key source of funding disappeared, leaving students with fewer options and institutions with an urgent need to rethink how they communicate cost and structure financial support.

At the same time, our latest survey of more than 8,000 graduate and adult students makes one thing clear: cost is the ultimate gatekeeper. And students expect that they will have access to financial aid, loans, and grants to fund their education.

This combination—the loss of Graduate PLUS and a student population that is increasingly cost-sensitive—creates a new level of urgency for graduate enrollment leaders. Here’s what surveyed students told us about paying for graduate school, and how university leaders can adjust their pricing and aid strategies in today’s landscape.

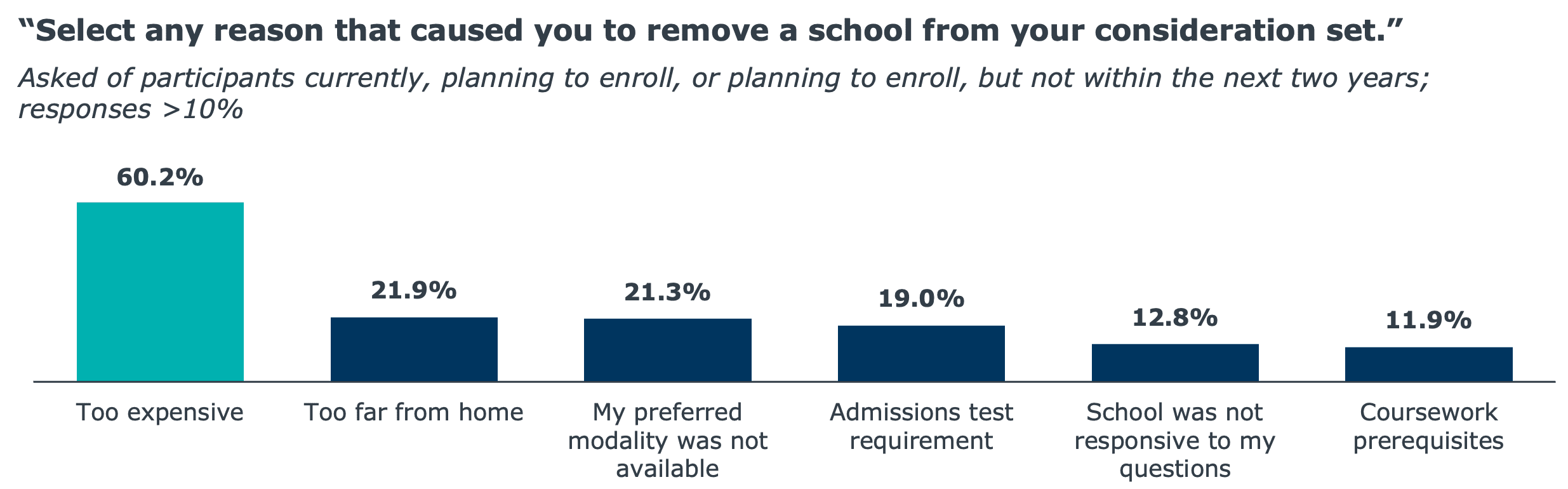

Cost is the top reason students remove schools from consideration

Our latest survey data underscores a trend I saw throughout my campus career: price determines whether institutions even make a student’s shortlist. Sixty percent of the graduate and adult learners we surveyed said cost was the primary reason they removed a school from consideration.

Cost has always been important, but we have moved from price sensitivity to extreme cost consciousness. In this year’s survey, respondents ranked cost as the most important factor in their enrollment decision, surpassing last year’s top factor: program accreditation. Only after a program clears this first hurdle—affordability—do students shift their focus to consider factors related to program quality, such as faculty expertise, career services, and program outcomes.

But what do adult learners consider a realistic price? Most operate within tight affordability boundaries. Nearly 40% say anything above $10,000 per year is out of reach and almost two-thirds say they won’t spend more than $20,000 per year.

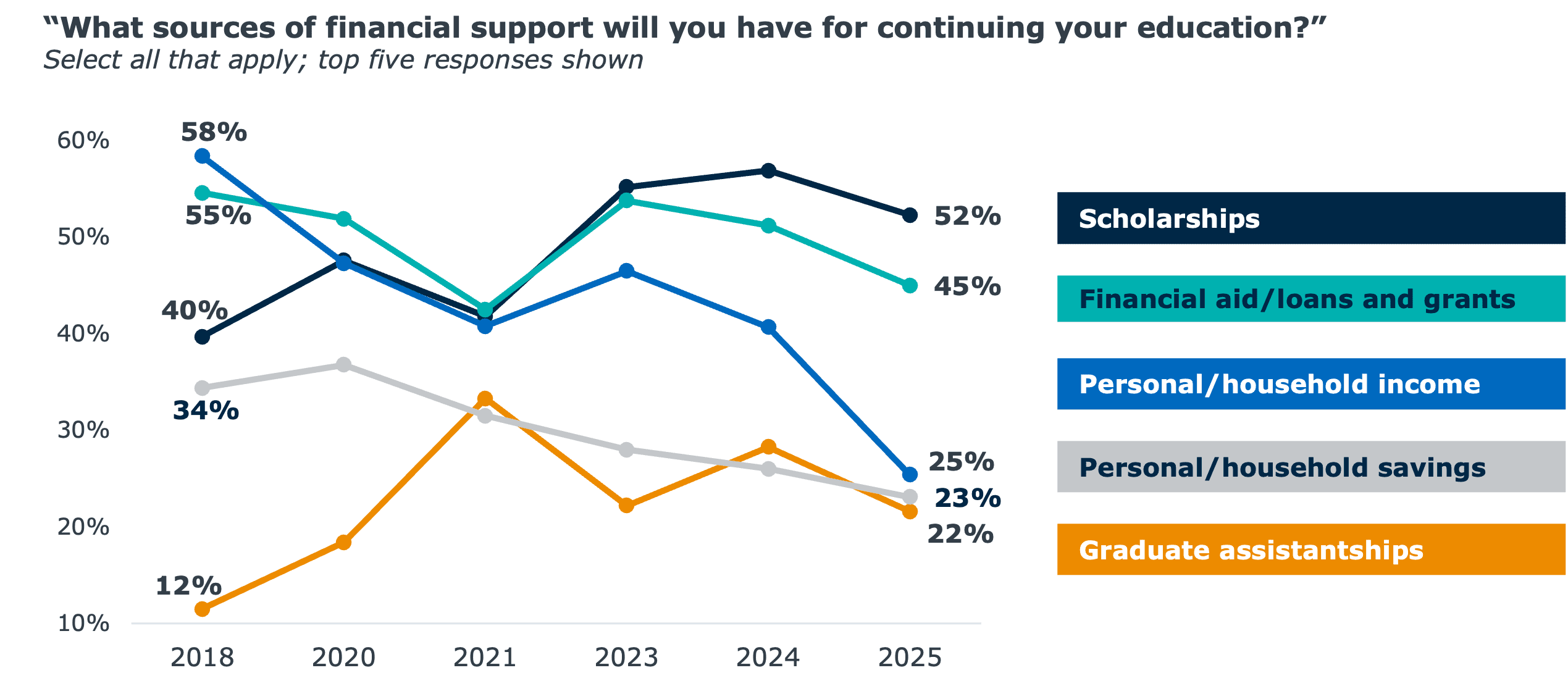

More than half of respondents expect to use financial aid, loans, and grants to pay for grad school

We asked students what sources of financial support they expect to have for continuing their education. Notably, just 25% of students said they plan to use personal or household income to fund their education, down from 58% in 2018. This shift reflects broader economic pressures and the reality that many students are balancing multiple financial responsibilities in addition to paying for their education.

Instead, students are increasingly relying on external funding like scholarships, loans, and grants to pay for their education. More than half (52%) said they would use scholarships to help fund their education, up from just 40% in 2018, the first year we conducted this survey. When I was on campus just a few short years ago, scholarships at the graduate level were often unheard of. Now, we are seeing grad students expect to have access to scholarships.

The survey was conducted shortly after the One Big Beautiful Bill was signed into law, so it’s difficult to determine how much influence changes to federal policy had on survey responses. Regardless, the turbulence in the funding landscape emphasizes the need for graduate and adult program leaders to be strategic when it comes to pricing and aid. Institutions can no longer assume external funding will carry students the final mile.

Given these federal policy changes, your grad aid strategy must evolve quickly. Below are four recommendations as you review your pricing, aid, and communications strategies.

1. Publish complete, scannable pricing information on every program page

If students can’t quickly determine how much your program costs, including tuition, fees, and materials, they aren’t going to raise their hand to learn more. Instead, they will just remove your program from consideration. Make sure your website and other marketing materials clearly list information about cost and scholarships, clarify payment plans, share examples of how aid can stack, and highlight prior-learning or transfer credits as opportunities to save time and money.

2. Pair pricing information with proof of program value

Pairing transparent pricing with clear, compelling evidence of your program’s value to students’ professional and personal development. Doing so helps students envision the payoff; career advancement remains the top reason surveyed students pursue a graduate degree. Graduate and adult learners look for:

- Job placement and salary outcomes

- Career services quality

- Employer partnerships

- Faculty expertise and research opportunities

- Accreditation and reputation

Ultimately, every program page on your .edu should clearly outline cost, time to completion, and program outcomes—the three things adult students care about most.

3. Redesign aid strategy for a world without Grad PLUS

Given the changes to federal aid policy, it’s important to understand your institution’s exposure to tuition revenue and enrollment risk. Some programs rely on PLUS loans for as much as 30 to 60% of tuition funding. If you aren’t sure to what extent your students rely on Grad PLUS, consider conducting your own analysis to determine what percentage of students may be at risk given changing aid policy.

As my teammate Amy Luitjens shared in her recent post, our Financial Aid Optimization division is partnering with schools around the country to model pricing, aid, and enrollment scenarios before these federal policy changes go into effect next summer. Through this work, our team can help identify at-risk programs and student populations and estimate the enrollment and revenue impact on your institution.

4. Ensure your aid strategy aligns with institutional goals

Too often, institutions distribute aid based on legacy practices rather than strategic priorities. But your aid strategy must be aligned with upcoming policy shifts, and we expect many institutions—your competitors—to adjust their pricing beginning in early 2026. Here are a few things your team can do to get started:

- Direct dollars toward programs where cost is a true barrier

- Support priority segments central to institutional goals

- Account for the reality that personal savings are no longer reliable

- Use student intent and demographic data to tailor offers

At EAB, we regularly see institutions overspend where they don’t need to—and underspend where affordability is the deciding factor in students’ enrollment decisions. Aligning aid with goals ensures finite resources generate meaningful enrollment impact.

Cost has become the defining force in graduate and adult enrollment. And with Graduate PLUS eliminated, affordability challenges will only intensify. Schools that pair transparent pricing, a modern, goal-aligned aid model, and clear ROI storytelling will stand apart.

More Blogs

The big bets that actually drive online enrollment growth

How to use state demand data to launch or revitalize programs