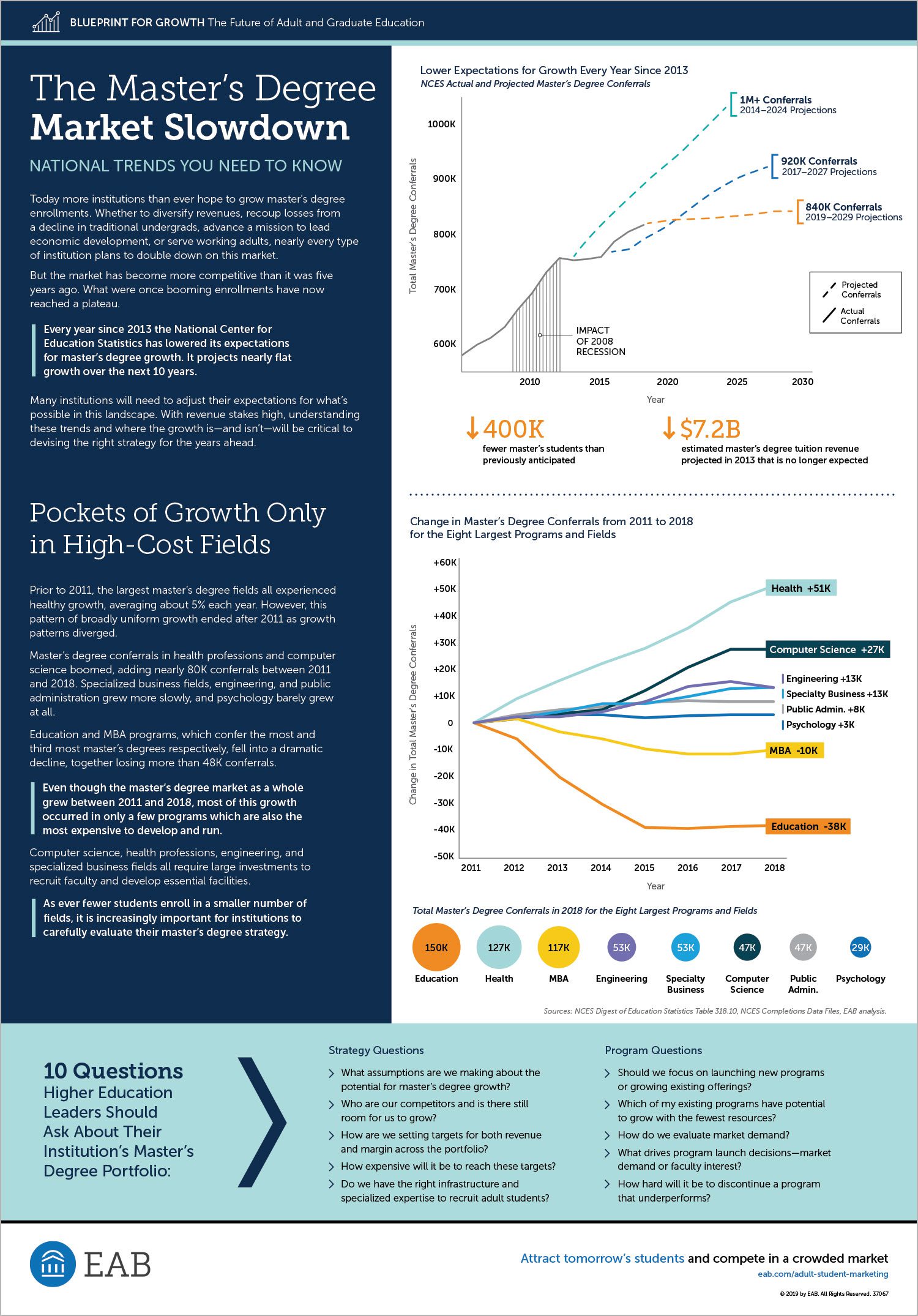

Today more institutions than ever hope to grow master’s degree enrollments. Whether to diversify revenues, recoup losses from a decline in traditional undergrads, advance a mission to lead economic development, or serve working adults, nearly every type of institution plans to double down on this market.

But the master’s degree market has become more competitive than it was five years ago. What were once booming enrollments have now reached a plateau.

More Resources

Insight Paper

Achieving Today’s Ever-Growing Graduate Enrollment Goals

This report shares three key insights to help graduate enrollment leaders better incorporate stakeholder perspectives into graduate goals.…

Adult Learner Recruitment

Insight Paper

Understanding and Navigating Today's Graduate Enrollment Staffing Concerns

This report shares three key insights to help graduate enrollment leaders better understand factors influencing staff retention. It…

Adult Learner Recruitment

Video

Maximizing Adult Learner Enrollment in a Digital-First Era

Watch our short video for an early preview of Adult Learner Recruitment’s upcoming enhancements, including optimized organic lead…

Adult Learner Recruitment