Three key trends to watch in the online graduate market

By now, you’ve probably heard the news: graduate enrollment growth in 2020 and 2021 far outpaced pre-pandemic growth projections from the National Center for Education Statistics. In 2019, the NCES projected graduate enrollment would grow 0.2% per year through 2030, but graduate enrollment grew 2.4% and 2.1% in 2020 and 2021, respectively.

These enrollment increases were fueled primarily by growth in online graduate enrollment. And while some of this growth can be explained by the shift to emergency remote instruction, the increase in online graduate enrollment is also part of a larger shift that began well before the pandemic. Our researchers examined shifts in the online market across the last two years-here’s what we found.

Online graduate enrollment surged in 2020 and 2021

From 2019 to 2020, enrollment in online graduate programs grew by 63%. We also saw that the median number of students enrolled in online graduate programs increased. In 2019, half of the institutions enrolled fewer than 168 online graduate students. In 2020, the median institution enrolled 317 online graduate students. Hybrid enrollments also increased 102% in this period. By contrast, enrollment in face-to-face graduate programs halved, declining by about 865,000 students in 2020.

The online giants are (temporarily) losing ground as other schools enjoy outsize growth online

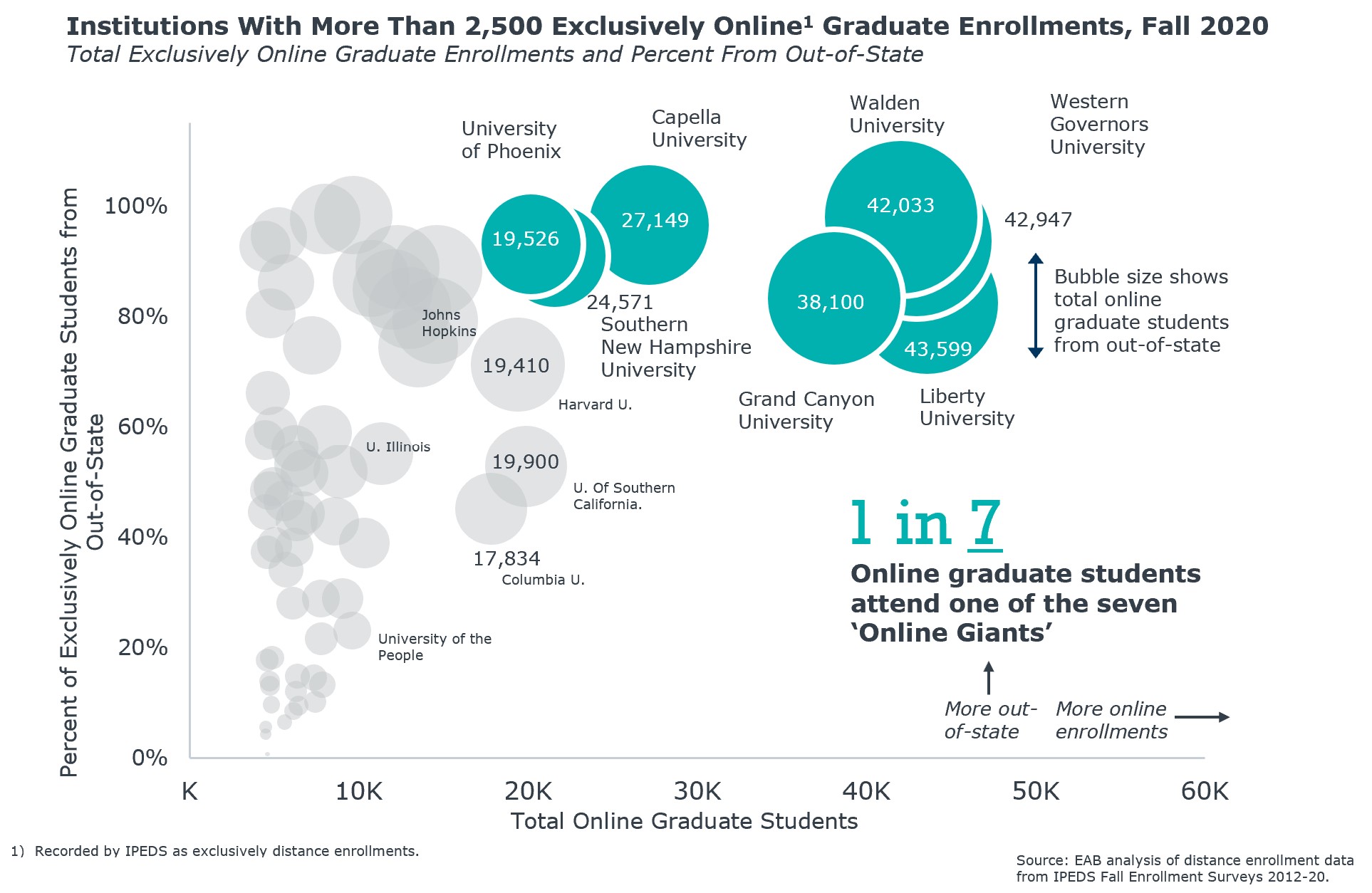

One reason the online graduate market is so competitive is because a group of online juggernauts have historically owned a large share on this market. If we consider the fast-food industry as an analogy, these institutions can be likened to McDonalds-a large national presence with seemingly endless funding for marketing.

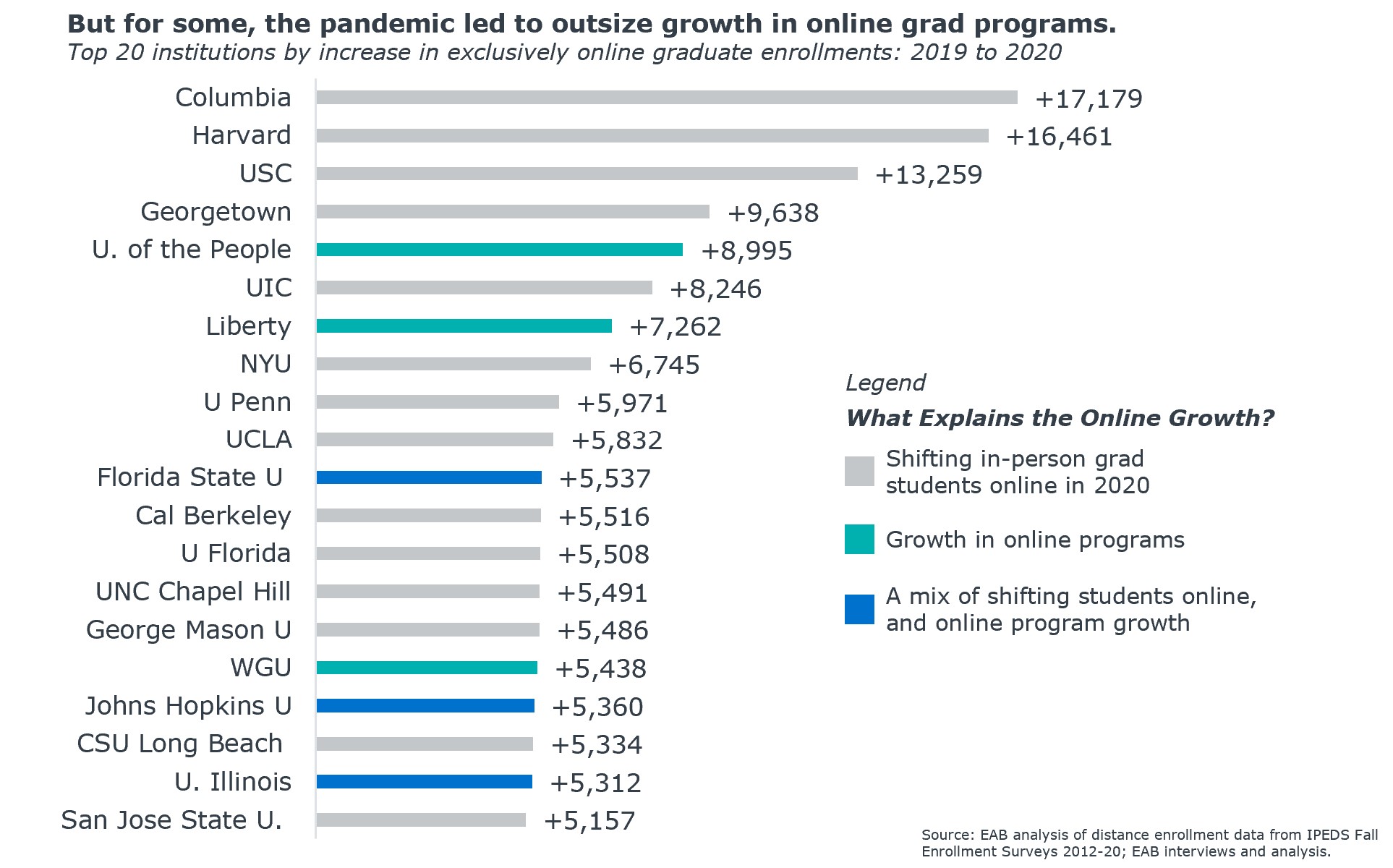

But this small group of online leaders did not enjoy a COVID-era bump in online graduate enrollment. Prior to the pandemic, the seven biggest players in the online graduate market-including both not-for-profits like Western Governors University and for-profit institutions such as Walden University-owned 20% of this market. While this group continues to dominate the online market, their share of online graduate enrollment has shrunk to under 15% of the market. However, it’s important to note that this reduction in market share is likely not permanent. Our researchers expect the online giants to bounce back and continue to own their pre-pandemic share of the market.

At the same time, we see schools outside of the top seven gaining ground. Florida State, Johns Hopkins, and the University of Illinois are just a few of the universities that grew online graduate enrollments in 2020. Some of the growth in online graduate enrollment at these institutions can be attributed to COVID-induced shifts to remote instruction-but not all of it. Online graduate enrollment at Florida State, for example, outpaced the growth we would have expected from its move to remove instruction alone. The data suggests that online programs at Florida State and others gained students from elsewhere during the pandemic.

IN WHICH STATES DID INSTITUTIONS SEE THE MOST GROWTH IN GRADUATE ENROLLMENT?

The biggest names in online education continue to prioritize marketing

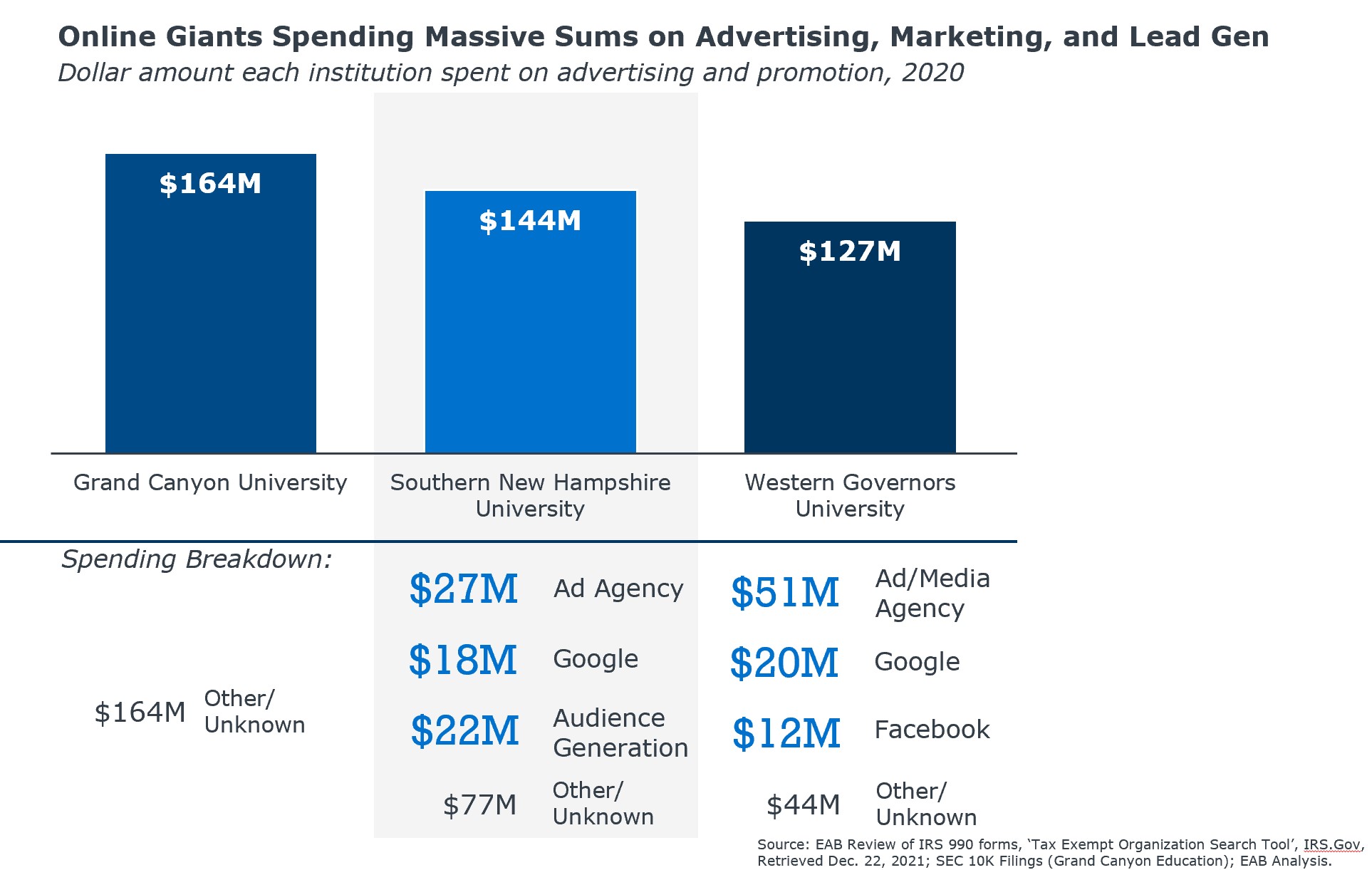

Although the longstanding leaders in online education have lost ground in recent years, our researchers continue to monitor IRS 990 forms and SEC filings to understand how they invest in marketing and recruitment. In 2020, we continued to see the online giants spend massive sums on advertising, marketing, and lead generation efforts. And while not all institutions can or should spend this much, it can be useful to examine in which areas the leaders in online education are investing.

HERE ARE MISTAKES YOU MIGHT BE MAKING WHEN MARKETING ONLINE PROGRAMS

Ad agencies continue to be big-ticket items for online leaders like Southern New Hampshire University and Western Governors University, accounting for $27M and $51M of their marketing budgets, respectively. Google also continues to be an important tool for the online leaders given the rates at which prospective students are relying on search engines to explore program options. Southern New Hampshire spent $18M on Google in 2020, while Western Governors spent $20M.

HERE’S WHAT 2,000+ STUDENTS SAID ABOUT THEIR COLLEGE RESEARCH PROCESS

And finally, we found that these institutions invest heavily in lead generation efforts-a trend we see across higher ed generally. For example, Southern New Hampshire spent $22 million on audience generation in 2020. To grow their audience, we see online leaders investing in college research platforms where students can browse and compare programs easily.

There is no question that the pandemic not only increased graduate enrollment but also necessitated a dramatic shift online. But it remains to be seen how much of this online shift will remain in the long term. As always, our researchers are monitoring the data closely and look forward to sharing the latest findings with our partners.

More Blogs

Adult learners: who they are and what they want from college

4 questions domestic students will ask before applying to your graduate program