The top 5 graduate programs to launch online in 2022

May 24, 2022

Author’s note: This blog post has been updated to include new degree completions and labor market data.

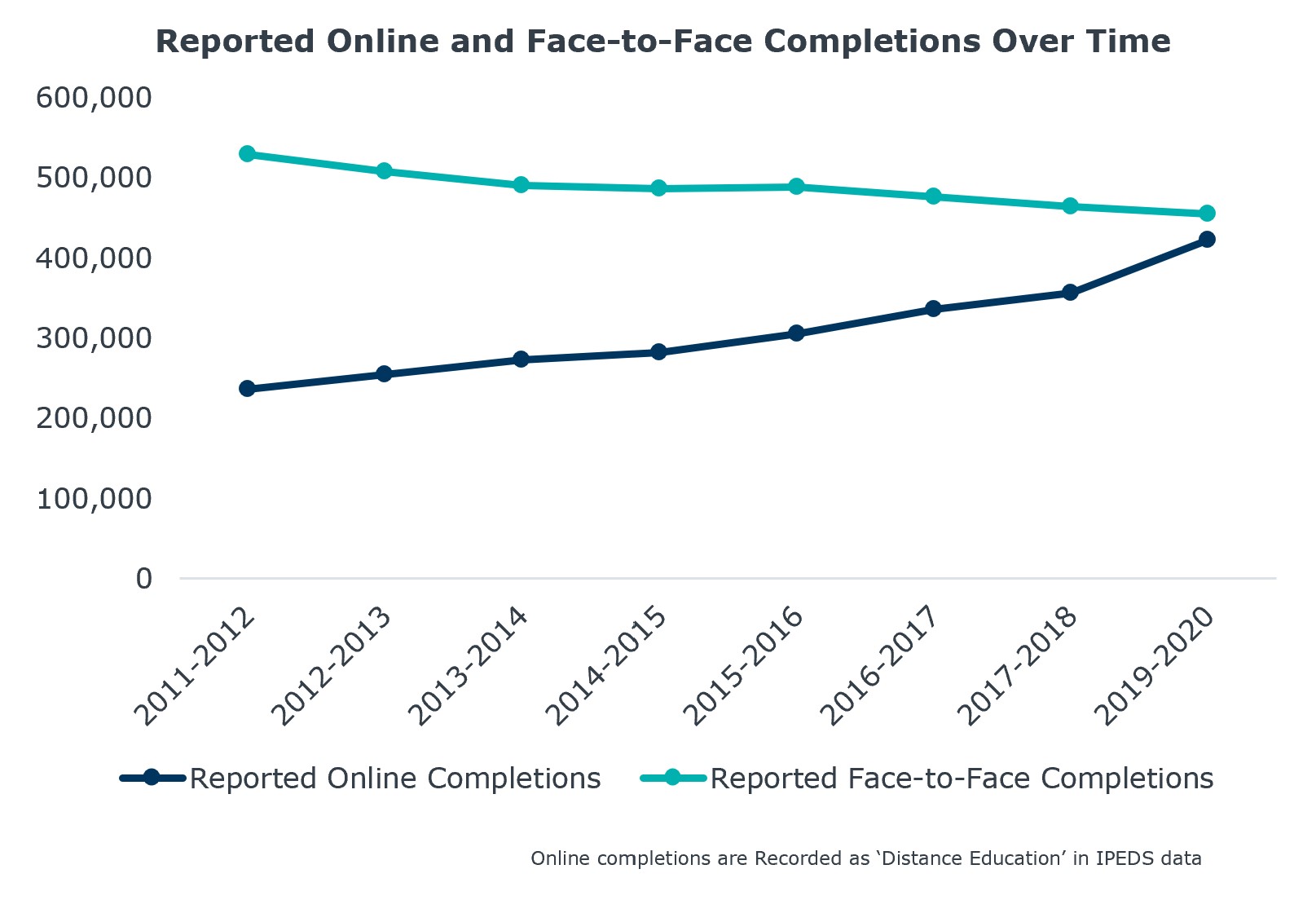

Online master’s degree completions are on the rise, especially when compared to changes in in-person master’s degree completions. While the pandemic of course contributes to the outsize number of online degree completions reported in the last few years, not all the growth in online can be attributed to COVID-19.

3 KEY TRENDS TO WATCH IN THE ONLINE GRADUATE MARKET

But the online graduate market poses unique challenges. Our research shows online graduate programs are not only competing with schools in their own backyards, but also with national competitors. Even though these online juggernauts did not benefit from the same COVID-era bump in graduate enrollment as some other institutions, our researchers expect these institutions to bounce back and continue to own their pre-pandemic share of the market.

HERE’S HOW ONE GRAD SCHOOL GREW ONLINE ENROLLMENT BY 15%

Schools eager to offer online graduate programs should prioritize developing programs with strong student demand but in fields with less market concentration. With these criteria in mind, our researchers took a look at which master’s degree programs have the highest potential for growth online. Here’s what we learned.

Research Methodology

EAB analyzed all reported online completions for master’s degree programs between the 2017-2018 and 2018-2019 academic years to evaluate student demand and to assess the competitive landscape for each program. Our analysis includes all students who graduated from a completely online master’s program in the United States within that time frame.

Programs with strong increases in completions and few dominant competitors offer the best potential for growth

First, we identified 19 programs with the highest increases in student demand between the 2017-2018 and 2019-2020 academic years based on the number of reported distance delivery completions. Programs with the highest growth in completions range include nursing programs such as Family Practice Nursing and Nursing Administration as well as business programs like Business Administration and Management and Accounting.

Programs with the highest student demand

- Computer and Information Technology Services

- Nursing Education

- Applied Behavior Analysis

- Management Science and Quantitative Methods (Business)

- Counselor Education/School Counseling and Guidance Services

- Social Work

- Computer and Information Sciences

- Teacher Education, Multiple Levels

- Special Education and Teaching

- Accounting

- Family Practice Nursing

- Business/Commerce

- Registered Nursing

- Computer and Information Systems Security

- Health Care Administration

- Education Leadership and Administration

- Organizational Leadership

- Educational/Instructional Technology

- Business Administration

From there, we assessed the competitive landscape for each of these 19 programs. We looked at whether there were clear winners in these markets, with reported degree completions heavily concentrated at only a few institutions. We also determined whether there was significant growth in the number of competitors annually, risking growth in new programs outpacing student demand.

Based on their diffuse markets and slower competitor growth, we identified five programs which present a strong opportunity for institutions to offer online:

Top Programs

- Special Education and Teaching

- Nursing Education

- Counselor Education/School Counseling and Guidance Services

- Computer and Information Services

- Education/Instructional Technology

In addition to strong student demand, the number of competing online master’s programs in these areas grew slowly in recent years. And when ranked against all 19 of the programs we identified initially, these five programs held the smallest difference between the mean and median number of completions per institution. The institutional leaders in these fields also captured the lowest relative market share. This indicates a favorable competitive landscape with low market domination, where degree completions are not heavily concentrated at only a few institutions.

Programs with the highest student demand

Favorable competitive landscape

- Special Education and Teaching

- Nursing Education

- Counselor Education/ School Counseling and Guidance Services

- Computer and Information Sciences

- Education/Instructional Technology

Unfavorable competitive landscape

Existing market domination

- Computer Information Technology Services Administration

- Family Practice Nurse/ Nursing

- Applied Behavior Analysis

- Registered Nursing

- Computer and Information Sciences

- Computer and Information Systems Security

- Teacher Education, Multiple Levels

High competition

- Social Work

- Business Administration and Management

- Management Science and Quantitative Methods (Business)

- Accounting

- Health Care Administration

- Organizational Leadership

- Educational Leadership and Administration

More Blogs

Our New Staffing Model Playbook for Higher Ed CMOs

Your digital marketing strategy is probably outdated—here’s how to fix it