Enrollment Growth Strategy Resource Center

EAB's Blueprint for Growth Initiative

Blueprint for Growth is EAB’s signature, multi-year research initiative on the future of post-secondary enrollment, both undergraduate and graduate, domestic and international, degree and alternative. This research makes bold predictions to shape our partners’ future enrollment strategy, based on cross-cutting and holistic market analysis. It goes beyond market sizing alone to uncover hidden risks and opportunities and the changing dynamics of competition, all while helping partner institutions anticipate whether and how they should grow.

Start exploring our work on growing enrollments for adult and graduate students, addressing undergraduate non-consumption, understanding demographic changes, and boosting international student enrollments.

Adult and Graduate Enrollments

Adult and graduate education has been a large and growing market for a long time, but growth (and revenue) is not a given for most institutions, particularly in the wake of a growing alternative credential landscape. A high tolerance for risk, along with sustained investments in marketing and recruiting, technology and student services, and specialized organizational infrastructure are all table stakes to compete for prospective students. We’re partnering with institutions to size the opportunity—and risks—present in the adult and graduate degree and alternative credential markets and identify a right-fit growth strategy.

Watch our on-demand webinar, The New Blueprint for Growth: Building a Graduate and Adult Education Portfolio Amid Economic Uncertainty, for a deep dive into the past decade of data on program enrollments and degree conferrals.

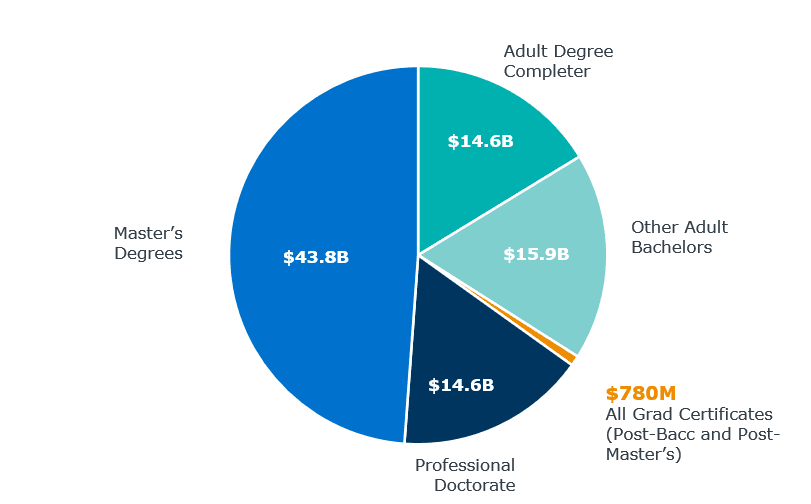

How Big is the Adult and Grad Ed Market Overall?

Total Gross Annual U.S. Revenue Generated from Adult (25+)

Bachelor’s, Post-Bacc Certificates, and Graduate Enrollment, 18-19

- Master’s Market Represents the Biggest Revenue Opportunity: Despite the projected overall slowdown, master’s enrollments are growing in the downturn.

- Degree Completion a High Volume, Low Margin Market: About a quarter of adult degree completers who re-enroll eventually graduate.

- Professional Doctorate Revenue Dominated by JD and MD Programs: JDs and MDs account for 68% of total revenue and nearly half of enrollments.

- Grad Certificates Growing Fast, but the Smallest Market: Double-digit growth belies the fact that there were 73K conferrals in 2019. The median number of conferrals per program is 4.

Related resources

Executive Guide to Certificate Market Risks and Opportunities

How higher ed can adapt to the changing MBA landscape

Opportunities and threats of alternative credentials

4 lessons for university presidents on how to grow professional and adult enrollment

How to Compete in the Degree Completion Market

Undergraduate Non-consumption

A global pandemic, volatile economic landscape, and looming “demographic cliff” have all created significant disruptions in the undergraduate enrollment market. The impacts of these disruptions have only been exacerbated by a decade-long rise in non-consumption of higher education by recent high school graduates. Between 2010 and 2020, there was a 7.3% increase in the high school graduate rate but a 5.6% decrease in the college enrollment rate.

We’re using market and competitive intelligence to identify hidden risks and opportunities to engage undergraduate learners and assist institutions in creating a sustainable enrollment strategy. To get an overview on our non-consumption research, watch our on-demand webinar, Converting the Shadow Funnel: Strategies to Combat the Rising Tide of Undergraduate Non-Consumption.

Related resources

Address Non-Consumption by Hiring High School Counselors

Are Parents Pushing Gen Z Away from Higher Ed?

High school graduates are going to work instead of college. Can we prove they don’t have to choose?

Demographic Forecasting Tools

Institutions must prepare for demographic changes and revitalize programs accordingly. Higher ed leaders should be monitoring not only demographic decline, but also college-going rates and market share to determine the potential affects on enrollment and identify opportunities for growth.

EAB has created tools to help colleges and universities understand enrollment changes and inform program improvements based on student demand:

- Enrollment Analytics Portfolio: EAB will evaluate your institution’s enrollment performance over the past decade, visualize key drivers of growth and contraction, and quantify the potential impact of three macroeconomic threats to your enrollment outcomes through 2035.

- Employer Demand Profiles: These profiles provide a snapshot of the employer demand in each region of the U.S., Canada, and the UK to inform portfolio and program brainstorming discussions.

Related resources

How to uncover hidden threats in past enrollment trends

Choosing the right undergraduate programs for revitalization

How to use state demand data to launch or revitalize programs

International Enrollments

Once considered a “blue ocean” opportunity for revenue and enrollment growth—particularly for American institutions—the international enrollment market has seen disruptive shifts in competitive positioning, sociopolitical policy, and student migration due to the COVID-19 pandemic and its aftereffects. As a result, higher ed leaders must reexamine their previous assumptions and recalibrate their strategy to grow in an increasingly complex international landscape.

Our team is working with partner institutions to track ongoing shifts within the international student market and identify and leverage competitive advantages.

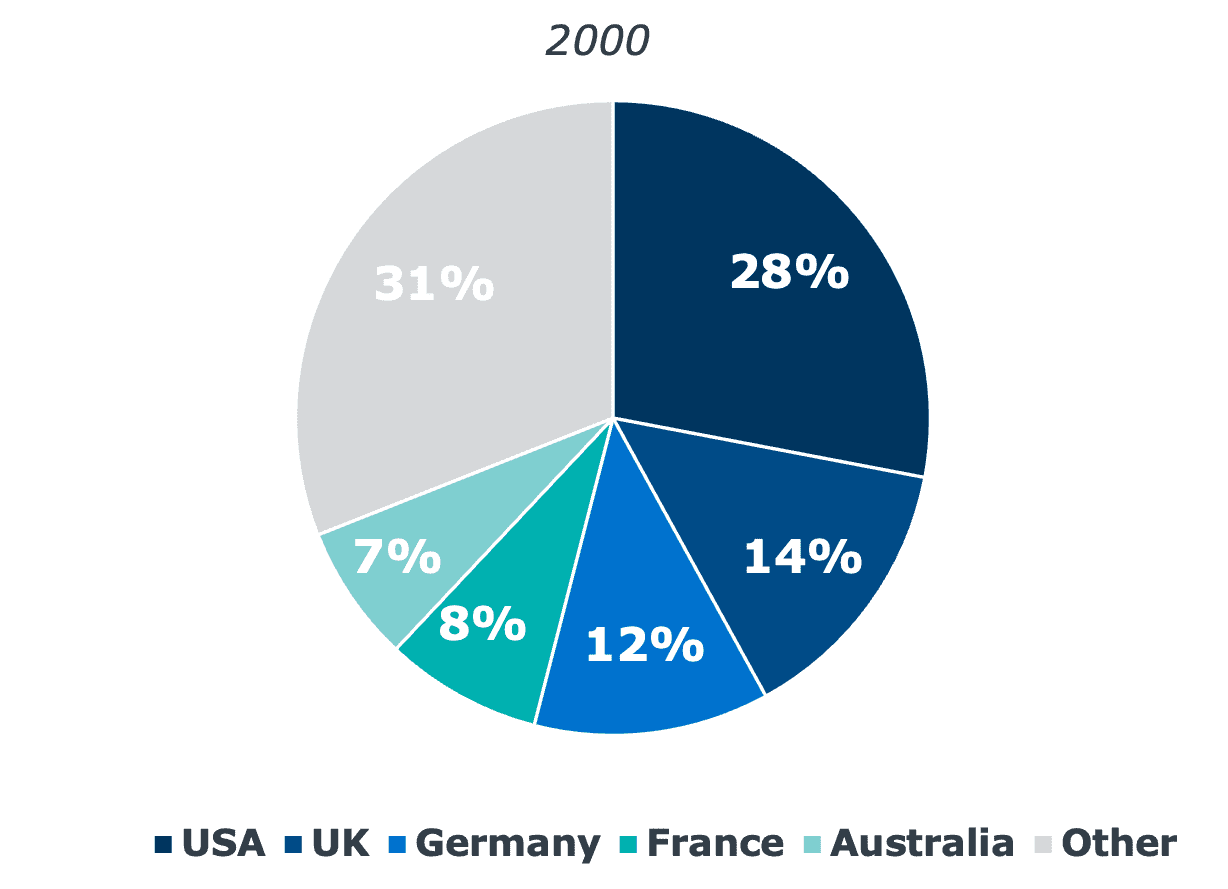

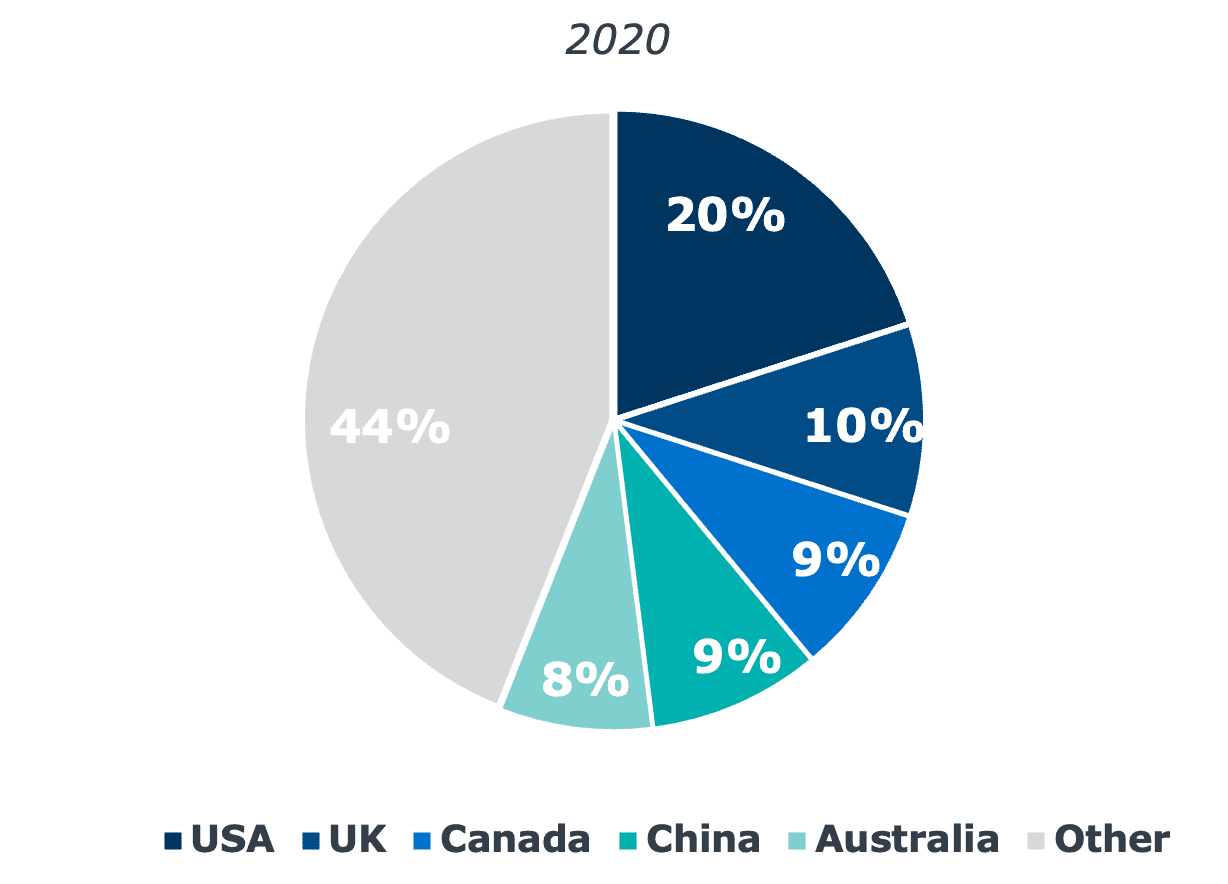

An Increasingly Competitive International Landscape

Leading Hosts of International Students, 2000-2020, IIE

Related resource

Grow international enrollment by leveraging these 3 hidden drivers

This resource requires EAB partnership access to view.

Access the resource center

Learn how you can get access to this resource as well as hands-on support from our experts through Professional and Adult Education Advisory Services.

Learn MoreAlready a Partner?

Partner Log InGreat to see you today! What can I do for you?