What burgers and fries can teach us about the state of grad program competition

With more students than ever enrolling in online or newly-remote programs during the pandemic, some have speculated that online mega-universities and national elites will soon take over higher ed. What could this mean for master’s programs, where already the most growth has been happening in online programs, while face-to-face enrollments steadily decline? Are we at the dawn of a winner-take-all era when it comes to competition in higher education?

To assess the potential threat, we asked how winner-take-all is the market already? And what parallels can we draw from other industries (including our favorite places to get a burger and fries) to understand the competitive dynamics in higher ed? Here’s what we learned.

This resource is part of our larger research initiative, Blueprint for Growth.

Big competitors have a lot of power in higher ed—but less so when compared to other industries

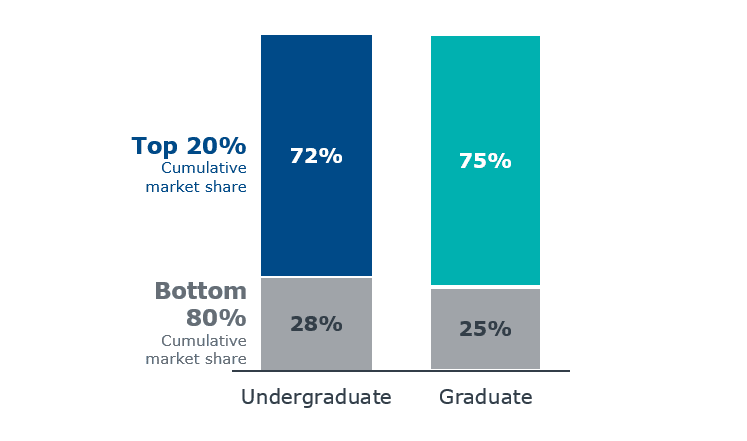

Here’s the good news: winner-take-all competition doesn’t dominate higher education—yet. It’s true that the top 20% of institutions (or the 20% of institutions that confer the most degrees) confer about 75% of degrees, both in grad and in undergrad. And some graduate programs, like computer science or cybersecurity, are highly concentrated with a small proportion of institutions conferring most of the degrees.

Institutions with highest conferrals control most of the market

Percentage of total degrees conferred by top 20% of institutions, 2018

But when we look at other industries, higher ed doesn’t look all that concentrated. For airlines and telecommunications, the top four competitors (not surprisingly) capture most of the revenue in the US. By contrast, in higher ed, the top four competitors bring in only about five percent of the revenue. Competition in higher education actually looks a lot more like competition in the restaurant industry than it does in the airline industry.

Higher ed is not an oligopoly, but still faces dominant market leaders

-

89%

Wireless Telecomms

-

63%

Airlines

-

6%

Restaurants

-

5%

Colleges And Universities

Oligopolies:

- National competition

- Large competitors dominate market

- Little room for new entrants

Competitive Markets:

- Regional and national competition

- Room for new entrants

- Still competition from market leaders

Why colleges and universities compete like restaurants

While restaurants look and operate a lot differently now than they did five months ago, their competitive context still looks similar to what it was before the pandemic. Restaurants face local, regional, and national competition all at the same time. They can’t afford to only think about their local competitors. A choice as simple of where to go to get a burger and fries illustrates how this works.

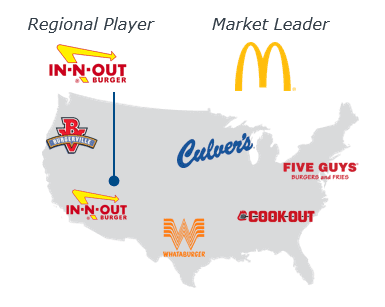

When the craving for a burger and fries hits, most people have a range of similar options: a large national chain like McDonald’s, a regional favorite like Culver’s in the Midwest, or local diners and “mom and pop” stands. It’s true these restaurants don’t serve the exact same products. And while we could debate the relative merits of getting a meal from McDonald’s (childhood memories!) or Culver’s (frozen custard on the side!), both places still deliver the same basic satisfaction.

Mass market leaders limit potential for national growth

Regional Players

- Strong regional brand affinity

- Large online and on-ground presence

- Low cost or elite brand

Market Leaders

- National marketing reach

- Massive online scale

- Low cost

Of course, the decision of where to get a burger and fries is nowhere near as important, expensive, or complex as the decision about where to enroll in a graduate program, but the analogy is still useful. Just as with restaurants, it’s not the case that colleges and universities are up against either powerful online mega-universities or competitive regional and local brands for grad programs. It’s that all these things are true at the same time.

Colleges and universities must contend with big national players marketing in their backyards, while also competing against strong regional institutions and other local institutions embedded in their communities and industries. Students could just as easily choose an online mega-university’s “mass market” offering, especially when aggressively recruited, as they could a familiar and trusted local option.

Case Study

See how one institution grew enrollments even after 12 competitors launched similar programs.

The market for online grad programs is simultaneously local and national

In fact, the split between the in-state and out-of-state market for online grad programs reflects this. Despite some studies that show that the online market is local, with most students enrolling at institutions within 100 miles of where they live, our analysis found that students are somewhat evenly split. We found graduate students are a little more likely to enroll in online programs out-of-state than they are to enroll in-state.

Wondering if out-of-state enrollment can really be a proxy for national enrollment? We found that the proportion of students enrolling out-of-state holds steady in both large states and small states clustered together. And one out of every five online graduate students enrolls at one of seven online mega-universities, suggesting higher education institutions face greater competition for online students from these national players than we had suspected.

In fact, the way these big online players draw students from across the country is on par with the geographic reach of elite institutions. For example, institutions like Southern New Hampshire have greater representation of students from a larger number of states than elite institutions like Harvard.

The Future of Graduate and Adult Enrollment

Have your competitors changed—or become more powerful—without you knowing it?

In the coming year, the pandemic will only intensify this competitive interplay, especially as institutions look beyond their usual markets to recoup lost revenue from international students and undergraduates. Institutions should anticipate more unexpected rivals and wider range of competitors, making it all the more important for every institution to reassess who its competitors in the graduate market really are, which institutions and programs pose the greatest threat, and whether these competitors have already changed during the pandemic.

More Blogs

How to use state demand data to launch or revitalize programs

Meeting the Gen Z moment