What recent coverage gets wrong—and right—about master’s degrees

September 24, 2021, By Ann Forman Lippens, Managing Director, Research and Lauren Edmonds, Senior Director, Research Development

Master’s degrees are having a moment in the limelight. In July, the Wall Street Journal (WSJ) published an article on the financial burden borne by master’s degree holders. The article focused primarily on programs at selective institutions whose graduates have higher debt-to-income ratios than peers. The article—and the wave of stories that followed—raised valid points about the high cost of select programs but oversimplified the landscape with cherrypicked student stories.

A critical question for higher education leaders permeates these articles: how can colleges and universities ensure they offer master’s programs that are worthwhile investments for students? We’ve been grappling with this question daily for over a decade, ensuring our partners offer worthwhile and attractive programs.

To help our partners answer that question today, our researchers dug into the College Scorecard data and connected with internal experts. Here’s what higher education leaders need to know.

More master’s programs “pass” the debt-to-income ratio test than some may realize

The WSJ analysis applied the conventional guidance that students should not take on more debt than they’ll earn after graduation: a program that required students to take on more debt than the median income immediately following graduation “failed.” 38% of top-tier universities failed that test in their analysis. However, EAB evaluated all master’s programs to reveal that the number is closer to 22% across nonprofit universities.

-

$359K

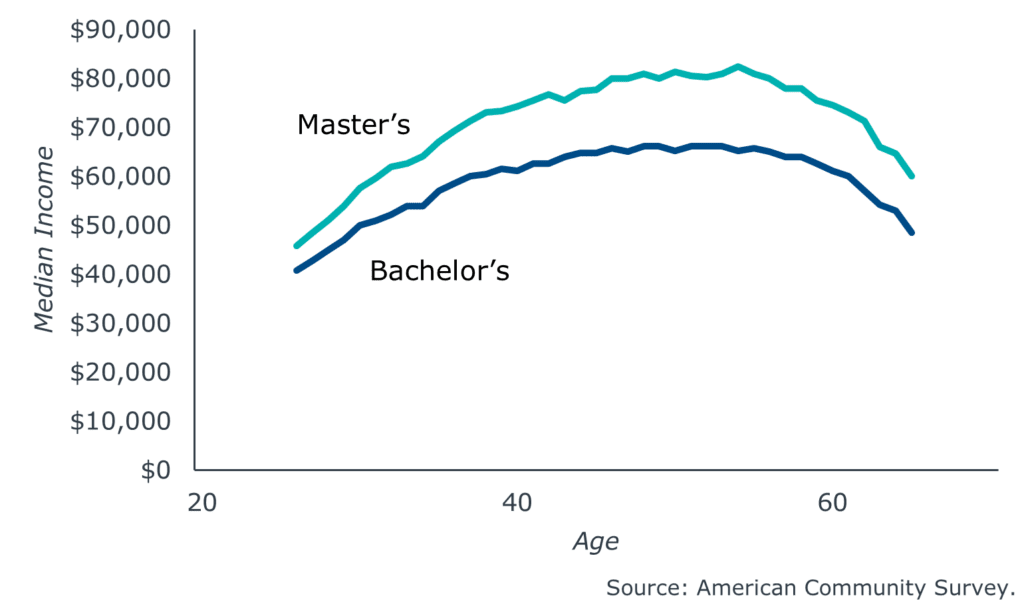

From ages 40 to 65, someone earning a median salary with a master’s degree out-earns their bachelor’s counterpart by $359,093

Importantly, both analyses are working from a limited snapshot. This data only covers graduates’ earnings two years after graduation. That said, EAB’s analysis found that institutions generally report more favorable near-term median debt-to-income ratios for business administration, education administration, accounting, and nursing programs—degrees that align clearly with industry professionalization expectations.

Regional universities are well represented on the top 100 programs sorted by debt-to-income ratios

While reputation is a top-three factor for undergraduate selection, adult learners tend to prioritize cost. Cost is the second-most important factor in adult learner program choice (surpassed only by accreditation). And it’s not shocking to see that the top 100 programs based on the debt-to-income ratio two years after graduation tend to be public, urban, and large.

What traits do the top 100 master’s programs share?

EAB researchers analyzed the characteristics of the top 100 master’s program based on debt-to-income ratio. Here’s what we found:

- More likely to be at a public institution. 56% of the top master’s programs are at public institutions and 44% are at private, nonprofit institutions. By comparison, public institutions accounted for 52.8% of fall 2019 enrollments while private, nonprofit institutions accounted for 47.2%. (For-profit programs are excluded from all EAB analyses referenced in this article.)

- More often urban. 57% of the top programs are in urban areas, 29% are in suburban areas, and 14% are in rural areas.

- More often large (>4,932 students). 88% of the top passing programs are at large institutions, while 12% are at small institutions. “Large” is defined as more students than the average, which was calculated by dividing the total fall enrollment in 2019 (19,637,499 students) by the total number of institutions in the 2019-2020 academic year (3,982 institutions).

Here are some examples of regional institutions reporting favorable ROI for various master’s-level fields:

Representative master’s degrees at regional institutions

Programs labeled by corresponding CIP category

San Jose State University

Public Institution

Teacher Education and Professional Development, Specific Levels and Methods

Graduates average $7,688 in debt and $54,769 in earnings two years after graduation (translates to $0.14 for every $1.00 of income)

Lehigh University

Private Institution

Educational Administration and Supervision

Graduates average $11,715 in debt and $72,325 in earnings two years after graduation (translates to $0.16 for every $1.00 of income)

Utah State University

Public Institution

Accounting and Related Services

Graduates average $12,000 in debt and $58,334 in earnings two years after graduation (translates to $0.21 for every $1.00 of income)

Anna Maria College

Private Institution

Public Administration

Graduates average $19,587 in debt and $92,277 in earnings two years after graduation (translates to $0.21 for every $1.00 of income)

The master’s degree wage premium is lifelong and at its smallest immediately after graduation—it peaks in the early 50s

As previously noted, the College Scorecard data that informed the WSJ analysis is limited. It only examines income two years post-graduation—when the wage premium is at its smallest.

This chart uses American Community Survey data to compare salary by education level and age, which adjusts for the effect of additional work experience on salary. The earnings premium of a master’s degree is greatest in the early 50s, when the median salary for someone with a master’s degree is 27% greater than someone with a bachelor’s degree.

Here are the wage premiums for specific industries:

8%

Wage premium for a master's degree between ages 50-65 for arts occupations22%

Wage premium for a master’s degree between ages 50-65 for business occupations42%

Wage premium for a master's degree between ages 50-65 for education occupationsThe master’s degree approval process is ripe for improvement, and this coverage should fuel fixing a system that traditionally failed to consider student outcomes

The recent public focus on debt-to-income ratios for master’s degrees has been intense. On one hand, it continues a larger (and important) national conversation over student debt. On the other hand, the discourse overlooks that this scrutiny is relatively new and that higher education is still developing the necessary guardrails.

Degrees undergo numerous levels of approval before launch. At the highest levels—the state board of education and accreditors—institutional leaders have limited ability to inflect change. At the institutional level, however, cutting-edge leaders aren’t leaving programs’ debt-to-income ratios to chance.

Ensure your master’s degree will offer students a strong return on investment before launch

Academic oversight recommendations

Degrees typically require approval from a dedicated committee and/or faculty senate. This step ensures a program offers a valid and enriching learning experience but has not historically been tasked with evaluating a degree’s ROI. Further, some institutions have established distinct approval processes for professional and adult degrees that may operate outside the traditional bachelor’s or even research-based master’s/PhD process.

EAB recommendations: Equip academic experts to evaluate market demand and ROI measures within their proposal and approval of new programs. Require these considerations within any program approval process.

- Use tools like the “Market Demand Validation Checklist” in EAB’s New Program Launch Toolkit to prompt market-focused discussions.

- Gauge market demand for master’s degrees to anticipate and avoid programs without desirable outcomes.

Administrative oversight recommendations

University leadership and the board approve degree plans before moving forward. Leadership typically considers impact on the school’s bottom line, reputation, and strategic priorities—which increasingly but doesn’t universally include student return on investment.

EAB recommendations: Assess anticipated student ROI alongside factors like required launch investment and projected enrollment.

- See examples of Business Case Templates in the New Program Launch Guidebook that incorporate details on graduate job prospects and anticipated wages.

- Adopt practices such as Social Media-Driven Outcomes Collection to inform post-launch evaluation as well, and evaluate how effectively programs deliver on anticipated graduate outcomes.

The Wall Street Journal sparked what could be an uncomfortable conversation for master’s degree programs. It also represents an opportunity for higher education to continue working to ensure our programs merit the investment students are making.

Research support provided by Eddie Issertell, Jennifer Lerner, Jake Nelson, Lindsay Rapkin, and Brian Schueler.

More Blogs

What it takes to win in grad and adult enrollment today

Our new staffing model playbook for higher ed CMOs

Your digital marketing strategy is probably outdated—here’s how to fix it

Great to see you today! What can I do for you?