What’s your graduate and adult programs’ recruitment reach?

Many professional and adult education leaders can recite the statistics with me by now: the vast majority (75% or more) of online students are enrolled at an institution within 100 miles of where they live, and about half are enrolled within 50 miles of where they live. That data comes to us from another research firm and had been a major influence on how we collectively thought about online and adult programs’ reach.

But, as our researchers have unpacked that data and the actual enrollment trends, we’ve learned there’s significantly more nuance to professional and adult education programs’ recruitment areas.

In fact, we found just over half of students enrolled in exclusively online graduate programs attend out-of-state institutions. Degree completers are more likely to enroll at institutions closer to home, with two-thirds of degree completers earning their degree at an institution in-state.

Online graduate market more regional and national, while most degree completers stay in-state

944K exclusively online master’s and doctoral students by state of origin, fall 2018

- 57% attended out-of-state institutions

- 43% attended in-state institutions

940K degree completion graduates, by in-state status

- 33% attended out-of-state institutions

- 66% attended in-state institutions

However, when evaluating your programs’ viability and growth potential, it’s important to identify a recruitment area that is specific to your program and institutional characteristics.

Use best-available data to identify individual programs’ reach

Of course, past enrollments offer individualized insight into a program’s geographic range, but that’s not as helpful if you’re trying to grow beyond those historical boundaries or launch something entirely new. It’s important to consider how aspects of your program and your school impact your most viable recruitment region. For example, an online program with extensive in-person requirements may be unable to attract a large audience from outside of your local market. On the other hand, a unique or niche program may be able to attract students from a wider geographic area given how few competitors exist in the market, regardless of modality.

Find your recruitment area and likely reach

-

Local

Local recruitment within your metro area or adjacent counties is most viable if the program is an undergraduate degree completion or professional graduate program with frequent (e.g., weekly) in-person requirements.

-

Statewide

Statewide recruitment is most viable if your program is an online degree completion program OR your institution is:

- Small: Program size is 1,500 or fewer students

- Less online: 36% or fewer graduate students are online

- Public university

-

Regional

Regional recruitment within your state and adjacent states is most viable if your program is:

- Graduate program with infrequent in-person requirements (e.g., one-week summer residency)

- Online graduate program

-

National

National recruitment is viable if your program is an uncommon online graduate program ORyour institution is:

- Large: Online enrollment is 2,700+ undergraduate students or 1,500+ graduate students

- More online: 43+% of graduate students are online

- Private, non-profit university

When in doubt:

- Test program viability in a smaller region before aiming to expand.

- Evaluate a combination of programs based on the lowest common denominator (such as statewide demand, even if some programs successfully recruit out of state).

- Use the region from which 50% or more of your current enrollments in that program come. And if you’re determining the geographic reach of a program that’s not yet launched, use a similar existing program in your portfolio as a benchmark.

Serving a larger region should be a welcome surprise, not a requirement for program success.

See how one program grew out-of-state enrollment by 64%.

What does it take to go national?

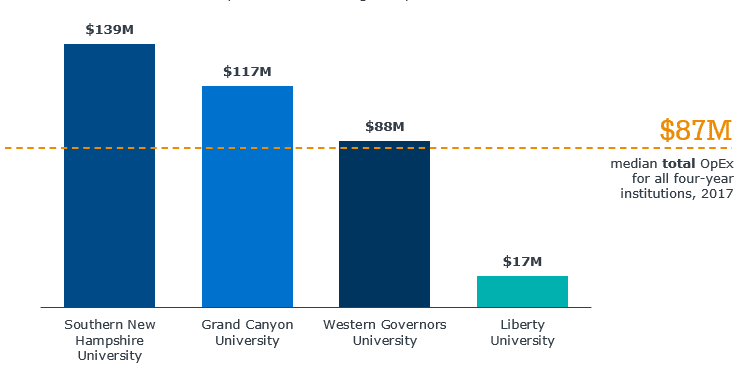

Although we know students are enrolling in online programs at out-of-state institutions at a higher rate than many expected, competing nationally is no small feat. Marketing spend is just one part of the equation, but it’s an important part. Of the major online giants with known marketing budgets, three of the four spend more on their annual marketing than most institutions’ overall operating expenses.

Large players spending more annually on marketing than most institutions’ OpEx

Dollar amount each institution spent on advertising and promotion, 2017

This investment contributes to these four institutions enrolling over 100,000 total exclusively online graduate students a year, with over 75% of those students enrolling from out-of-state. But very few universities can compete on that scale, and it typically requires a major redirection of the overall institution to pursue that massive online growth.

Competition for online graduate students is both local and national-here’s why.

Individual programs with national recruitment goals don’t need to spend $17 million or more annually, of course. While marketing expenses beyond your immediate region will appear substantial compared to your other programs, marketing select programs nationally can contain that cost compared to the “all-in” approach of the online giants. Even on an individual program level, however, significant nationwide enrollment often depends on distinctive characteristics, like University of Maryland Global Campus’s military relationships and dominance in the cybersecurity market, or Georgia Tech’s innovative $7,000 online master’s in computer science.

When anticipating your graduate and adult programs’ recruitment reach, use the guidelines above as a rule of thumb and consider if your school or program has a distinct advantage to stretch beyond that range. Otherwise, plan toward the smaller end of your range so your enrollment expectations are reasonable and attracting students from farther away can feel like the bonus it is.

More Blogs

The big bets that actually drive online enrollment growth

How to use state demand data to launch or revitalize programs