3 headwinds shaping graduate and adult enrollment in 2026

January is when many of us take stock of what worked, what didn’t, and what we want to change in the year ahead. As an avid reader, I’m setting a new reading goal for the year (and please feel free to reach out with recommendations for books I should add to my TBR). And as a former VPEM, I know my colleagues are setting budgets, enrollment goals, and reflecting on cycles past and present.

But 2026 is already markedly different from a few years ago, forcing VPEMs and other graduate enrollment leaders to take a new approach to goal setting. The international market is in flux, federal financial aid policies are changing, and AI is reshaping how students discover programs. Taken together, these headwinds are making an already challenging market even more complex. Below, I outline how these headwinds are impacting graduate enrollment—along with the ways the savvy enrollment teams I work with are responding.

Headwind #1: Worsening volatility in the international market

International students have long been critical to graduate enrollment, especially in STEM programs. But travel bans and immigration restrictions, coupled with heightened safety concerns in the US, have meaningfully depressed international enrollment.

International Enrollment Trends and Impact

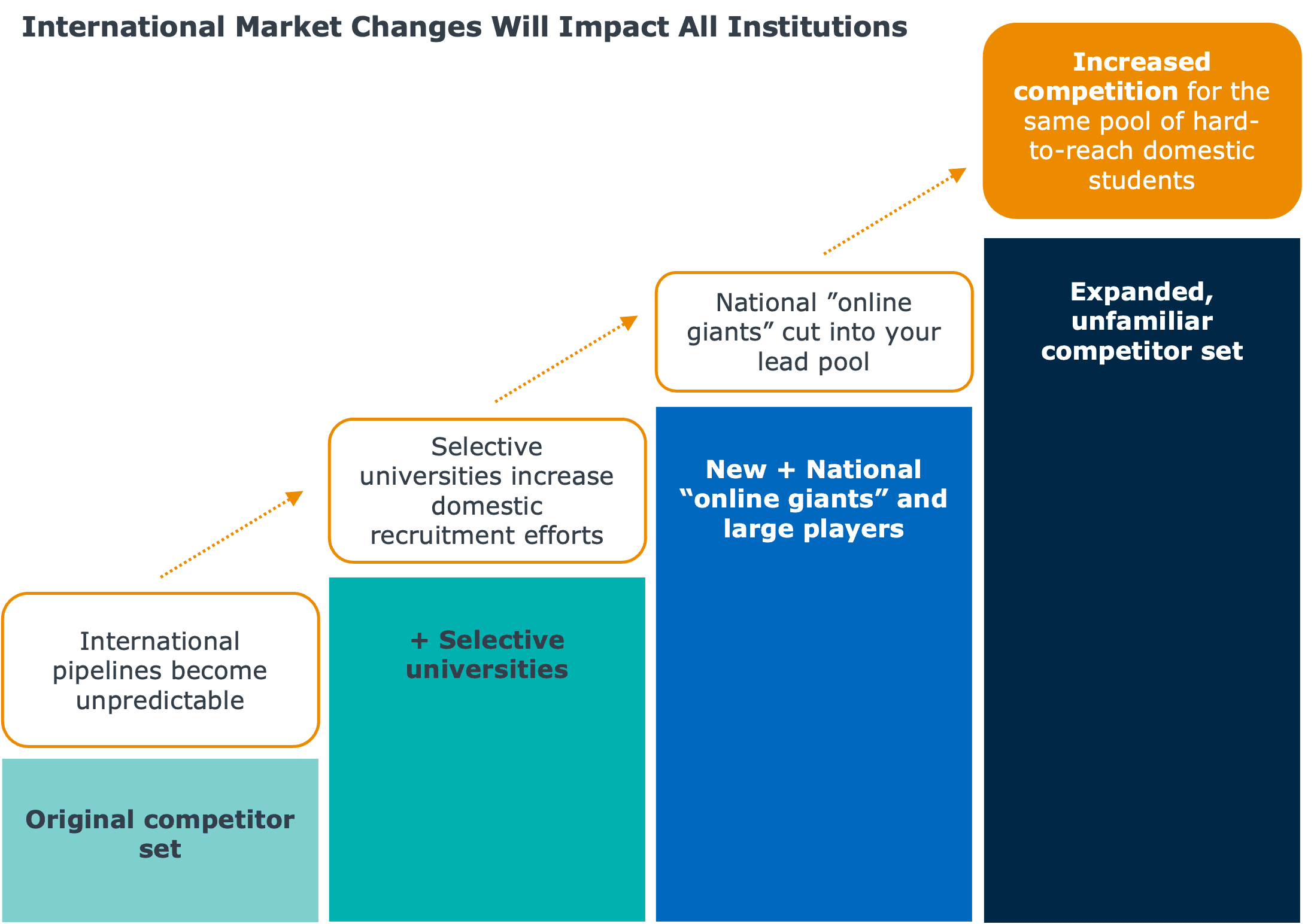

No institution is immune to the downstream impacts of international enrollment declines. In the absence of a sufficient international pipeline, more institutions will be competing for the same set of domestic students, further crowding this tight market. The schools best positioned to weather this shift are focusing on their domestic students and how to win in that market.

Doubling down on domestic student strategy

Institutions are responding to a shrinking international market by focusing on their domestic enrollment strategy. This means reallocating marketing dollars, revisiting program portfolios, and investing in outreach strategies that reflect how domestic learners actually search, evaluate, and decide.

Diversifying lead sources

With more institutions recruiting the same domestic students, relying solely on traditional inquiry channels is no longer sufficient. Many teams are expanding reach through consumer database targeting, platforms like Appily Advance, and employer partnerships to reach domestic students earlier in their enrollment journey.

Focusing on differentiation

A clear and differentiated value proposition is critical to standing out in a crowded market. Programs that clearly articulate outcomes—such as time to completion, modality, and career pathways—are more competitive than those relying on brand recognition alone. Check out this step-by-step guide to differentiating your graduate programs from competitors’.

Headwind #2: The end of Grad PLUS

In our latest survey of graduate and adult students, cost of attendance emerged as the most important factor in students’ enrollment decisions, ahead of program accreditation and program quality. And 45% of respondents said they expect to use financial aid and/or loans and grants to fund their education.

It’s fair to think, then, that the elimination of Grad PLUS loans in July will meaningfully suppress the number of students willing or able to pay for grad school. As my colleague and friend, Todd Heilman, wrote recently, “I’ve never seen a financial aid disruption hit graduate education as hard or as quickly as the elimination of Graduate PLUS loans. It feels like 10 years of change occurred in just a few months as a key source of funding disappeared.”

Grad PLUS Quietly Enabled Enrollment Growth

Savvy institutions aren’t waiting to see how the end of Grad PLUS impacts their enrollment or revenue. Here’s how we’re encouraging our Adult Learner Recruitment partners to think about and get ahead of changing loan policy.

Identifying risks and modeling out options

Each student and each program will be impacted differently by the end of Grad PLUS. Our Financial Aid Optimization team is working with institutions of all shapes and sizes to model pricing, aid, and enrollment scenarios in light of federal policy changes. This modeling is a critical first step in mitigating enrollment and revenue risk—and making the most of available aid.

Transparently communicating about price

Prospective students are far more likely to remove an institution from their consideration set when they can’t quickly discern how much a program will cost. Schools that proactively communicate total cost (including both tuition and fees), time to completion, and financing options build trust—and enrollment advantage—earlier in the funnel.

Pairing cost with proof of program value

Programs that clearly connect tuition to outcomes like salary increases and promotion potential are better positioned to attract students and grow enrollment.

Headwind #3: AI search is fundamentally changing the way students find programs

Our research shows that 80% of prospective graduate and adult learners explore program options—and decide whether to apply—before ever filling out a form on your site, contacting your admissions team, or otherwise making themselves known to your institution.

AI is exacerbating this trend. Students can now find and compare program options directly in tools like ChatGPT or Claude. And AI overviews in traditional search engines like Google enable students to learn more about your institution without ever visiting your .edu.

AI is already making a meaningful impact on your marketing. When an AI overview is present on a Google search results page, for example, organic click-through rates decline by 60% (and AI overviews will be on 75% of search results by 2028, according to research from McKinsey).

The result: competing on digital channels is becoming even more expensive. In fact, the average cost-per-click for higher ed Google Ads increased 42% from 2024 to 2025.

Institutions that continue to rely solely on legacy SEO won’t appear in AI-generated search results, missing a valuable opportunity to get in front of a growing number of students who use AI to explore program options. Here’s how our partners are staying ahead of the AI curve.

Treating the .edu as an enrollment engine

Institutions that create and structure web content for both traditional and generative search will be more visible to students. Program pages that clearly answer student questions—about outcomes, modality, and cost—are more likely to surface in AI search results. Those schools will also be ahead of their peers. In our new survey of marketing leaders, only 33% have conducted an audit to determine how their program(s) appear in AI search results.

Planning for sustained acquisition costs

Rather than reacting to rising costs, savvy marketing teams are setting realistic benchmarks and prioritizing investment toward high-performing programs and channels. This disciplined approach helps institutions compete even as costs of acquisition grow.

Diversifying lead sources to manage risk

As AI limits web traffic and increases ad costs, enrollment and marketing teams should consider other sources of leads for their grad programs. Institutions that generate leads from a range of sources, including paid search, student search platforms like Appily Advance, “known” lead sources (such as your institutional inquiry pool), are less exposed to volatility in any single channel.

In this market, standing still means falling behind. But for graduate enrollment leaders willing to proactively navigate these headwinds, there is a real opportunity to build enrollment advantage in 2026 and beyond.

Let’s boost your graduate and adult learner enrollment together

To speak with an expert or request a demo, please submit this form.

More Blogs

What Blockbuster can teach enrollment leaders about AI-powered college search

The big bets that actually drive online enrollment growth